A recent publication by the Institutes of International Finance (IIF) gives us a clear picture of the dangers that government responses to the COVID-19 pandemic have created. Let's look at some highlights from the report. I'll break this posting into two parts; the first will look at debt in dollar terms and the second part will look at debt as a percentage of GDP.

1.) Global debt in dollar terms: Thanks to the pandemic, total global debt for the 61 nations in the IIF's sample has increased in 2020 from $257 trillion to $281 trillion, a new record high. Mature markets (i.e. advanced economies) are responsible for $205 trillion of this debt, up from $183 trillion in 2019. Debt outside of the financial sector rose from $194 trillion in 2019 to $214 trillion in 2020.

Government debt accounted for more than half of the increase in total debt, rising by over $12 trillion compared to a rise of $4.3 trillion in 2019. Mature markets saw the biggest increases in government debt, rising by $10.7 trillion thanks to governments' fiscal response to the pandemic and the decline in tax revenues. The IIF expects that government budgetary deficits will continue to remain well above normal, pre-pandemic levels, with government debt increasing by another $10 trillion in 2021, reaching $92 trillion by the end of 2021.

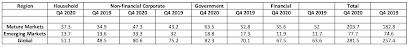

Here is a table summarizing the debt in dollar terms for mature and emerging markets, comparing the 2019 and 2020 fourth quarter data:

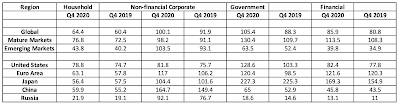

2.) Global debt as a percentage of GDP: On a global basis, government debt rose from 88.3 percent of GDP in Q4 2019 to 105.4 percent in Q4 2020. Mature market economies saw their government debt rise by 20.7 percentage points (15.9 percent) to 130.4 percent of GDP in Q4 2020 compared to a rise of 11.1 percentage points (21.1 percent) to 63.5 percent of GDP in Q4 2020. Non-financial private sector debt (households and corporate debt combined) rose by 41 percentage points to 165 percent of GDP in Q4 2020 and financial corporate debt saw its largest annual increase in debt ratios in over a decade, rising by 5 percentage points to 86 percent of GDP in Q4 2020. This is the largest increase since 2007 and the first annual increase since 2016.

Mature markets saw the biggest increases in debt ratios during 2020 (outside of the financial sector). The rapid buildup in debt was largely due to increases in government debt in mature markets, particularly in Greece, Spain the United Kingdom and Canada. In emerging markets, China saw the largest increase in non-financial debt ratios followed by Turkey, Korea and the UAE. South Africa and India recorded the largest increases in government debt ratios.

When looking at overall debt-to-GDP ratios, the ten largest increases were noted as follows (in order from greatest to least):

1.) France

2.) Spain

3.) Greece

4.) United Kingdom

5.) Belgium

6.) Cyprus

7.) Canada

8.) Italy

9.) Portugal

10.) United States

Here is a breakdown of debt as a percentage of GDP by sector/nation:

Looking forward, the IIF projects that the highest fiscal deficits in 2021 will occur in the following nations (in order from greatest to least):

1.) South Africa

2.) United States

3.) Australia

4.) China

5.) United Kingdom

6.) India

7.) Japan

8.) Spain

9.) Canada

10.) France

One has to wonder how long the global mountain of debt can continue to grow without causing significant pain to the global economy. If the proponents of Modern Monetary Theory are to be believed, governments that control their own currencies can continue to increase their debt without any negative repercussions, however, the theory is completely unproven and, if its proponents are wrong, will lead to extreme levels of economic pain for individuals, corporations and governments. The ongoing growth in debt at all levels will prove to be particularly problematic if interest rates rise or economic growth slows markedly, neither of which can be counted out.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment