J.P. Morgan and Biometric Payment Solutions – Welcome to the Future of Commerce

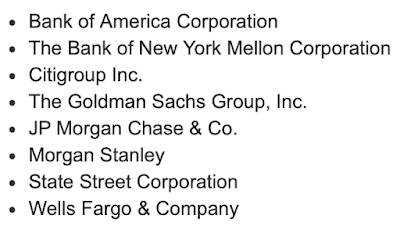

While it may just be that my tinfoil hat is a bit on the tight side, a recent announcement by J.P. Morgan, the sixth-largest bank in the world and one of the so-called “too big to fail” banks that is under the supervision of the Federal Reserve’s Large Institution Supervision Coordinating Committee (LISCC) as shown here:

…is key to understanding what our future will look like.

Here is the announcement:

Here are is the opening paragraph from the announcement:

“J.P. Morgan will begin piloting biometrics-based payments with select retailers in the U.S. This is the first pilot solution to launch from J.P. Morgan Payments’ new Commerce Solutions suite of products, dedicated to helping merchants adapt to the rapidly evolving payments landscape.“

J.P. Morgan Payment’s biometric system includes both palm and face identification for payment authentication in stores and works on a enrol-capture-authenticate-pay basis. Of course, this is being sold to consumers and merchants as a means of providing fast, secure, simple and modern checkout experiences for consumers and a means of enhancing customer loyalty for merchants at the same time as it provides transactional security and reliability.

J.P. Morgan wants to be an early promoter of biometric payments technology because global biometric payments are expected to reach 3 billion users and $5.8 trillion in spending by 2026.

Here’s how the system will work and key benefits:

“After a short customer enrolment process in store, the workflow is; cashier scans items or customer uses self-service terminal, user scans palm or face, user completes checkout, user gets receipt. The solutions has a benefits for merchants and their consumers. For merchants, the key benefits include customer sales and loyalty growth and the removal of friction from merchants’ day-to-day processes. For the customer, the payments are phone-free, private, secure, fast and simple.”

The first pilots will run in brick-and-mortar stores in the United States and will potentially include the Formula 1 Crypto.com Miami Grand Prix, which is planning to be the first Formula 1 race to pilot biometrics-based payments to provide guests with a faster checkout experience. If the pilot stage is a success, additional merchants will be added in 2024.

Have you noticed that all of this technology is being sold to society as a means of speeding up payment and convenience for customers, the same logic that is being used to promote central bank digital currencies? After all, it is just so time-consuming and physically exhausting to haul a credit card out of your wallet or use a smartphone-based payment system, isn’t it? In my humble opinion, the implementation of biometrics as part of a payment system is a key and necessary aspect of the implementation of both digital identification and central bank digital currency ecosystems.

We are all being played for suckers in a global game that the serf class simply can’t win. Welcome to the future of commerce where we have no privacy and where the powers that be can ultimately control our spending.

Be the first to comment