No matter what Janet Yellen and the group of deep thinkers that make up the FOMC may tell us, the Federal Reserve has backed itself into a policy corner, an issue that Ms. Yellen confirmed when she stated that low borrowing rates will continue for some time. Here's why.

1.) Here is the public debt, owed by the Federal government:

Using the "Debt to the Penny website", total outstanding federal debt is $17.484 trillion, a more up-to-date number than FRED supplies.

2.) Here is the total state and local government debt:

While the total state and local government debt, excluding underfunded employee retirement funds, has not grown significantly since 2009, it still totals $2.941 trillion.

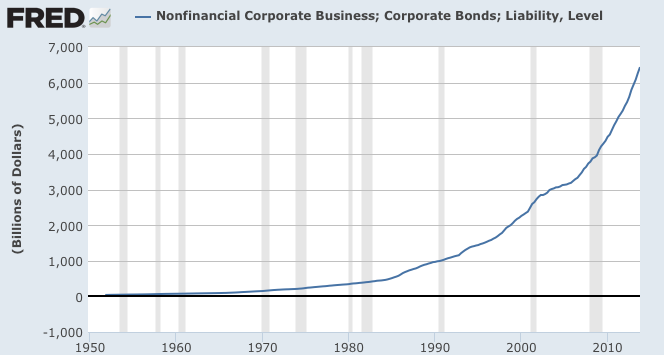

3.) Here is the total size of the corporate bond liability of non-financial corporations:

That's another $6.435 trillion in non-financial corporate credit liabilities.

4.) Here is a graph showing the total outstanding mortgage debt for all types of dwellings:

While down from its peak of $14.806 trillion in the second quarter of 2008, the total mortgage debt in the United States is still a very substantial $13.244 trillion.

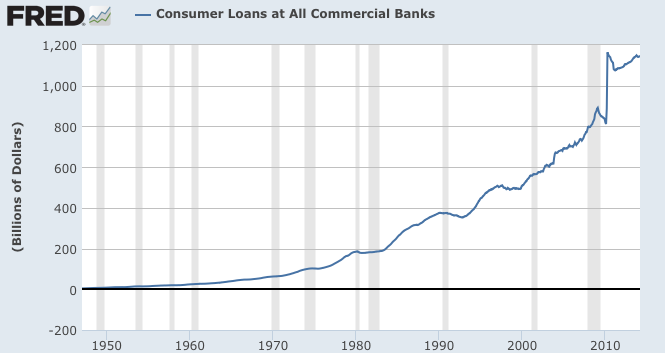

5.) Here is a graph showing the total that consumers have borrowed at all commercial banks in the United States:

6.) According to the Federal Reserve Bank of New York's Household Debt and Credit publication for the fourth quarter of 2013, total outstanding student loans rose by $114 billion over 2013, hitting $1.08 trillion. Interestingly, about 11.5 percent of student loans are delinquent by more than 90 days. This graph shows the amount of consumer credit (i.e. mainly non-revolving credit like car loans etcetera) and student loans (i.e. Sallie Mae) that are outstanding:

According to the Household Debt and Credit publication for the fourth quarter of 2013 published by the Federal Reserve Bank of New York, aggregate consumer debt rose by $241 billion in the fourth quarter of 2013 alone, the larger quarter-to-quarter increase seen since the third quarter of 2007. On December 31, 2013, total consumer debt hit $11.52 trillion, up 2.1 percent from the third quarter of 2013 but still 9.1 percent below the all-time peak of $12.68 trillion in the third quarter of 2013.

I realize that this is not anything close to all of the outstanding debt in the United States, however, the total debt accrued in the six items listing in this posting is just over $42.3 trillion, an unimaginable amount of credit that works out to $136,450 for every man, woman and child in the United States. My numbers are not that far off; according to the Federal Reserve's fourth quarter 2013 Financial Accounts of the United States, domestic non-financial debt was $42 trillion at the end of Q4 2013 with the level of debt growing at 5.4 percent annually during the quarter, the second-highest growth rate since 2008, excluding Q4 2012.

The Federal Reserve has painted itself into a policy corner. If (and they surely will) interest rates begin their rise to what would be termed normal levels, the piper will have to be paid. With the level of debt consistently hitting new highs, the cost of even a modest one or two percentage point increase in interest rates could prove to be very painful. The price of getting hooked on the cheap credit fed to us by our favourite central bankers over the past five years will be very, very high as will be the risks to America's and the world's future economic health.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment