As the mainstream media reminds us every month, the unemployment picture in the United States is showing signs of life. From its peak of 10 percent back in October 2010, the U-3 unemployment rate (or what I refer to as the "headline unemployment rate") has fallen to its current level where it seems to be stubbornly stuck as shown here:

What we rarely see discussed is the improvement to the U.S. employment rate. That's because it hasn't improved since the depths of the Great Recession as you will soon see.

The OECD provides employment data for its 34 member nations from 2005 to 2012 as shown on this graphic:

The OECD defines the employment rate as the percentage of the working age population that is actually working. Here is a listing of the numbers for the United States by year:

2005 Employment Rate: 71.5 percent

2006 Employment Rate: 72.0 percent

2007 Employment Rate: 71.8 percent

2008 Employment Rate: 70.9 percent

2009 Employment Rate: 67.6 percent

2010 Employment Rate: 66.7 percent

2011 Employment Rate: 66.6 percent

2012 Employment Rate: 67.1 percent

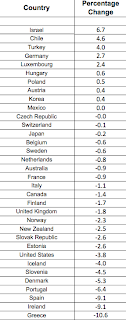

Here's how the change in the United States employment rate between 2008 and 2012 looks compared to its OECD counterparts (in descending order):

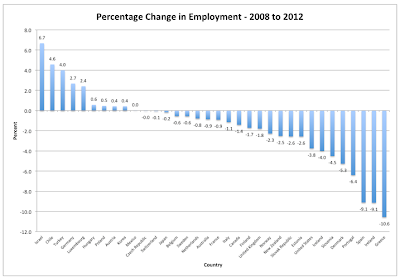

Lastly, here's a bar graph showing us just how poorly the situation has improved in the United States compared to America's OECD peers:

The United States economic growth period since the Great Recession has left America with the eighth worst employment growth standing, just ahead of a selection of Europe's weakest economies and most indebted nations; Greece, Ireland, Spain and Portugal. The United Kingdom which has suffered from what could be termed a triple dip recession has seen its employment level rise to within 1.8 percentage points of its recessional lows. Even Italy, the world's third most indebted nation in nominal terms and home to the renowned Silvio Berlusconi has a better track record than the U.S., seeing its current employment level rise to within 1.1 percentage points of its lows.

While Mr. Bernanke and his minions at the Fed are keying their future interest rate experiment on a drop in the unemployment rate, we can clearly see that the statistical measure of unemployment is only part of the picture that faces the economy. Employment is hardly what one would term as robust.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment