We all know that the fraction of a percent are different than the majority of Americans who live on Main Street but just how different are they? With the U.S. in the middle of a Presidential election cycle, how does this impact the tax messages that both the Republicans and the Democrats are sending?

An analysis by the Tax Policy Center at the Brookings Institute puts a finger on the differences through an examination of the sources of cash income. For most of us, income is a very simple concept; wages or salary, pension or social security and a small amount of interest income. For the minority of Americans, the income equation is complicated by the inclusion of dividends, rent, capital gains among others. It is these different sources of income that separate the wealthy from the remainder of society as you will see.

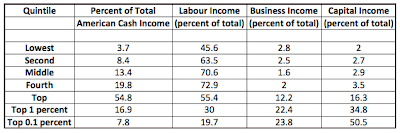

According to the Tax Policy Center's analysis, when cash income levels are divided into five quintiles (five groups of twenty percent each), the middle two quintiles (or middle 40 percent) of Americans source between 70.6 and 72.9 percent of their cash incomes from labor (i.e. working for a living) and only between 2.9 and 3.5 percent from capital sources (i.e. capital gains and losses, dividends, interest income and inputed corporate tax liabilities). On the other hand, the top quintile (or top 20 percent) of Americans source only 55.4 percent of their income from labor and 16.3 percent from capital income as described above. In addition, the top 20 percent of Americans source 12.2 percent of their incomes from business income, a far greater amount than the maximum of 2.8 percent for the remaining 80 percent of Americans.

Here is a chart summarizing the data:

Drilling even further into the Tax Policy Center's analysis, we find that the top 1 percent of income earners source 30 percent of their income from labor, 22.4 percent from business income and a very significant 34.8 percent from capital. Narrowing the field even further, we find that the top 0.1 percent of income earners source only 19.7 percent of their income from labor sources with whopping 50.5 percent coming from capital income and 23.8 percent coming from business sources.

You'll notice the first column in the chart above is labeled "Percent of Total American Cash Income". This column tells us that the bottom 80 percent of American income earners bring home only 45.2 percent of all cash income (3.7 8.4 13.4 19.8 with rounding) while the top 20 percent bring home 54.8 percent of the total cash income. The top 1 percent bring home 16.9 percent of the total and the top 0.1 percent bring home 7.8 percent of America's total cash income.

When politicians propose changes to the individual tax code, particularly reductions in taxes paid on certain types of income, we need to keep this information in mind. Unless income taxes are reduced across the board on all types of income, it is quite apparent that certain socio-economic groups will benefit more than others when tax reductions are selective and that income will be transferred from one level of society to another. Right, Mr. Romney?

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment