In researching another posting, I stumbled on some interesting data that I wanted to pass along.

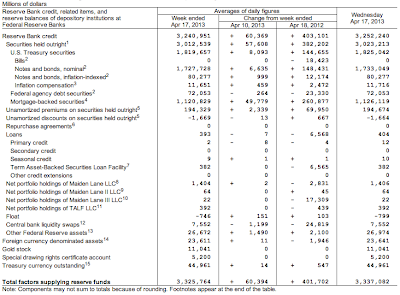

Since the Great Recession, the Fed has been very busy intervening in the free market in a series of desperate attempts to stimulate the American economy. Through the use of quantitative easing and "The Twist", the Fed has ended up with a very bloated balance sheet, containing nearly two trillion dollars worth of U.S. Treasuries as shown on this graphic:

In the two years before the crisis in 2008, the Fed's balance sheet stood at between $860 billion and $920 billion. On September 3, 2008, the Fed had $905 billion in assets; by October 1, 2008, that number had risen to $1.504 trillion, a 66 percent increase.

In mid-April 2013, the Fed owned $1.819 trillion worth of U.S. Treasury securities as shown on this chart:

The data shows that 55.8 percent of the Fed's total asset base is made up of United States Treasuries.

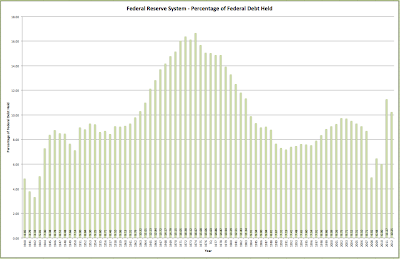

Now, let's get to the key point of this posting. From the President's Fiscal Year 2014 Budget, comes the following data showing the history of the Federal Reserve's holdings of U.S. Federal debt since 1940:

Here is a bar graph showing how the percentage of the Federal debt held by the Federal Reserve has changed over the 7 decade period, showing how it has more than doubled since 2008:

As I've said before, Mr. Bernanke and his merry band of bankers are trapped in interest rate purgatory. If they raise rates, the value of the Fed's balance sheet could plummet as the market value of the majority of the Fed's assets drop since the trading price of bonds varies inversely with interest rates. A recent study shows that a mere 2 percentage point increase in interest rates on a 30 year bond with a 4 percent coupon would see the bond price drop by 27.7 percent. The same 2 percentage point rise would push the price of a 20 year bond down by 23.1 percent and a 10 year bond by 14.9 percent.

In any case, the Federal Reserve is now at the mercy of its own policies and, since interest rates are just above zero, it is highly unlikely that they will see the market value of their Treasury portfolio rise with a drop in interest rates, unless they are willing to experiment with a negative interest rate policy.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment