In the United States in recent weeks, there has been a plethora of articles in the mainstream media about the rising price of gasoline and who is to blame. Some fingers are pointing at President Obama, some at oil producing and refining companies and others at oil producing nations. While $4.25 a gallon may seem excessive, by some measures, it’s actually quite reasonable.

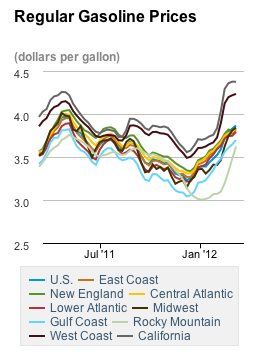

Let’s open by looking at what has happened to gasoline prices across the United States over the recent past with this graph from the U.S. Energy Information Administration:

Now, here’s a chart showing the price of West Texas Intermediate since March 2009:

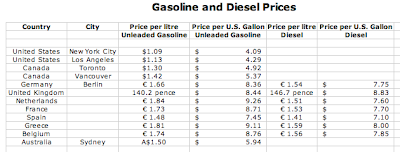

From several sources, I have gathered gasoline/petrol prices from several European nations, Canada and Australia, entered the data on this table and converted the price per litre to a price in U.S. dollars per U.S. gallon:

For consistency, I have used the following conversions:

1 U.S. gallon = 3.785 litres

1 USD = 1 CAD

1 AUD = 1.57 USD

1 Euro = 1.33 USD

You’ll notice that the prices in European countries are generally at or close to twice the price that we find at our local station. Even Canadians are paying roughly a dollar more per gallon for gasoline, largely because Canada’s excise tax on a gallon of gasoline is higher than the United States as you’ll see below.

Here is a map showing the level of excise taxes on gasoline for each state from the American Petroleum Institute website:

On average, across the United States, in January 2012, consumers were paying 48.8 cents in combined local, state and federal taxes on a gallon of gasoline or the equivalent of 12.89 cents per litre.

Here’s a chart showing what Canadian consumers pay in fuel taxes for comparison:

Depending on the province of residence, gasoline taxes range from 24.439 cents per litre all the way up to 43.52 cents per litre. On top of that, some cities impose additional taxation; Montreal consumers pay $45.395 cents per litre and Vancouver residents pay the highest gasoline taxes in the country at $45.868 cents per litre, nearly 4 times what American consumers pay.

Let’s take a look at one European nation in a bit of detail. The United Kingdom just set a new petrol (as they call it) price record of 140.2 pence per litre for unleaded gasoline and 146.7 pence per litre for diesel. That works out to $2.23 per litre for gasoline and $2.33 per litre for diesel. When converted to United States gallons, U.K. motorists are paying $8.40 for a gallon of gasoline or $8.99 for a gallon of diesel, twice the price that Americans are paying. To add insult to injury, the U.K. government has scheduled a fuel duty rise in August; the fuel duty is set to rise by 3.02 pence per litre to 60.97 pence per litre plus VAT (20 percent) for a total fuel duty of 73.16 pence per litre or $115.6 per litre or $4.48 per gallon. Basically, U.K. consumers are paying as much in taxes per gallon of gasoline as Americans are paying for the product, taxes included.

From the chart, you can see that gasoline is even more expensive in Belgium, France and Greece and the high prices really hit their stride in The Netherlands where a gallon of gasoline will set drivers back $9.26.

Let’s put all of these prices into perspective. Let’s take an average car like a Toyota Camry which has a 17 gallon fuel tank capacity. In the United States, a dry fill will cost drivers $72.93 at a price of $4.29 per gallon. That same fill costs Canadians $87.55 at $5.15 per gallon. United Kingdom drivers will pay $143.48 and drivers in the Netherlands will pay a whopping $157.42, more than twice what American consumers will fork over. Fortunately for Europeans, they have an excellent mass transit rail system.

While no one likes to feel like someone is sticking their hands into your wallet/purse/pocket while you are filling your car with gasoline/petrol/diesel, it is quite apparent that at least some of the blame lies in two directions; greedy governments who want more than their share in gasoline taxes and the higher price of the raw commodity that is the source of gasoline and diesel. It’s harder to put a finger on who is to blame for that.

Data Sources:

Click HERE to read more of Glen Asher’s columns.

Article viewed on Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment