The 2012 National Financial Capability Study by FINRA provides us with an interesting snapshot of the state of household finances in the United States. The study was undertaken based on data from a nationwide online survey of over 25,000 American adults and can be broken down into both state level. I'm going to jump right into the questions asked and the data supplied by respondents on a national basis. Please note that all of the responses do not add up to 100 percent because I have chosen to ignore the small sample of respondents that "preferred not to say".

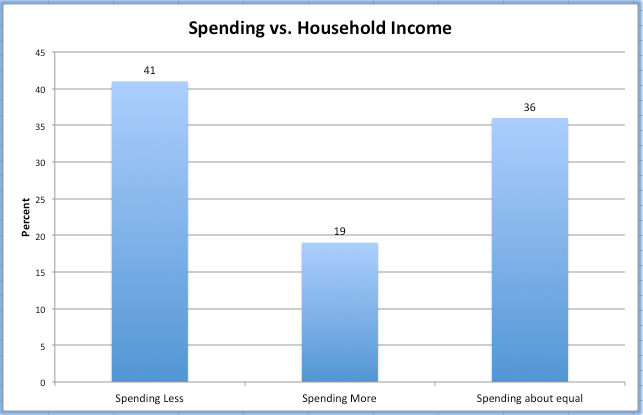

1.) Over the past year, would you say your household's spending was less than, more than or about equal to your household's income?

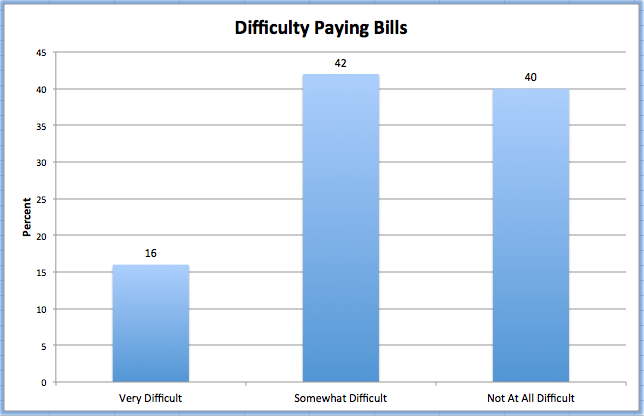

2.) In a typical month, how difficult is it for you to cover your expenses and pay all of your bills?

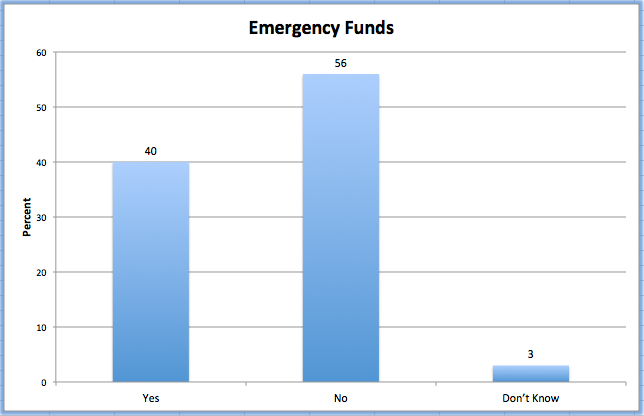

3.) Have you set aside emergency or rainy day funds that would cover your expenses for 3 months in case of sickness, job loss, economic downturn or other emergencies?

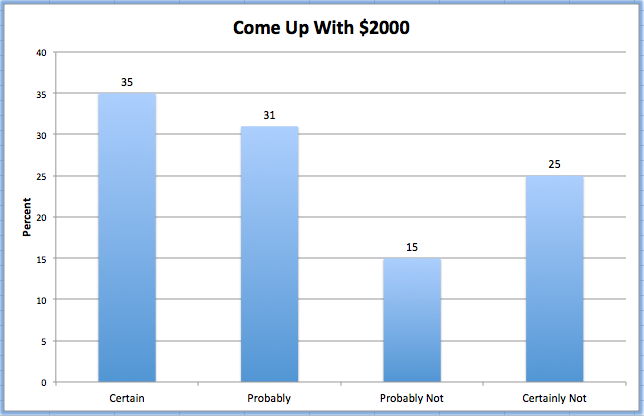

4.) How confident are you that you could come up with $2000 if an unexpected need arose within the next month?

5.) Have you ever figured out how much you need to save for retirement?

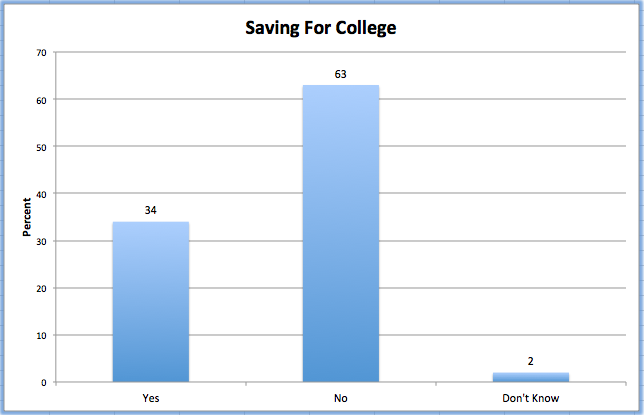

6.) Are you setting aside any money for your children's college education?

I found it interesting that nearly one in six American households are spending more than they are earning and that nearly six in ten are having some or great difficulty paying their monthly bills. It is also interesting to see that nearly six in ten households have not saved the bare minimum of three months worth of salary as a buffer to cover an emergency (i.e. a sudden job loss) and that four in ten feel that they would not be able to come up with $2000 if there was an urgent need. It is fascinating to see that very substantial numbers of Americans have done very little planning for their retirement or saving for college education for their children but not terribly surprising given the number of households that are living hand-to-mouth.

When one looks at the numbers, the financial vulnerability of America's households is frightening and perhaps goes a long way to explaining why the consumer-driven United States economy is not growing at anything approaching historical levels. Given that the economy is five years into a "recovery", the situation for millions of households could become dire if the economy experiences a downturn as interest rates rise to historical norms and over-indebted households are forced to face their own personal day of debt reckoning.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment