Last year, I posted a brief summary of the State of the Union using screen captures. With your patience and, in light of the President’s State of the Union speech, I’d like to update the information from last year’s posting and show how much or little progress has been made on five critical sectors of the American economy. Please note that if you click on the introductory line to each section, you will be taken directly to the source documents.

Last year, I posted a brief summary of the State of the Union using screen captures. With your patience and, in light of the President’s State of the Union speech, I’d like to update the information from last year’s posting and show how much or little progress has been made on five critical sectors of the American economy. Please note that if you click on the introductory line to each section, you will be taken directly to the source documents.Last year’s debt to the penny number was $14,062,239,904,820.69. With the debt number for January 20th in mind as I’ve linked to above, the Obama Administration has added an additional $1.174 trillion or 8.3 percent to the debt in just 12 months. All that, despite the kerfuffle in Washington back in July and August 2011. Way to go D.C.! As an added bonus, if we use the current dollar GDP for the third quarter of 2011 of $15.176 trillion as released by the Bureau of Economic Analysis, we see that the debt-to-GDP ratio has reached 100.4 percent. Kudos again!

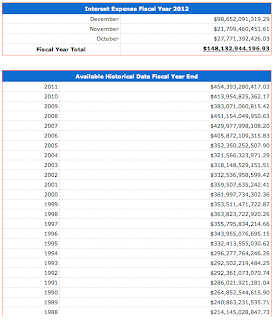

For the first three months of fiscal 2011, the interest owing on the federal debt was $148,238,982,913.81. Basically, the interest owing has remained relatively constant from last year’s despite the growth in the debt. With last year’s interest record of $454 billion, it certainly looks like we are on target to either meet or break the record. We have our current ultra-low interest rate environment to thank for that. Heaven help us all should interest rates rise to historic norms or we experience a bond run like several European nations have over the past year.

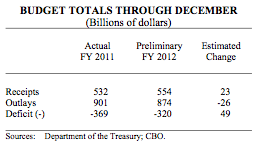

For the first three months of fiscal 2012, Washington has run a deficit of $320 billion, down $49 billion from the deficit of $369 billion in the first three months of the previous fiscal year. Over the quarter, about $9 billion in savings was achieved through lower unemployment insurance payments (as the long-term unemployed ran out of benefits) and outlays for Medicaid fell by $15 billion because the federal government’s share of program costs dropped in July 2011. We’ll see how long those two savings last should another recession take hold and as the population ages.

4.) The housing market:

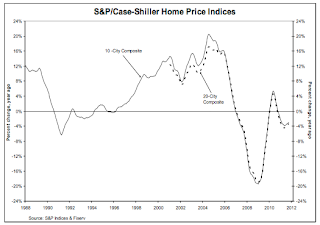

One year ago, it looked like there was a slim chance the American housing market might be coming off its multi-year lows as the Case-Shiller Home Price Index was sitting right on the zero percentage change from the previous year. While the price drop over the past 12 months has not been as bad as it was in previous years, data through to the end of October 2011 (the most recent data available) show that the leading measure dropped by 1.2 percent from the previous month and by 3.4 percent from the previous year. Nineteen of the twenty markets surveyed saw month-on-month price declines from October to September. The bottom of the housing market does not appear to have arrived just yet.

5.) Unemployment:

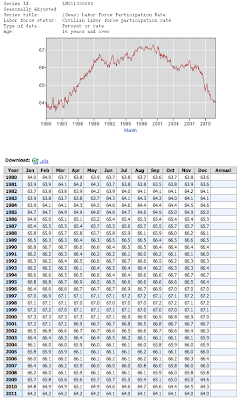

The year-over-year drop in unemployment is the one "bright" spot in the State of the Union. The headline U-3 unemployment rate has dropped from a seasonally adjusted rate of 9.4 percent in December 2010 to 8.5 percent in 2011. While that is marvelous news for those individuals who actually regained employment, the broader U-6 rate (which includes persons that are unemployed, those who are marginally attached to the labor force and those who are working part-time for economic reasons plus those who are marginally attached to the work force) is still a rather high 15.2 percent, down from 16.6 percent one year earlier. Part of the drop in unemployment is related to a drop in the size of the labor force, which has reached its lowest level since the early 1980s as shown here:

While the State of the Union in some sectors of the economy has improved, one would hardly call the "recovery" robust, in fact, it is among the most sector specific and weakest recoveries since the Great Depression. Let’s hope that the world doesn’t slip into Part 2 of the Great Contraction, making a lukewarm economic situation become worse very quickly.

Click HERE to read more of Glen Asher’s columns.

Article viewed on Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment