A recent article making the rounds in the mainstream media discusses the use of tax havens by the ultra-wealthy, an issue that has made headline news in the United States, particularly as Mitt Romney is making a mad dash for the Oval Office. As I have posted before, it is not just individuals that are trying to avoid taxes with the use of overseas tax havens, corporations have a long history of doing the same thing in a desperate attempt to avoid paying America's 35 percent corporate marginal tax rate.

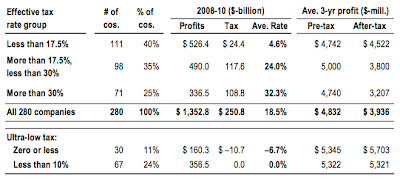

As shown in this paper by Citizens for Tax Justice (CTJ) entitled "Corporate Taxpayers & Corporate Tax Dodgers 2008 – 10", out of the 280 large and highly profitable corporations in the study, one quarter paid an effective tax rate of less than 10 percent and an equal number actually paid something close to the 35 percent official rate on total pretax U.S. profits of $1.4 trillion. Here is a chart showing a summary of the three year tax rates for the 280 companies in the report:

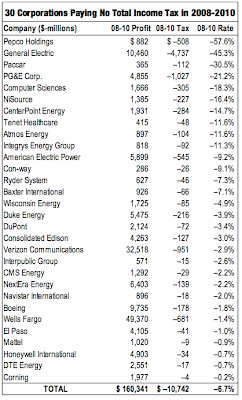

Seventy-eight of the companies paid zero or less in federal income taxes in at least one year between 2008 and 2010 with a total of 108 no-tax years while earning a total of $156 billion in pretax United States profits which, without loopholes, would have generated $55 billion in corporate income taxes. In fact, many of these companies actually generated enough deductions to warrant a negative tax situation, resulting in Americans who actually pay taxes, forking over a total of $21.8 billion in tax refunds. Here is a chart showing the 30 corporations that paid no total income tax over the three year period:

Notice the presence of major household-name American corporations including General Electric (home of CEO Jeffrey Immelt, President Obama's choice for his job czar), Corning, Pacific Gas and Electric, Verizon, Boeing, Mattel and Honeywell among others. These 30 tax avoiding companies generated $160 billion in profits in the three years between 2008 and 2010 and yet paid an average negative effective tax rate of 6.7 percent and actually received a total of $10.74 billion in tax rebates.

Here is a chart showing the 25 companies with the largest total tax subsidies between 2008 and 2010:

You have to love seeing companies like ExxonMobil, Duke Energy, Devon Energy and Chesapeake Energy among the crowd that got subsidized by taxpayers, don't you? These four companies alone received tax subsidies totalling $11.094 billion. Think about that the next time you pay $30 to top up your gas tank.

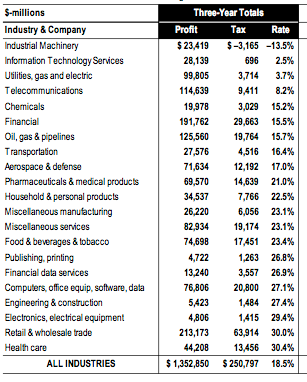

Now that we've put to rest the myth that American corporations actually pay the 35 percent corporate tax rate, here is a chart showing the average effective corporate tax rate for various industries over the three-year period:

On total profits of $1.353 trillion over the three-year period, the 280 companies in the study paid a total of $250.8 billion in taxes, yielding an average effective tax rate of 18.5 percent. The effective tax rate varied from -13.5 percent for corporations involved in Industrial Machinery to a high of 30.4 percent for Health Care corporations. Oil, gas and pipeline companies paid an effective rate of 15.7 percent and financial companies (i.e. the banking industry) paid an effective rate of 15.5 percent.

How do American corporations get such low effective tax rates? Here are the four mechanisms by which the corporate tax rate is reduced:

1.) Accelerated depreciation of capital investments.

2.) Stock options, primarily for executives.

3.) Industry-specific tax breaks.

4.) Offshore tax sheltering allows corporations to shelter their profits into their foreign subsidiaries.

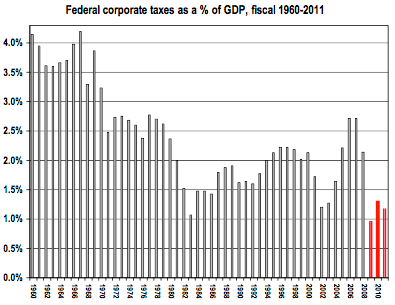

Here's one last graph showing how federal corporate taxes as a percentage of GDP has dropped over the five decades from 1960 to the present:

In the 1960s, corporate taxes covered one-quarter of total federal spending. In the 1990s, the average dropped to 11 percent and, by fiscal 2010, corporate tax revenue covered a tiny 6 percent of federal government spending.

In closing, here is a quote from Susan Ford, Vice President of Tax at Corning Incorporated who recently testified before the House Committee on Ways and Means about the competitive disadvantages to America's high corporate tax rate:

"American manufacturers are at a distinct disadvantage to competitors headquartered in other countries. Specifically, foreign manufacturers uniformly face a lower corporate tax rate than U.S. manufacturers, and virtually all operate under territorial systems which encourage investment both abroad and at home."

I think that she forgot to mention that, according to CTJ, between 2008 and 2011, Corning was one of 26 companies that paid no American income taxes despite earning nearly $3 billion in profits during that time and that her employer is sheltering profits earned in overseas subsidiaries.

One has to admit that something needs to change when most individual Americans are paying more taxes than Verizon, Wells Fargo, General Electric, Boeing and DuPont combined. This is something that all of us need to remember when our elected elite insist that, in order to remain competitive, corporate taxes simply must be lowered.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment