A recent Economic Letter taken from a speech by John C. Williams, President and CEO of the Federal Reserve Bank of San Francisco, looks at the latest economic recovery.

Mr. Williams begins by noting that, while aspects of the economy have recovered since the depths of the Great Recession, it has not rebounded as quickly as central bankers and the rest of us had hoped with the pace of growth being modest, particularly when compared to past recoveries.

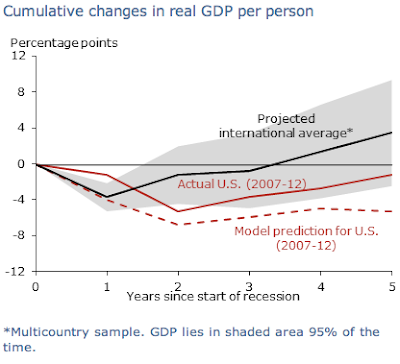

Here is a graphic from his presentation showing the changes in real (inflation corrected) GDP growth per person over the five year period since the beginning of the latest recession shown in solid red for the United States and the black line which shows black for the 150 year average of 17 advanced international economies):

Note that 95 percent of the time, real per person GDP growth falls within the grey shaded area.

The solid red line shows that the American real per capita GDP fell by over 5 percent by the second year of the latest recession, a substantial drop when compared to historical economic retrenchments.

Now, take a look at the dashed red line. This line shows the forecast of real per capita GDP growth from an economic model that looks at past recessions and recoveries. The model suggested that the huge buildup in private sector credit prior to the recession resulted in a deeper than normal recession and that the economy should have been stagnant well into 2012. If you compare the dashed red line (the projection) to the red line (the reality), you can see that the economy grew faster than it should have given the extent of the credit bubble. Unfortunately, many Americans would suggest that the fact that the latest economic recovery was among the weakest in 150 years does not speak well for the actions taken by the Fed.

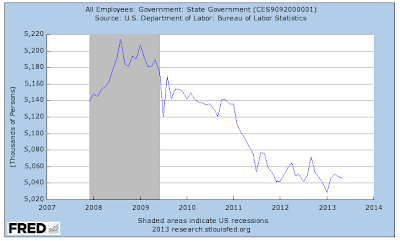

According to Mr. Williams, the credit for this unexpected growth lies with his fellow central bankers at the Federal Reserve and the extraordinary measures that they took which pulled us out of the Great Recession at a faster pace than anticipated. That said, he notes that all sectors of the economy are not firing on all cylinders, particularly in the public sector where government budgets are in a no-growth situation particularly at the state and local level where dropping revenues have resulted in cuts to both employment and spending as shown here:

Since the end of 2009, governments at all levels have cut more than 600,000 employees and government spending has fallen nearly 7.5 percent.

Mr. Williams goes on to outline the impact of the Fed's policies on the mortgage markets; after all, buying $85 billion worth of Treasuries and mortgage-related securities every month will have an impact on the mortgage market. At the bottom of the recession, 30 year mortgages could be had with an interest rate of 5.5 percent. Today, these same mortgages are about 1 percentage point lower. A homeowner buying a home with a 20 percent downpayment and a $300,000 mortgage at 5.5 percent resulted in a monthly payment of $1360. Under the current interest rate scenario, this drops to $1220, a saving of $1700 annually which "…could be saved or spent" Alternatively, a homeowner willing to pay $1360 per month could buy a house worth more than $335,000, boosting demand for homes." My guess is that the Fed would prefer that American consumers consume rather than save and, as shown here, that's just what's happening:

The savings rate has dropped from a high of 6.5 percent during the recession to its current level of 3.2 percent (off its post-recession low of 2.2 percent). As well, household debt-to-GDP, while down from its 2009 highs, is beginning to grow again and hit 84.87 percent in the third quarter of 2012.

What does Mr. Williams see in his central banker crystal ball? He suggests that inflation will gradually rise to the Fed's 2 percent target, hitting roughly 1.75 percent in 2015. Unemployment will fall to 7.25 percent by the end of 2013 and drop to 6.75 percent by the end of 2014. This is still above the Fed's target of 6.5 percent. As a whole, inflation-corrected GDP growth will be 2.25 percent in 2013, rising to 3.25 percent in 2014.

With all of these projections in mind, when will the Fed end its experiment? Mr. Williams' suggestion is that "it is still too early". He notes that the Fed needs to ensure that the economy maintains its growth momentum in the face of the current fiscal contraction taking place as sequestration cuts work their magic. He also suggests that the Fed needs to make certain that inflation doesn't come in below expectations, a scenario that could take place if the demand for goods drops due to consumer spending cutbacks resulting from uncertainty.

Mr. Williams states that a large majority of FOMC Committee members do not expect the first increase in the federal funds rate to take place until 2015 or later; as well, the median projected value of the federal funds rate at the end of 2015 is only 1 percent, hardly a massive increase above its current level of 0 to 0.25 percent.

Let's close with his summary:

"As I emphasized at the start, I am convinced that our extraordinary policies during the recession and recovery, including our current asset purchase program, have been hugely beneficial for the economy. The good news is that the economy is on the mend. The time will come when we will no longer need to keep adding monetary stimulus. When that time comes, I am confident that we can make this change without jeopardizing the recovery, while working toward our goals of maximum employment and price stability."

There's nothing like a central banker patting himself on the back and blowing his own horn. Only time will tell whether he should be patting himself on the back and blowing his horn at the same time….or not. In looking back at the first graphic, while things could have been worse, the recovery certainly was modest at best.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment