As we all have noticed, the European debt crisis is still ongoing despite the occasional headline that suggests that the worst of the problems are behind us/them. As my regular readers know, in researching for this blog, I always try to reference the best sources available. That means that I almost never quote from the mainstream media since their coverage is often rife with inaccuracies, rather, I prefer to source my postings from government databases or well-researched think-tank material where possible.

To that end and staying on the theme of the Eurozone debt problems, I have always found it difficult to ascertain the veracity of debt data, particularly debt- and deficit-to-GDP ratios as published in daily newspapers. Fortunately, the European Community, through its Eurostat website, has released asummary of the fiscal situation of all 27 European nations including both those that use the euro as their currency (the EA17) and those that both do and don’t use the euro (the EU27). In this posting, I will summarize the data on both graphs and charts from this data release.

Here is the annual GDP, debt and deficit information for all European nations current to the end of 2011 in alphabetical order:

Please note that, for your convenience, I have converted all of the non-euro statistics to euros. Should you refer back to the original source material, you will find that it uses the national currencies for the non-euro nations.

Remember that, according to the original mandate of the European Community, nations were supposed to ensure that their deficit-to-GDP ratio did not surpass 3 percent and that their debt-to-GDP ratio did not surpass the 60 percent level. You can quite quickly see that there are more debt and deficit transgressors than nations who have stayed within the bounds of the original agreement.

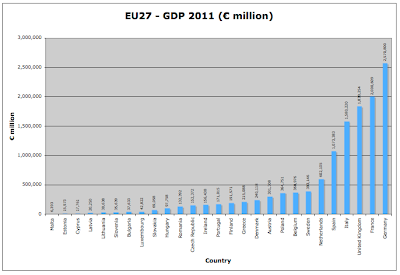

Let’s start by putting the countries in order from the smallest economy to the largest:

You can see that there is quite a range in economic size with the smallest economy (Malta) being less than one four-hundredth the size of the largest (Germany). Out of the EU27 nations, there are 10 that have economies that are less than €100,000 million euros in size representing 37 percent of all Member States. Four economies alone, Germany, the United Kingdom, France and Italy, account for 58.8 percent of the entire output of the European Union.

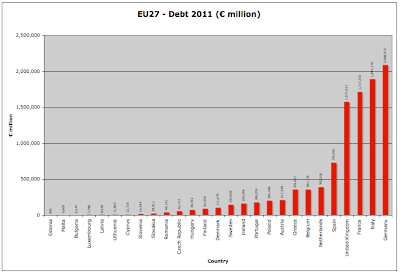

Now, here’s a graph showing the total debt for all EU27 nations in order from smallest debt to largest:

From the graph, you can quite readily see that four nations are responsible for the lion’s share of Europe’s debt. The largest debt is, of course, held by Germany, the EU’s largest economy. Germany had a total debt of €2.088 trillion euros ($2.714 trillion) at the end of 2011, the world’s third largest nominal sovereign debt after the economic powerhouses of the United States and Japan. In second place (within Europe) is Italy at €1.897 trillion followed by France at €1.717 trillion and the United Kingdom at €1.577 trillion. Between these four nations, they are responsible for €7.279 trillion in sovereign debt or 69 percent of the EU27 total and their average debt-to-GDP ratio is 93.2 percent, well above the average of 82.5 percent for all EU27 members. This indicates that the four major economies in the European Union are responsible for a disproportionate share of Europe’s overall debt burden and, unfortunately, in the case of Italy, their economy is less able to grow itself back to stability.

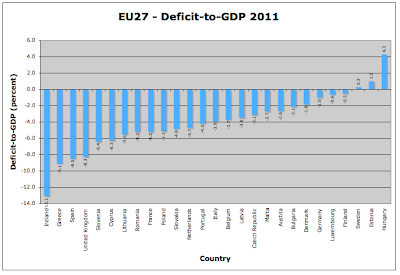

Here is a graph showing the deficit-to-GDP ratio for all nations in order from the smallest to the largest ratio:

Only 10 out of the 27 nations or 37 percent of the total are within the current 3 percent deficit-to-GDP limit and only 3 have budgets that were in a surplus situation in 2011. These nations are mainly the smaller economies of the EU27 including many former Iron Curtain countries and those in Scandinavia.

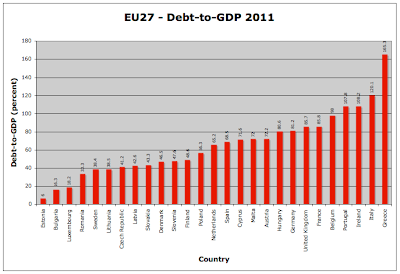

Here is a graph showing the debt-to-GDP ratio for all nations in order from the smallest to the largest ratio:

Again, only 13 out of the 27 nations or 48 percent of the total were within the current 60 percent debt-to-GDP limit at the end of 2011. As well, the less indebted nations as a percentage of GDP are those former Iron Curtain nations and those in Scandinavia.

From this brief look at the fiscal data for Europe, it becomes quickly apparent that the debt problem is not going to solve itself anytime soon. Most nations, including Europe’s powerhouse nation of Germany, have experienced rapidly growing debt levels over the past four years with Germany’s debt rising by 21 percent from €1.649 trillion to €2.088 trillion with only 3.9 percent economic growth over the same timeframe. It is quite obvious that Europe’s debt and deficit scenario is not sustainable, particularly as it appears that Europe’s economy is flitting in and out of recession this year. With the world’s economy so interconnected, trouble in Europe will soon find its way around the world, causing grief for the United States economy in particular.

Click HERE to read more of Glen Asher’s columns.

Article viewed on Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment