As my long-term readers know, I have a particular fixation with the transformation of our economy into a cashless reality. I have recently posting this musing on why I believe that the Federal Reserve will be forced to implement a non-physical dollar as part of its next economic recovery efforts. Thanks to Congress and its response to the COVID-19 pandemic, we now have a roadmap for how the initial phases of this plan will be implemented.

Under the H.R. 6321 "Financial Protections and Assistance for America's Consumers, States, Businesses and Vulnerable Populations Act" as introduced by Rep. Maxine Waters (D-Cal) as shown here:

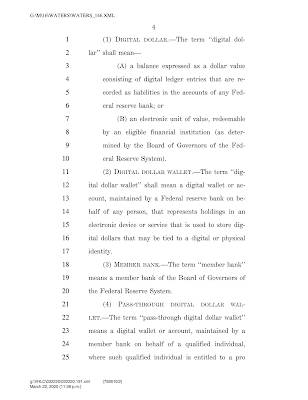

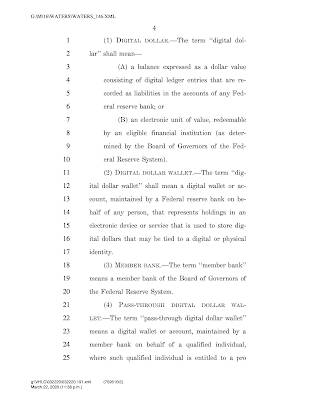

…we find the following under Title 1, Section 201 Direct Stimulus Payments for Families:

"(1) DIGITAL DOLLAR.—The term ‘‘digital dollar” shall mean—

(A) a balance expressed as a dollar value consisting of digital ledger entries that are recorded as liabilities in the accounts of any Federal reserve bank; or

(B) an electronic unit of value, redeemable by an eligible financial institution (as determined by the Board of Governors of the Federal Reserve System).

(2) DIGITAL DOLLAR WALLET.— “Digital dollar wallet’’ shall mean a digital wallet or account, maintained by a Federal reserve bank on behalf of any person, that represents holdings in an electronic device or service that is used to store digital dollars that may be tied to a digital or physical identity.

(3) MEMBER BANK.—The term ‘‘member bank’’ means a member bank of the Board of Governors of the Federal Reserve System.

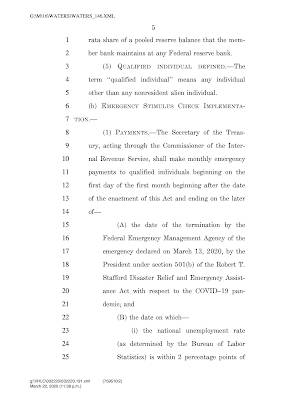

4) PASS-THROUGH DIGITAL DOLLAR WALLET.—The term ‘‘pass-through digital dollar wallet’’ means a digital wallet or account, maintained by a member bank on behalf of a qualified individual, where such qualified individual is entitled to a pro rata share of a pooled reserve balance that the member bank maintains at any Federal reserve bank."

The Federal Reserve banks have terms which they must follow when establishing digital dollar wallets:

"TERMS OF DIGITAL DOLLAR WALLETS.— Federal reserve banks shall ensure that digital dollar wallets established under this section—

(A) may not be subject to any account fees, minimum balances, or maximum balances; (B) shall pay interest at a rate not below the greater of—

(i) the rate of interest on required reserves; and

(ii) the rate of interest on excess reserves;

(C) shall provide access to debit cards, on- line account access, automatic bill-pay and mobile banking services, customer service, and such other services as the Board determines, except that digital dollar wallets shall not include overdraft coverage.

(D) shall provide, in conjunction with the United States Postal Service, access to auto- mated teller machines to be maintained on be- half of the Board by the by the United States Postal Service at branch offices;

(E) shall be prominently branded in all ac count statements, marketing materials, and other communications of the Federal reserve bank as a ‘‘FedAccount’’ maintained by the member bank on behalf of the United States of America;

(F) may not be closed or restricted on the basis of profitability considerations; and

(G) shall provide holders with reasonable protection against losses caused by fraud or security breaches."

Here are screen captures of the key pages for posterity:

According to the legislation, each of the twelve Federal Reserve banks "…shall make digital dollar wallets available to all citizens and permanent lawful residents of the United States..." Digital dollar wallets may also be offered by member banks (commercial banks that are part of the Federal Reserve system) with total consolidated assets in excess of $10,000,000,000.

Please note that the House Democrats' latest version of the bill as introduced by Nancy Pelosi , "Take Responsibility for Workers and Families Act" does not contain any language around the use of a digital dollar in its section on direct payments to American families.

It is interesting to note this advancement of the digital currency agenda by both Congress and the Federal Reserve. While the final approved legislation may not actually include the words "digital dollars", we know what Washington really intended in the original draft of the legislation. Digital currencies are coming whether we like it or not.

Click HERE to read more from this author.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment