With U.S. sanctions against Russia now well into their fifth year as shown here:

…Russia has learned that it must work around the United States dollar-denominated global economic dominance. Recent developments by Rosneft, the "…leader of the Russian oil sector and the largest global public oil and gas corporation…" show clearly that the global oil market is on the cusp of a very significant change.

Let's put things into perspective. Rosneft is a major, world-class hydrocarbon producer with oil production hitting 4.7 million BOPD in 2018 and gas production of 1.12 million BOEPD. Revenues in 2018 were up 31.4 percent to $133.7 billion putting it in eighth place globally when measured by revenues as follows:

1.) Sinopec (China Petroleum and Chemical Corporation)

2.) Royal Dutch Shell

3.) China National Petroleum Corporation

4.) BP Plc

5.) ExxonMobil

6.) Total

7.) Chevron

8.) Rosneft

9.) Lukoil

10.) Phillips 66

According to its website, Rosneft is included among Russia's strategic companies. Its major shareholder is ROSNEFTGAZ JSC, a 100 percent state-owned company, which holds 50.0000001 percent of outstanding shares. BP Plc owns 19.75 percent of outstanding shares, QH Oil Investments LLC owns 18.93 percent of outstanding shares, the Russian Federation through the Federal Agency for State Property Management owns one share and the remaining shares are in free float.

Here are the key operating metrics for Rosneft showing us that it is not an insignificant player in the global oil market:

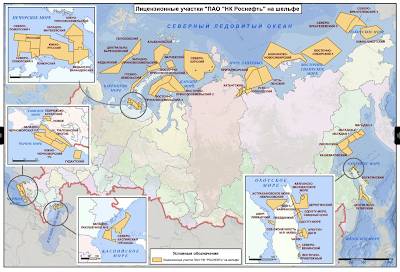

Rosneft is active in Belarus, Ukraine, Kazakhstan, Turkmenistan, China, Vietnam, Mongolia, Germany, Italy, Norway, Algeria, Brazil, Canada, Venezuela, UAE and Armenia. Rosneft plans to become the worlds largest operator of offshore hydrocarbon field development with prospective resources of 45.9 billion tonnes of oil equivalent (336.447 billion barrels equivalent). By way of comparison, Saudi Arabia has 297.7 billion barrels of proved crude and natural gas liquids. Here is a map (in Russian) showing Rosneft's offshore areas of activity:

Now, let's look at how a recent move by Rosneft could lead to very significant changes in the global oil market. Back in September, Washington's Special Representative for Venezuela, Elliot Abrams, made the following comments about the relationship between Rosneft and Venezuela:

"We have seen, in the course of all this year, a greater and greater reliance by PDVSA and by the regime on the Russians, both the Russian Government and also on Rosneft, the Russian oil company. More and more of the PDVSA oil is being given and sold to Rosneft. Rosneft is transporting it. Rosneft is merchandising it, if you will, laundering it and selling it to other destinations. Rosneft is arranging financing. So Rosneft and Moscow have become even more important to the survival of the regime. And I think the move of the headquarters is a nice symbol of that." (my bold)

According to Reuters, Mr. Abrams recently stated that the Trump Administration is "…taking a closer look at ways in which Russia is sustaining the regime (in Venezuela)…" which could well result in the imposition of sanctions against Rosneft since they are seen to be aiding the Maduro government.

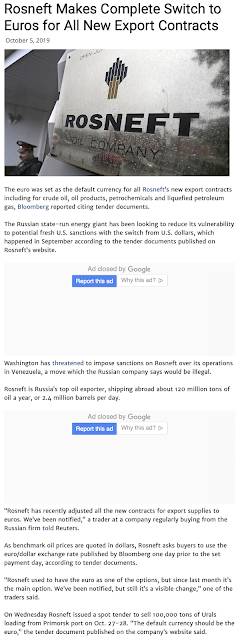

Here is an article about Rosneft from Russia Business Today dated October 5, 2019:

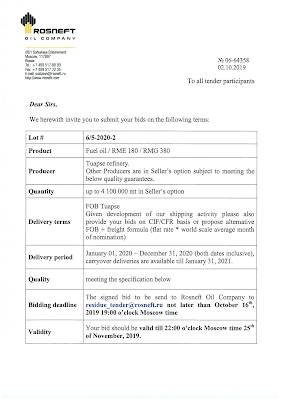

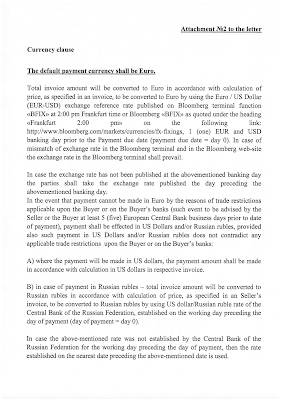

In order to work around potential sanctions against its operations by Washington, Rosneft is now tendering its export contracts in euros as shown here:

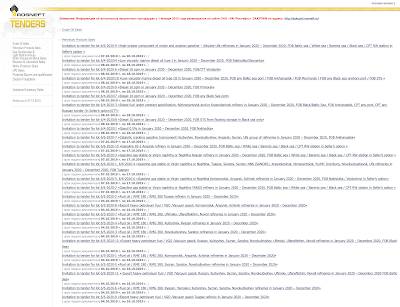

In fact, in perusing through all of these invitations to tender for oil exports:

…I could not find any that were denominated in U.S. dollars.

This move by Rosneft will prove to be a major game changer for the world's oil markets. With Washington using economic sanctions to bully other nations who stand in its way of global dominance, foreign oil companies will increasingly switch away from the U.S. dollar as their preferred trading currency as a means of protecting themselves against any future punishment for actions that do not receive Washington's blessing. It is only a matter of time before the euro or a currency other than the U.S. dollar become the preferred currency for trading, yet another unanticipated consequence of poorly thought out foreign policies.

Click HERE to read more from this author.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment