It’s not abnormal to place homeownership on par with the tooth fairy or the return of the dinosaurs when it comes to plausibility. Phrases like “mortgage loan” and “debt-to-income ratio” can be enough to reassure you that you’re more than happy to rent forever. But here’s the thing: Buying a home doesn't have to be as intimidating as it sounds. It’s simply a matter of knowing where to begin.

Whether you’re finding a mortgage plan, saving for a down payment, negotiating a contract, or just shopping around, it’s all more manageable than you think, so long as you have the right resources on your side. Lucky for you, we've already done the work. We tapped Priya Malani, founder of financial planning firm Stash Wealth, for some expert advice on shopping for real estate, navigating cryptic mortgage jargon, and saving time with financial tools like Mint and Turbo from Intuit. Read ahead to find out everything you need to do before you gear up to make your big purchase.

Pre-Qualification: Get Your Finances In Order

Sure, you’re familiar with your own spending habits. You know how much you make. You know how much of your cash flow goes toward your rent and how much lands in the abyss commonly referred to as your “student loans.” But how intimately do you really know your finances?

Before buying a house, you’ll need to know a lot more than your general net worth. In fact, to determine what sort of property you can actually afford — and how you ought to start saving — you’ll need to take serious stock of your personal finances.

“First, you’ll obviously want to know what you have available for a down payment — making sure you’re not tapping into your emergency funds,” says Malani. “Second, you’ll want to make sure you qualify for a mortgage. Most banks will allow you to pre-qualify to figure out how much house you can afford.”

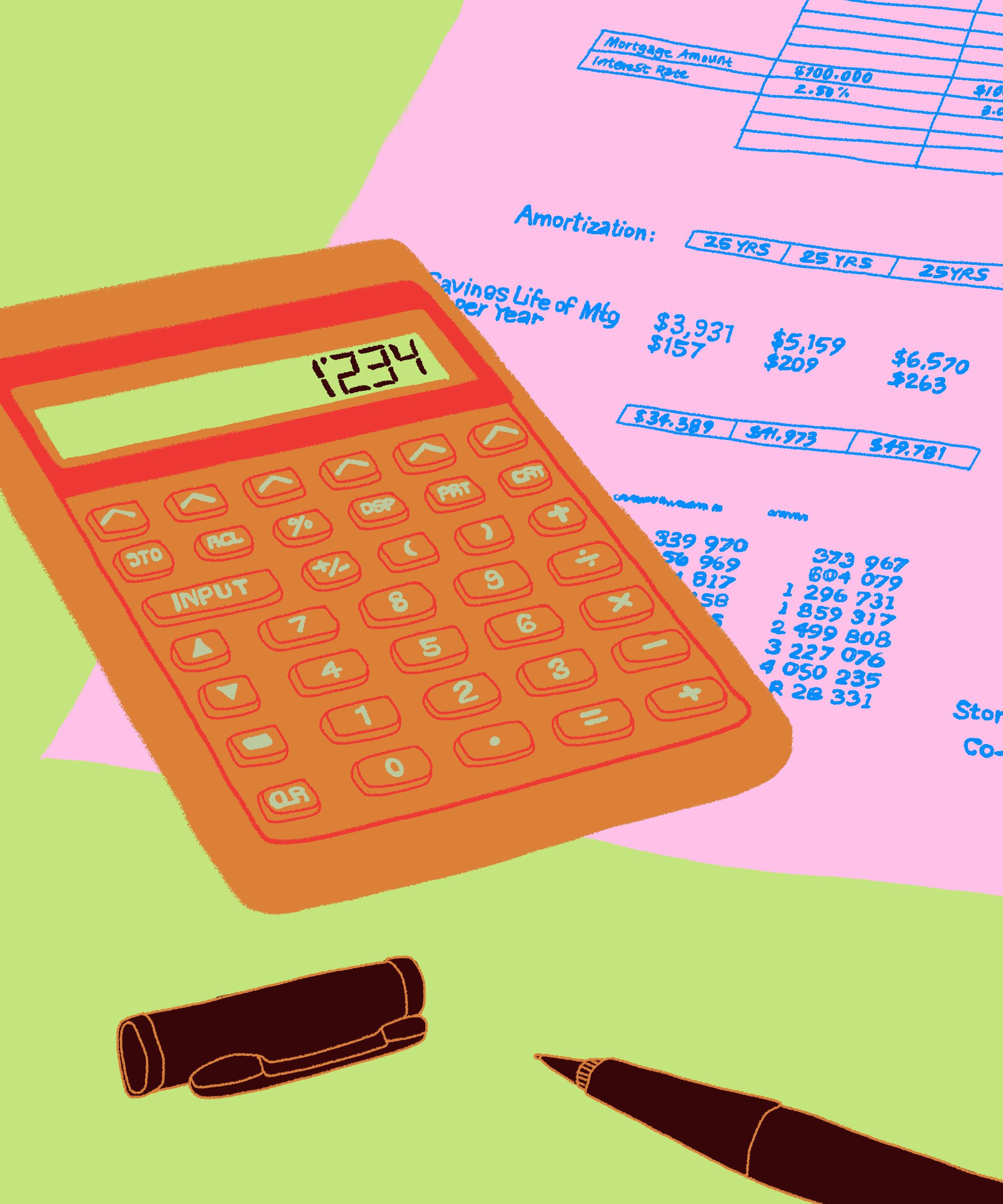

In order to pre-qualify, you’ll need to determine your debt-to-income ratio (DTI). This is essentially a number that indicates how much of your monthly income goes toward debt payments — and naturally, the lower the percentage, the more attractive you are to potential lenders. This gives you a better shot at pre-qualifying for a larger mortgage. Malani recommends using an online calculator to determine your DTI.

If you're looking to streamline the process, try downloading Turbo by Intuit. Once you input your information, the app will provide you with a full view of your lender profile, including your DTI, total debt, credit score, and verified income — all in the same, easy-to-use dashboard. It's an easy way to keep track of your credit and maintain your financial health.

“Most banks will pre-qualify you for more house than you can actually afford,” Malani explains. “Keep in mind that you may not be able to support monthly payments for a home as large as what you pre-qualify for. For example, you may pre-qualify for a $300K home but only be able to support the mortgage payment on a monthly basis on a home that’s $200K.”

In short, you’ll need to know how much you’re truly capable of setting aside on a monthly basis before you can start shopping around.

If you find that you don’t pre-qualify for the sorts of properties you’re looking to buy, this is probably a good indicator that now is simply not the right time. “Homeowning is not always the smartest investment,” Malani explains. “We’re raised to believe it’s the pinnacle of ‘adulting,’ but it’s honestly a pain in the ass. If you’re living paycheck to paycheck and you need your excess funds for weekend brunch, maybe, right now, it’s just not the right move.”

Illustrated by Hannah Minn.

Start Saving For Your Down Payment (& Everything Else)

When you think about home buying — and whether or not you can afford it — odds are, you tend to dwell on the down payment. This is, of course, warranted — there are few more intimidating numbers you’ll encounter in the process. That said, it’s not the only number. So while you set out to build yourself a savings plan, make sure to keep that in mind.

“My advice here is always to automate your savings plan,” says Malani. “Online calculators can help you factor in things like HOA or condo dues, insurance, taxes, and so on. Then on top of that, things like trash, lawn maintenance, and HVAC servicing are also worth keeping in mind. For those, we often have clients keep a ‘home maintenance’ savings account that equals 1% of the value of their home.”

Once you’ve determined (with the help of your calculator) what sorts of dues you’re really looking at, you’re ready to come up with a game plan. “When you know how much you plan to spend, you can track backwards. See how much you can set aside a month, then you’ll know how much time you need.” For some folks, this takes 12 months. For others, it’s 10 years. Either way is fine, just so long as you’re realistic about what you can or can’t afford.

If you need a little extra help on the saving front, try a free app like Mint that'll help you create easy budget plans based on your average spending patterns.

Illustrated by Hannah Minn.

Get Pre-Approved For A Mortgage

As similar as they may sound, pre-approval and pre-qualification are not the same. Pre-qualifying is typically the first step in your home-buying saga, while pre-approval comes once you’ve determined what it is that you’re actually working towards — and you’ve begun to save. Your pre-approval is essentially an indication of how much a bank is willing to lend you for your mortgage.

“The lender will run your credit and look at your DTI and savings among other things to determine how much they’re willing to lend to you for a home purchase,” Malani explains. “It’s not too complicated: You’ll fill out a basic application and you’ll probably provide social security information and tax documents. Each lender may require slightly different information.”

All major banks will have personnel fully prepared to walk you through the process — so don’t fret if the whole “pre-approval” thing sounds foreign. And if you've already used a service like Turbo, you should already have all your DTI and credit score information compiled — which means there won't be any late-in-the-game surprises.

Once you’ve been approved, you’ll want to begin comparing interest rates at different banks to ensure that you’re getting the best possible plan. For those who associate number crunching with paralyzing panic, a mortgage broker is a great option. They’ll weigh the plans for you — so you can find the most cost-effective option.

Illustrated by Hannah Minn.

Find A Mortgage Plan That Works For You

Okay, so let’s be realistic: How much can you actually afford to shell out for your mortgage on a monthly basis, once you part with your down payment?

“Don’t overcommit here,” Malani warns. “Being ‘house poor’ isn’t glamorous. We see it all the time: Couples who have no money to see friends, to buy furniture, to eat out, because it’s all going to the house.”

If you’re looking to contribute the largest possible amount to your mortgage each month, it’s essential that you take your lifestyle, and other expenses, into account as well.

“The sexier the house, the bigger the mortgage, the more enticing,” Malani says. “But lenders are incentivized to give you the biggest loan possible because that’s how they’ll make the most money. It’s your job to make sure your monthly plan is feasible.”

Illustrated by Hannah Minn.

Make An Offer

So, your approvals are in order, you’ve saved for months — years, even — and you’ve found the place of your dreams. This is the fun part: You’re finally bidding on The Space. You’re a soon-to-be-homeowner — what a glamorous thing!

“First, you want to make sure you have a real estate agent who really gets you and your motives,” Malani says. “It’s not a must, but we highly recommend it. Most of the cost falls on the seller, and the agent will be super helpful when it comes to navigating competitive markets and negotiating.”

Depending on the market — or the part of the country — that you’re buying in, the whole offer-game changes. There are times when you can low ball, times when you can drive a hard bargain, and other occasions when you’ll lose the property if you don’t offer above the asking price. A real estate agent is helpful precisely because they can let you know which of these instances pertains to you.

“We often advise our clients to write a letter to the owner about their life, why they’re buying the house, so on,” says Malani. “Pulling at the heartstrings can definitely help.”

Illustrated by Hannah Minn.

Close The Deal On Your New House

At long last, we have arrived: This is the final step remaining between you and your property. This one’s pretty self explanatory: Any major business transaction will require some kind of closing — a signed contract delineating the terms of your agreement in print. When it comes to home buying, this is typically a pretty hefty contract. Unfortunately, it’s in your best interest to actually read this contract.

“It’s on you to read the fine print — or else you have to have someone do it for you,” says Malani. “We definitely recommend using a broker and a real estate attorney because you’re dealing with the law here and it can be so nuanced. Every market in every state has so much variability when it comes to the law — it makes sense to trust a professional.”

Once you’ve hired someone to help guarantee you a fair, transparent contract, Malani recommends that you opt for a home inspection. Especially in older properties, before you’ve signed off, you’ll want to make sure there are no fundamental issues with the property — piping problems, weakened foundations, infestations. These are the sorts of things your seller should communicate to you before you close the deal — and they’ll certainly change the terms of your contract if discovered.

“If you’ve planned appropriately, this part shouldn’t be scary!” Malani declares. “This is huge! It’s exciting — you now have complete ownership over a home. ”

Illustrated by Hannah Minn.

Click HERE to read more.

You can publish this article on your website as long as you provide a link back to this page.

Thanks For sharing this information……and Such a Great article of work and money maybe you afford to buy a home!