In recent days, weeks and months, those of us who live in the overly-indebted so-called "developed" world have been subjected to repeated attempts by governments to cut spending in a last gasp effort to achieve some semblance of fiscal balance. Those of us who live in Canada and the United States are well aware that the feeble efforts of our elected elitists are pretty well pointless; to make the expenditure cuts and tax increases necessary to balance budgets would be a surefire guarantee of losing in the next election cycle.

With all of the hubbub about Europe's debt dilemma over the past 18 months and, in particular, the talk of austerity among the most uncomfortably indebted nations, how deep have the spending cuts really been? Fortunately, one of my favourite economists, Veronique de Rugy, a Senior Research Fellow at the Mercatus Centre at George Mason University in Virginia has answered the question for us. How hard are European leaders really trying to achieve fiscal balance and reduce their debt and deficit load?

Ms. de Rugy's researchshows that, while it appears that the results of recent elections in both Greece and Spain suggest that the citizens of these countries turfed their incumbent governments because of severe cuts in spending, that is not the case. Apparently, austerity in Europe does not mean cuts in spending rather, the size of spending cuts were tiny compared to increases in taxes. Ms. de Rugy notes that spending cuts are the most important form of austerity. Increases in taxes, while helping to increase revenue, actually do not successfully reduce debt-to-GDP ratios. As well, tax increases usually have a negative impact on the guilty nation's economy.

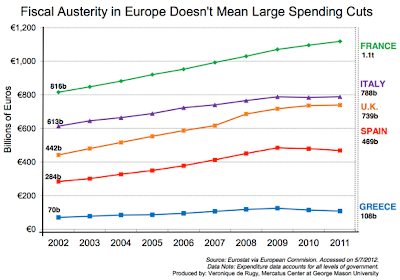

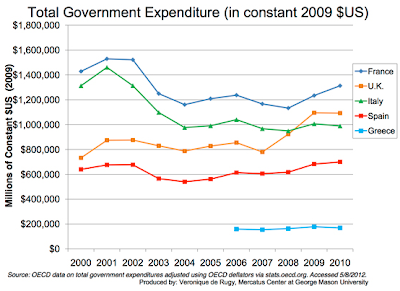

Ms. de Rugy looks at five nations in particular; Italy, Spain, France, the United Kingdom and Greece and examines their spending habits over the past decade. Remember, these four nations are among those that supposedly have implemented the greatest austerity measures. Here is a graph showing the spending habits of all five aforementioned nations between 2002 and 2011:

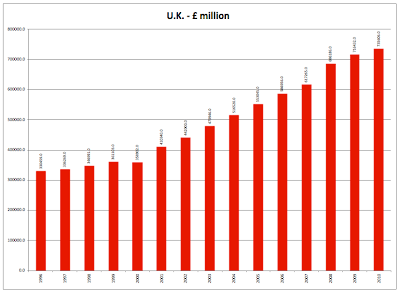

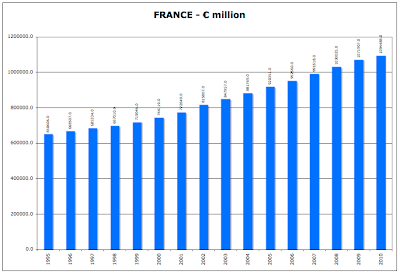

Quite clearly, United Kingdom and France have not cut spending as shown on these two graphs:

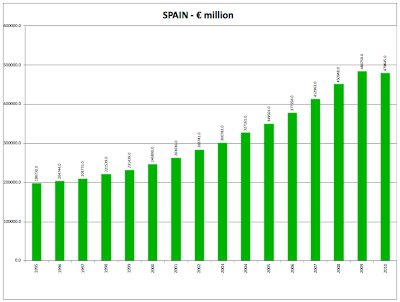

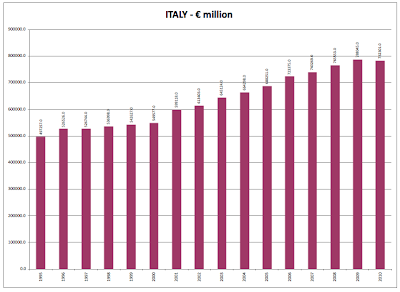

Spending cuts in Greece, Italy and Spain were actually very small when compared to the size of their budgets as shown on these two graphs for Spain and Italy:

Italy's expenditures in 2010 were only 0.75 percent lower than in 2009 and were actually 2.2 percent higher than in 2008. Spain's expenditures in 2010 were 1 percent lower than in 2009 and were 6.4 percent higher than in 2008. That's some austerity!

As shown on this graph, even using total government spending in constant 2009 U.S. dollars, only three of the nations, the United Kingdom, Italy and Greece, show very marginal drops in spending since the inception of the Great Recession when everything seemed to go off the rails for Europe's debtor nations:

In her conclusion, Ms. de Rugy notes that those European nations that did impose spending cuts, accompanied those cuts with larger tax increases. Here is her analysis of that approach:

"This so-called balanced approach – some spending cuts for large tax increases – has been proven to be a recipe for disaster by economists. It fails to stabilize the debt, and is more likely to cause economic contractions."

Recent economic data from Europe showing an overall contraction in some of Europe's strongest economies may be proving Ms. de Rugy's hypothesis. An even moderate period of negative economic growth is about the last thing that Europe needs right now.

Perhaps our North American leaders could learn from Europe's example; showing some restraint on overspending now and resisting the temptation to overdo it on the taxation side of the ledger may be more important than they think.

Click HERE to read more of Glen Asher's columns.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment