One of the big questions surrounding the implementation of the Affordable Care Act is the cost of insurance premiums for those that will be forced to purchase coverage because they are not covered by Medicare or job-related health insurance. A recent study by the nonpartisan Kaiser Family Foundation (KFF) answers this question for us. The analysis provides a look at insurance premiums in the largest cities in seventeen states and Washington, D.C. and the impact of tax credits that will at least partly offset the costs of insurance for low- and middle-income families. As well, the analysis provides estimated insurance costs for 25, 40 and 60 year old enrolees.

Under the ACA, starting on October 1, 2013, individuals and families will be able to purchase private insurance coverage through new state-based insurance exchanges. In states that decide against running their own exchanges, the federal government will run the system or partner-up with the state to run the exchange. Enrollees with family incomes between one and four times the federal poverty level ($24,000 to $96,000 for a family of four) may qualify for:

1.) Premium tax credits that reduce the cost of coverage.

2.) Subsidies to reduce the cost of coverage.

Insurers must cover a minimum set of essential health benefits and will organize their plans into five levels of cost-sharing; catastrophic, bronze, silver, gold and platinum in ascending order of the amount of protection offered. Insurers will not be able to deny coverage based on health conditions that already exist but will be able to vary premiums by age, use of tobacco, family size and geographic region.

Here is a listing of the states participating in insurance exchanges, the number of insurers involved and the number of plan options that the insurers will offer:

As the health insurance situation sits now, one insurer dominates the American market, insuring at least half of the market in 30 states and Washington, D.C. This is expected to change to some degree as the new exchange program will allow participants to switch from one plan to another, improving competition.

Exchange insurance premiums will vary from state-to-state because of differences in the cost of health care and varying levels of health care marketplace competition. Additionally, exchanges also have varying authority to negotiate premium levels with insurers.

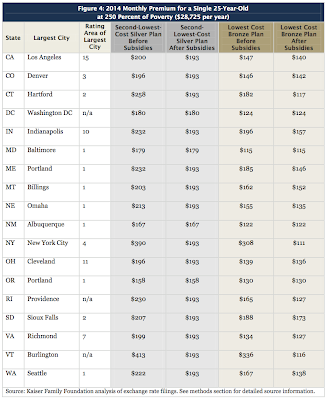

Let's look at the monthly premiums (before and after subsidies) for the second-lowest cost silver and bronze plans that a single 25 year old would pay with an income that is at 250 percent of poverty for each of the 18 markets:

The city with the cheapest silver plan before subsidies is Portland Oregon with monthly premiums of $158. Subsidies do not apply to this rate in Oregon. The city with the most expensive silver plan is Burlington, Vermont with monthly premiums of $413. Fortunately, subsidies bring this rate down to $193, the same level as most of the other states after subsidies are included.

Obviously, at some income levels, the impact of cost-sharing subsidies and premium caps on the monthly premium payable are not unsubstantial. Here is a chart showing the premium caps and cost-sharing subsidies by income level for 2014:

Basically, a single 40 year old individual with an income that is 250 percent of the federal poverty level (i.e. $28,725 annually) would pay 8.05 percent of their income or $193 per month to enrol in the second-lowest-cost silver plan regardless of where they live.

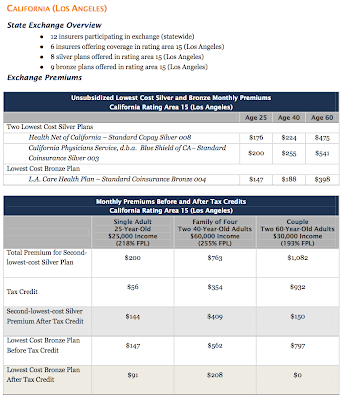

The analysis then goes on to look at a state-by-state analysis of each of the 18 exchanges, providing the monthly premiums for 25, 40 and 60 year olds and the premiums before and after tax credits for a single 25 year old with an income of $25,000, a family of four with two 40 year old adults and an income of $60,000 and a 60 year old couple with an income of $30,000. Here is an example for Los Angeles:

Note that the tax credit for the sample 60 year old couple is a whopping $932 monthly for the second-lowest-cost silver plan, bringing their monthly premiums down to $150 from $1082.

I would recommend that you read through the remainder of the report as linked above since the details for each of the 18 state exchanges is too lengthy for this posting.

Surprisingly, the Kaiser report found that health care premiums were below what was projected by the Congressional Budget Office in July 2012. At that time, the CBO estimated that the second-lowest-cost silver plan premiums for a single 40 year old would be $320 per month. As you can see in the report, in only three out of the eighteen areas participating in the exchange, is the monthly premium in excess of the $320 estimate. This suggests that it is quite possible that accessing health care insurance under ObamaCare will not be as expensive as was anticipated.

One can only hope that the Kaiser Family Foundation analysis is correct.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment