We all know that the Fed's primary purposes are to keep inflation in check, to support maximum employment and to moderate interest rates. Most of us would generally agree that inflation is relatively under control right now, at least by official measures, and there is no denying that long-term interest rates are in the toilet. That said, maximizing employment has certainly proven problematic and the Fed has failed in part of its mandate as required under Section 2A of the Federal Reserve Act as quoted here:

"The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy's long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates."

Let's open this posting by looking at a graph showing the official civilian unemployment rate from FRED since 1948:

While the civilian unemployment rate has dropped from its peak level of 10 percent reached in October 2009, it is still at a very elevated level when compared to other inter-recessional periods.

Now, let's look at a graph that shows where at least part of the employment problem lies:

Between 1948 and the Great Recession of 2008 – 2009, the longest average duration of unemployment was slightly over 21 weeks back in July 1983, just after the end of the recessionary period of the early 1980s. While that duration of unemployment was nearly twice the inter-recessional duration seen in the previous years, it is nothing compared to what the United States is experiencing now. In the months just prior to the Great Recession, the mean duration of unemployment averaged between sixteen and seventeen weeks or just over four months. This began to rise rapidly in late 2008 and early 2009 and quickly and by the end of the official recession in June 2009, had reached 23.9 weeks.

Unfortunately for America's unemployed, the situation did not improve as shown on this graph:

Despite the drop in the headline U-3 civilian unemployment rate from its peak of 10 percent to 8.2 percent last month, the average duration of unemployment has not improved at all, increasing consistently until it reached its peak of 40.9 weeks in November of 2011 where it has more-or-less remained. Last month's average duration of 39.7 weeks is only 2.9 percent below the peak and is also still at a level that is more than twice the rate prior to the Great Recession. What is particularly concerning is that we are now nearly three full years into the so-called "economic recovery" and this particular facet of America's employment picture is showing no meaningful signs of improving anytime soon.

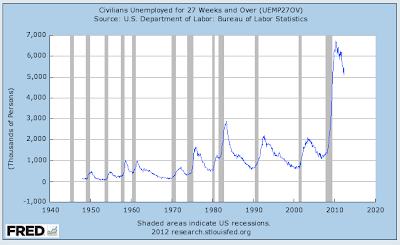

To put the numbers of Americans suffering from long-term unemployment into perspective, here is another graph from FRED showing the number of civilians unemployed for 27 weeks and longer:

In mid-2007, 1.291 million Americans were considered long-term unemployed. By April 2010, this had risen 422 percent to a peak of 6.73 million. Since that time, the number of long-term unemployed has fallen to 5.411 million, a drop of only 19.6 percent from its peak. Note that the data shows that the economy seems to be stuck at this level with the data showing a range from 5.588 million in December 2011 to the current level of 5.411 million six months later. Once again, you'll notice that the current number of long-term unemployed is far above the normal inter-recessional levels experienced over the last six decades and that the level has hardly dropped considering that we are three years into the "recovery".

Millions of Americans are suffering while Mr. Bernanke "fiddles" with the economy. It most certainly appears that the Federal Reserve really doesn't have a clue how to meet one of the critical parts of its mandate, you know, the part where the Fed is supposed to ensure maximum employment. And yet, Mr. Bernanke persists to no avail.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment