With the global climate change narrative ramping up and the fact that governments have realized that they are capable of controlling their citizens, an interesting development from 2020 looks like it has the potential to significantly impact the "sweaty masses".

Doconomy claims that it is a "banking service with a conscience" as shown here:

Doconomy, a privately owned company in partnership with Finnish bank Ålandsbanken, was founded in Sweden in 2018 by Johan Pihl and Mathias Wilkstrom, two Swedes who launched a financial technology (fintech) company with a "mission to solve the climate crisis through behavioural change". Their solution to carbon emissions by individuals was to set up a suite of banking tools which allows people to "compensate the planet" for their purchases through carbon offsetting since approximate 60 percent of carbon emissions are linked to consumption of goods.

In 2019, Doconomy launched its DO Black credit card in April 2019, which helps people track their personal carbon footprint. The DO Black card is the first credit card in the world which cuts off further transactions once a user exceeds their carbon limit. Here is a quote on how the system works:

"So how does it work? Doconomy uses the Åland Index to calculate the carbon impact of each transaction, which is developed by the Bank of Åland using data from Thompson Reuters, Sustainalytics and the WorldBank’s Mitigation of Climate Change Working Group. It is also partnering with Mastercard and UNFCCC to launch its credit cards.

Consumers will be able to ‘carbon compensate’ for carbon emissions related to their purchases. This means donating to UN-certified emission reductions projects, or investing in sustainability funds.

Retail partners must also pay for their climate impact by rewarding customers with DO-credits. There’s a caveat for consumers: these credits must be used to ‘climate compensate’ or to contribute to personal savings, but they can’t be used to buy more!

In doing so, Doconomy is radically rethinking the provision of credit: credit cards have always encouraged overspending. Doconomy’s credit cards hope to achieve the opposite.

Here is a video from Docomony regarding the DO Black credit card, issued in cooperation with Mastercard and the United Nations:

Notice the pledge above the signature line on the DO Black card:

Here is a screen capture from Doconomy's website noting the input from the World Economic Forum in the top left corner:

In case you can't read it, here is the quote from the WEF, an organization that represents the will of the wealthiest consumer class on earth:

"Everything we put in our shopping basket comes at an environmental cost."

The WEF offered more details on its support for the DO credit card as shown here:

….and here:

"The DO card tracks the CO2 emissions linked to purchases to calculate the carbon impact of every transaction. The aim is to encourage people to actively reduce their carbon footprint and demonstrate the impact that small changes can have on the environment.

The card uses the Aland Index as the basis on which it calculates the carbon footprint of each product purchased. Users can set a maximum value for their carbon spend and learn how to compensate for their carbon footprint by contributing towards schemes to reduce or remove greenhouse gas emissions.

A savings product also offered by the company offers an interest rate that includes investment in climate-friendly projects.

The card itself is made from bio-sourced materials, and printed with air ink – ink manufactured from recycled carbon in air pollution."

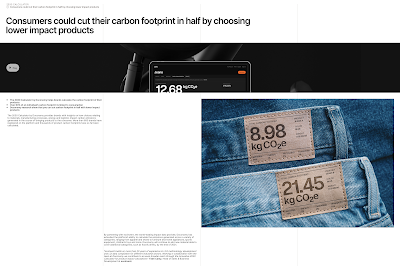

Let's look at some additional products from the company. Doconomy is allowing consumers to better understand the impact of their consumption with the 2030 Calculator as shown here:

Docomony and the United Nations Framework Convention on Climate Change (UNFCCC) have worked together to launch a Lifestyle Calculator to allow consumers to understand how their lifestyle affects the climate:

It also has launched the world's first water impact calculator for every purchase, allowing consumers to measure both the CO2 and H2O impact of every transaction as shown here:

Obviously, Docomony is very serious about climate change. Unfortunately, their novel, first-of-a-kind credit card, which cuts off users' spending once it reaches a predetermined carbon footprint could be the opening salvo in a new normal where the consumption of goods by the serf/organ donor class is controlled by the hyperconsumer ruling class (think – social credit score). My suspicion is that governments will take it upon themselves to set the carbon emissions limits for us, all in the name of saving the planet by reducing our personal carbon footprint…for the benefit of the wealthiest, meat-eating, private jet-owning, supercar-using class, of course. The very fact that the World Economic Forum is backing this project should give us pause to ponder its ultimate implications on all of us because they aren't going to be positive.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment