The mainstream media has spent a great deal of energy questioning whether the Federal Reserve should continue to resume interest rate increases during 2016. With the global economy looking rather shaky at best and the United States economy looking positively glowing when compared to its peers even though it is expanding at modest levels, the Fed is finding itself caught between a "monetary policy rock and hard place". As we all know, one of the Fed's mandates as established by Congress is to maximize employment. While the drop in unemployment from ten percent in October 2009 to its current level of five percent, it looks like the Fed has succeeded in meeting at least one part of its obligations, however, scratching slightly below the surface of the headline U-3 unemployment rate, we find that the Fed's long-term monetary policy experiment has been less than a resounding success when it comes to employment for America's prime-age workers.

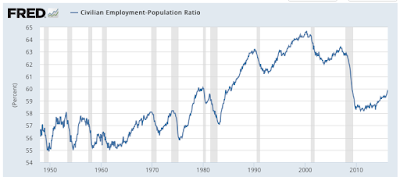

Here is a graph from FRED showing the employment-to-population ratio since the late 1940s to help us put the current ratio into perspective:

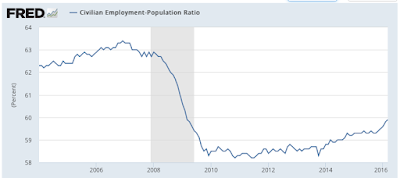

Here is the same data for the period from the beginning of 2004 to the present:

The employment-to-population ratio is defined as the ratio of total civilian employment to the civilian non-institutional population. It is used to track the pace of job creation and compare it to the rate of growth in the adult population. As you can see, there was a precipitous drop in the civilian employment-to-population ratio during the Great Recession, from a pre-recession peak of 63.4 percent to a low of 58.2 percent in both 2010 and 2011. Since its low point, it has only improved to its current level of 59.9 percent, an improvement of only 1.7 percentage points from its lows. A 2015 analysis by the Congressional Research Service suggests that demographics are playing a significant role in this stubborn decline for two reasons:

1.) retirement of older workers (i.e. the baby boom generation).

2.) younger workers pursuing or extending their education.

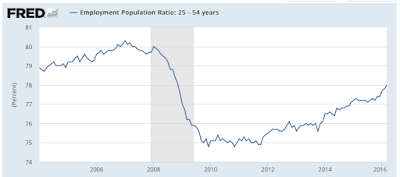

As a result, one would expect that if younger and older workers were subtracted from the employment-to-population ratio, the ratio for prime-age workers between the ages of 25 and 54 would show that there is little remaining impact of the Great Recession, particularly given the Fed's massive interference in what passes for the free market. With that in mind, here is the data from FRED showing what has happened to the employment-to-population ratio for prime age workers since the beginning of 2004:

The ratio for prime-age workers hit a high of 80.3 percent at the beginning of 2007 and fell to a low of 74.8 percent in late 2009 and 2010. Since then, it has recovered to its current level of 78 percent, an improvement of 3.2 percentage points, however, it is still 2.3 percentage points below its pre-Great Recession peak.

Let's do a bit of an analysis of the data:

Low point – 74.8 percent in November 2010

Current level – 78 percent in March 2016

Total Change – 3.2 percentage points

Time elapsed – 65 months

Average monthly improvement – 0.049 percent per month

As long as there is no economic slowdown or sudden economic growth spurt, it will take another 47 months for the prime-age employment-to-population ratio to return to its pre-Great Recession level.

This begs the question – how successful has nearly seven and a half years of Federal Reserve monetary policy really been when it comes to meeting at least one of its congressionally-mandated obligations? It would be my guess that millions of prime-age American workers would unequivocally state that the Fed and its long monetary policy have been an unqualified failure and that additional interest rate increases should be off the table.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment