Global Systemically Important Banks and Credit Suisse – A House of Cards

With the recent turmoil in the American banking sector, the collapse of Credit Suisse and the global interconnectedness of the banking system, the potential impact of the collapse of four banks in the past few days is, to put it mildly, concerning. This is particularly the case for the death of Credit Suisse, a bank that has been deemed “systemically important” as you will see in this posting.

The world’s largest and most influential banks have received a classification as the Global Systemically Important Banks or G-SIBs. The 2022 list of G-SIBs is the most recent iteration of the listing and is based on data to the end of 2021. The 30 banks on the list receive their designation from the Basel Committee on Banking Supervision according to methodology that was revised in 2018 to reflect the importance of higher loss absorbency requirements. Global Systemically Important Banks are institutions that are perceived as not being allowed to fail due several factors, most importantly, the concern that their failure would trigger a wider financial collapse and a threat to the global economy as was experienced in 2008 when the world’s banking system nearly collapsed.

Global systemic importance is measured in terms of the impact that a bank’s failure can have on the global financial system and wider economy, rather than the likelihood that a failure could occur.

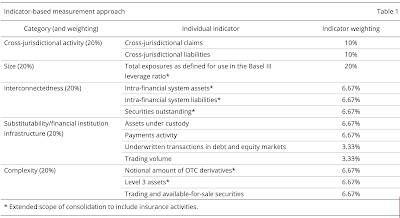

The methodology that assess the systemic importance of G-SIBs relies on several indicators which can be categorized as follows:

1.) size

2.) cross-jurisdictional activity

3.) interconnectedness

4.) substitutability/financial institution infrastructure

5.) complexity.

Each of these categories is given an equal weighting of 20 percent and each category has multiple indicators as shown on this table:

The 2018 enhancements included the following:

1.) Amending the definition of cross-jurisdictional indicators consistent with the definition of BIS consolidated statistics;

2.) Introducing a trading volume indicator and modifying the weights in the substitutability category;

3.) Extending the scope of consolidation to insurance subsidiaries;

4.) Revising the disclosure requirements;

5.) Providing further guidance on bucket migration and associated higher loss absorbency (HLA) surcharge when a G-SIB moves to a lower bucket; and

6.) Adopting a transitional schedule for the implementation of these enhancements to the G-SIB framework.

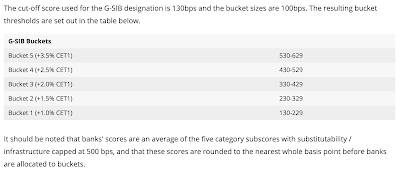

Since G-SIB failures could pose a threat to the international financial system, the banks must hold more risk-based capital to enhance their resilience. The capital add-on (surcharge) is shown on this table which also shows the “bucket” to which various levels of the capital add-on are assigned with the cut-off score being 130 basis points (bps) with CET1 being Common Equity Tier 1 which is the banks core capital including common shares, stock surpluses, retained earnings and accumulated other comprehensive income :

Here is a list of the G-SIBs and their buckets effective November 2022:

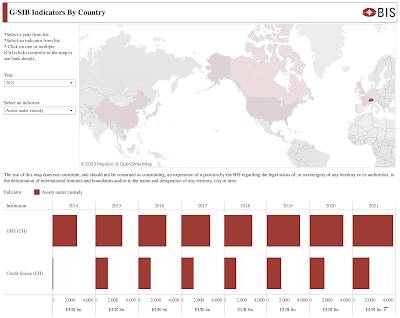

You’ll note the presence of Credit Suisse in Bucket 1.

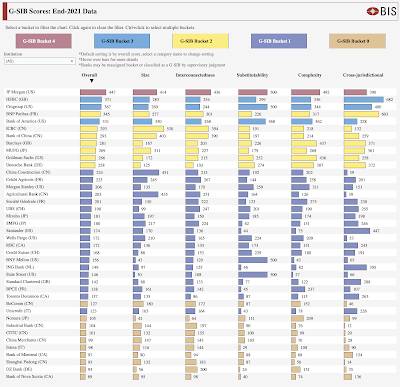

Here is a graphic showing the breakdown of G-SIB scores from data at the end of 2021:

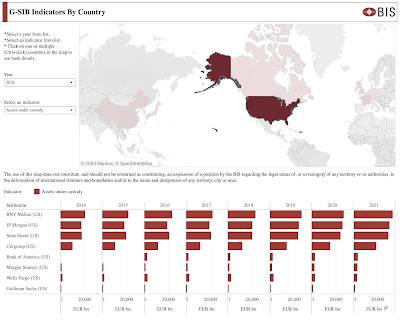

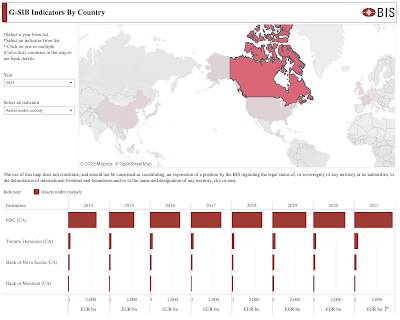

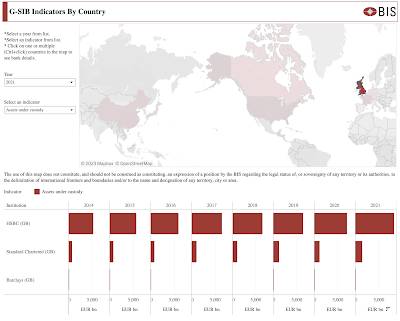

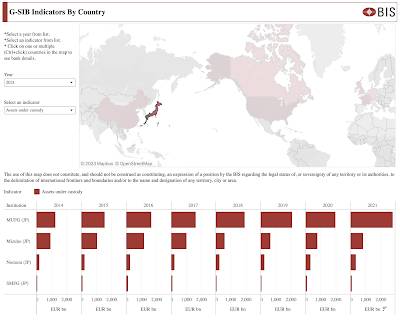

Here is data showing total assets under custody for the largest banks in several nations and how the value of these assets has changed since 2014:

1.) China:

2.) United States:

3.) Canada:

4.) United Kingdom:

5.) Japan:

6.) Switzerland:

It’s very apparent that the collapse of even a single G-SIB in any nation could prove catastrophic to that nation’s banking system and cause severe stress in the wider global banking ecosystem.

Given the global nature of the world’s banking system means that it is only as strong as its weakest link. While the recent collapse of smaller banks in the United States could prove to be contagious at some point, impacting the nation’s G-SIBs, the implosion of Credit Suisse is of greater immediate concern given its importance to the global banking sector. A house of cards indeed.

Be the first to comment