It is becoming increasingly clear, at least to those of us who are trying to suss out the "big picture", that the current pandemic is being used as the catalyst for a complete rebuilding of society. One piece of the puzzle that fits well with the implementation of a vaccine passport is the introduction of central bank digital currencies or CBDCs. A recent announcement from the Bank for International Settlements (BIS) clearly shows the progress that is being made on this aspect of what will be a new normal.

Here is the announcement from BIS, the central bank for central banks:

Here is more information on Project Dunbar from the BIS:

Project Dunbar will include four central banks from Australia, Malaysia, Singapore and South Africa. Here is the announcement about Project Dunbar from the Reserve Bank of Australia:

According to pymnts.com, Project Dunbar will take shape as a CBCD platform where a collection of nations will issue CBDCs that are aimed for cross-border uses. It also notes that Project Dunbar might just be the catalyst for the accelerated development of CBDCs in the United States. According to Fintech Times, Project Dunbar is one of the most significant central bank partnerships

Now, let's look at what the Bank for International Settlements has to say about CBDCs:

"Interest in CBDC has grown in response to changes in payments, finance and technology, as well as the disruption caused by Covid-19. A 2021 BIS survey of central banks found that 86% are actively researching the potential for CBDCs, 60% were experimenting with the technology and 14% were deploying pilot projects.

In simple terms, a central bank digital currency (CBDC) would be a digital banknote. It could be used by individuals to pay businesses, shops or each other (a "retail CBDC"), or between financial institutions to settle trades in financial markets (a "wholesale CBDC").

Central banks are exploring whether CBDC could help them to achieve their public good objectives, such as safeguarding public trust in money, maintaining price stability and ensuring safe and resilient payment systems and infrastructure.

If successful, CBDCs could ensure that, as economies go digital, the general public would retain access to the safest form of money – a claim on a central bank. This could promote diversity in payment options, make cross-border payments faster and cheaper, increase financial inclusion and possibly facilitate fiscal transfers in times of economic crisis (such as a pandemic).

The BISIH intends to contribute to this area through applied technology research, proofs of concept (POCs) and prototypes with central banks around the world."

In a July 2021 report to the G20, BIS and the World Bank (among others):

…stated the following:

"The G20 has made enhancing cross-border payments a priority and endorsed a comprehensive programme to address the key challenges. Faster, cheaper, more transparent and more inclusive cross-border payment services would deliver widespread benefits for citizens and economies worldwide, supporting economic growth, international trade, global development and financial inclusion. To that end, this report takes stock of the international dimension of central bank digital currency (CBDC, see glossary) projects and the extent to which they could be used for cross-border payments. The report also investigates possible macro-financial implications associated with the cross-border use of CBDCs. The analysis does not imply that central banks mentioned in this report have reached a decision about issuance of a CBDC."

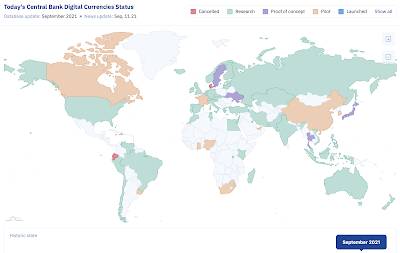

Let's close with this graphic from CBDC Tracker which shows the current status of CBDCs around the globe:

China, South Africa, South Korea, Nigeria, Ghana, Singapore, Uruguay, Canada and France are among the most leading nations when it comes to development of their CBDCs.

Let's close with this thought. During and just prior to the pandemic, the use of physical currency was slowly being curtailed with Sweden being a leading edge contender for a cashless future where digital payments are the only means of paying for many services. Physical cash is being replaced with virtual digital wallets which are often accessed using either a smart phone, a biometric scan or a microchip implant which makes it all the easier for the powers that be (or ought not to be) to block access to your accounts and control what you purchase should you be found in breach of a government diktat. As well, the implementation of CBDCs at the retail level will result in very significant breaches of what little remains of our privacy as central banks and governments will be able to track our every expenditure.

Project Dunbar is just one more step in the march toward what will surely be a dystopian, technocratically controlled future. One thing that we can be certain of is that the implementation of central bank digital currencies is not being done to improve our lives in any way and that it is just further move toward the new normal.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment