The latest monthly conjured up employment numbers are ugly even with the usual generous fudging of the data.

The May change in Nonfarm Payrolls: +54,000 vs. Consensus estimate of +165,000; Private Payrolls: +83K, vs. Cons. +170K; Unemployment Rate: 9.1%, vs estimates of 8.9%. The birth/death rate model assumption that is built into the government’s numbers added a whopping 206k jobs to non farm payrolls, meaning that even with the extra padding, the final number could only be goosed to 54,000 growth, or right around a third of what was expected. As my friend @agwarner tweeted this morning on Stocktwits, "the Fed may as well skip QE3 and go right to QE4." lol.

While GDP figures show annual growth at 1.8%, the US imho is in a "technical recession". There is no way that I can take seriously anyone who tries to spin the slate of economic numbers to say we are in a slow growth cycle — no, not with weak employment, declining manufacturing, a real estate depression and tepid bank lending.

But readers of this daily dispatch have known about these cracks, much like the wax makeup of an 18th century fair lady (crack a smile anyone?). And who really cares, since it’s National Donut Day!!!

In all seriousness, the initial reaction in the stock market will be negative, though you can never rule out a rally attempt on the notion that the data is so ugly that someone will have to come along with instant cash to prop things up. I’d be inclined to bet, however, that not enough pain has been inflicted. So far, my SPY puts are looking good.

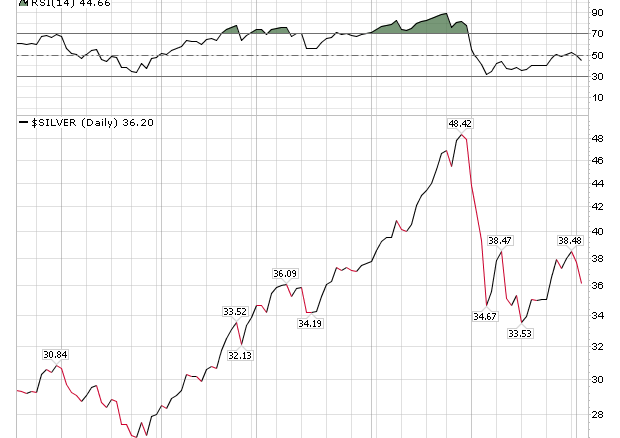

Gold has caught a nice bid with a gain of about $13/oz. Silver is more problematic. I like to use relative strength (RSI) as aquick and easy indicator of things to come. The silver RSI is still not flashing a bullish signal. I’d like to see RSI (top of chart) go above 50 and stay there.

A quick thought on Moody’s. What a bunch of (insert expletive here). The bottom line is that they threaten to cut present US debt at 105% of GDP unless DC agrees to raise the debt limit to about 120% of GDP. Hmmm… now that makes perfect sense. Not.

Click HERE to sign up for my free newsletter about the latest market trends.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment