Overview

The European Central Bank (ECB) raises interest rates again, this time by a quarter of a percentage point. The bank is taking the measure because inflation in Europe is still considered too high. It is the seventh rate hike in a row. The interest is now at 3.25 percent.

Reason for the hike

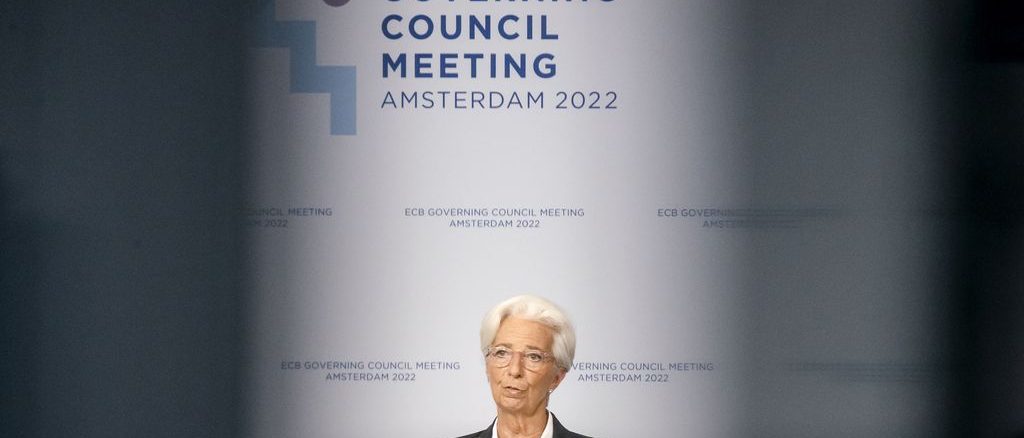

A statement from the ECB said that although inflation fell last Monday, “underlying price pressures” remain strong. Previous rate hikes have been bigger, but according to ECB president Christine Lagarde “it was wise to go back to a more standard hike”. The purpose of the increase is to cool down the economy. For example, it costs more to borrow money, both for investment and for consumption. The high inflation arose because there was more demand for products. If there is less demand, prices rise less quickly.

Future outlook for interest rates

There will be more increases, according to Lagarde, because the “complete impact” that the ECB wants to see is not yet visible.

ECB’s objective

The ECB makes and implements the economic and monetary policy of the EU. One of the core tasks is to ensure that inflation does not become too high. In two years, in 2025, the ECB wants inflation to be a maximum of 2 percent. In our country rose inflation in April slightly to over 5 percent, after falling for a while.

Unrest in the financial markets

In recent months, there has been unrest in the financial markets due to the collapse of three American banks and the Swiss Credit Suisse.

Interest rate hike by US Federal Reserve

Yesterday elevated the US central bank, the Fed, also raised interest rates by 0.25 percentage point. That was the tenth increase in more than a year. Now there may be a pause in the number of hikes in the US to see how inflation and the banking situation develop. The interest rate in America is higher than in Europe, at 5.25 percent.

Be the first to comment