In developed nations around the world, politicians are prone to harp on the issue of lowering corporate taxes. Politicians directly link lower taxes with economic growth and job creation. Having spent 30 years working in the oil and gas sector, it seemed to me that this wasn't always the case. For example, when royalty rates on production were dropped, it generally led to one result; higher profits (or decreased losses) for companies throughout the sector. A recent study by the labour-based Canadian Labour Congress examines the relationship between corporate taxes, unemployment and the corporate bottom line, particularly cash reserves and suggests that all may not be what it appears to the ruling class.

As background, the corporate tax rate in Canada was 28 percent back in 2000 and was lowered until it reached 21 percent under Paul Martin's watch. Under the leadership of the Harper government, the tax has been cut in stages to its current level of 15 percent. On top of that, the provincial component of corporate taxes has also been lowered with the combined provincial/federal tax rate falling from 40.5 percent in 2001 to 27.8 percent in 2011 and is projected to fall to 25 percent over the coming years.

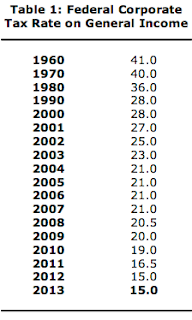

Here is a chart showing the history of the federal component of the corporate tax rate since 1960:

Over the past 50 years, the federal portion of the corporate tax rate has fallen by 26 percentage points or 63.4 percent. The combined provincial/federal corporate tax rate was 52 percent in 1972 and has fallen to roughly 25 percent today, depending on the province. It is important to note that personal tax rates have also fallen over the past four decades; in 1972, those lucky Canadians making over $60,000 paid nearly 70 percent in combined income taxes compared to between 39 and 48 percent today on incomes over $128,000, again, the rate is dependent on the province of residence.

Now, let's look at the effective rate of corporate taxes, the percentage of profits that corporations actually remit to Ottawa. This varies between 20 and 25 percent of before-tax profits because corporations have the ability to deduct certain costs from their taxable income before Ottawa gets their share.

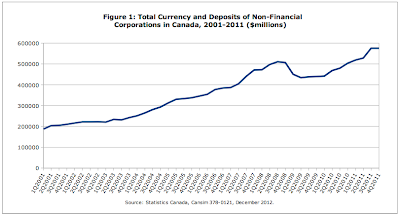

Now, let's look at how Canada's large, non-financial (i.e. excluding the much despised banking sector) have benefitted from these cuts in the rate of taxation:

The total cash reserves of Canadian non-financial corporations has risen from $187 billion in 2001 to $575 billion at the end of 2011, an increase of 307 percent. To put this number into perspective, the current federal net debt was $596.197 billion at the end of November 2012 according to the latest Fiscal Monitor.

How does this impact all of us? In fiscal 2012 – 2013, Ottawa expects to collect $33.1 billion in corporate income tax revenues based on a tax rate of 15 percent. If the Harper government was to raise the corporate tax level back to the 21 percent level, Ottawa would collect an additional $13 billion annually in corporate taxes.

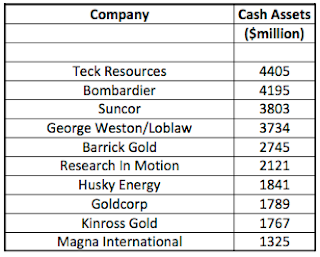

Here are the top ten Canadian companies in order of size of cash reserves from greatest to smallest for 2011:

That's a total of $27.725 billion in cash reserves for 10 companies alone. While it is understandable that some corporations like to sit on cash for potential future acquisitions or as a buffer against an economic slowdown, while it is sitting there, it is not creating jobs or boosting economic growth and productivity levels. As an added benefit, while individual Canadians have to wait until early to mid-June for "Tax Freedom Day", corporations will have thrown off the shackles of taxation by the end of January.

Must be nice. Think about that when the Harper government prattles on about lowering the corporate tax rate even further.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment