In its most recent statistical release, the Federal Reserve gives us a detailed inventory of their massive balance sheet which has grown to levels that are unimaginable five short years ago.

The Federal Reserve now holds the following:

United States Treasuries – $2.426 trillion

Mortgage-backed Securities – $1.678 trillion

Foreign Currency Denominated Assets – $23.715 billion

Gold Stock – $11.041 billion

Treasury Currency Outstanding – $46.034 billion

The United States Treasuries include $2.313 trillion in Treasury notes and bonds, $97.332 billion in inflation-indexed notes and bonds (TIPS) and $42.046 in Federal agency debt securities.

This brings the Federal Reserve's balance sheet to $4.377 trillion, up $11.521 billion from the previous week.

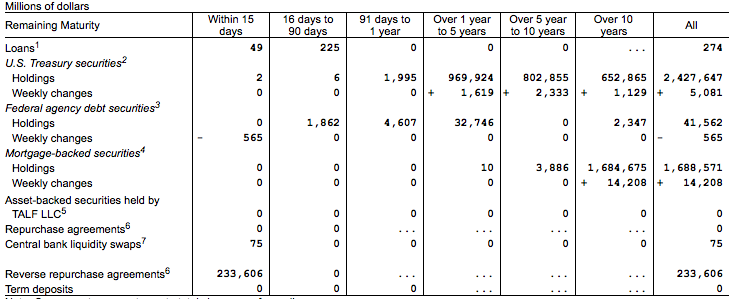

Here is a graph showing the maturity range of the securities held by the Fed:

The Fed holds Treasuries that mature right along the spectrum from one year to over ten years with $1.7 trillion or 70 percent of the total maturing between in the one to ten year range. Here is a graph showing the maturity distribution of the Fed's holdings of Treasuries over the past seven years:

Notice how back in 2007, over half or around $400 billion worth of the Fed's holdings of Treasuries matured within a year compared to nothing now. This is because the Fed's operations in the Treasury market have deliberately tried to push down interest rates on the long end of the bond spectrum. Back in 2007, the Fed owned less that $100 billion each of Treasuries maturing in the five to ten and over ten year ranges compared to $800 billion and $650 billion respectively now.

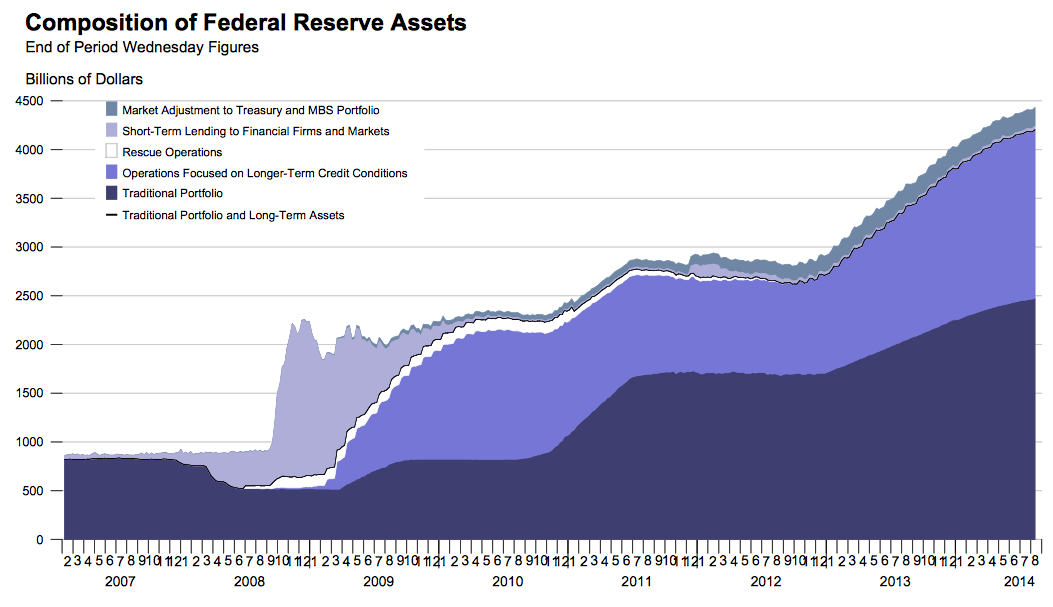

Here is a graph showing the growth in the Fed's balance sheet and the changes in its composition since the beginning of 2007 when it was a mere $870 billion:

From SIFMA, here is a graph showing the outstanding Treasury bond market debt since 1980 which stood at $12.1205 trillion in the first quarter of 2014:

Now, if we take the Fed's share of the outstanding Treasuries, we find that Ms. Yellen et al owns 20 percent of the total federal marketable debt, a situation that is hardly healthy for the bond market and has completely distorted the Treasury market, particularly in longer dated bonds as shown on this chart:

To show us how distorted the Fed's actions have made the market for ten year Treasuries, here are some numbers keeping in mind that QE 1 began on December 16, 2008:

Between 1962 and 2014 the average yield was 6.23 percent

Between 1962 and QE 1 the average yield was 6.97 percent

Between 2000 and QE 1 the average yield was 4.6 percent

Between QE1 and 2014 the average yield was 2.68 percent

The current yield on ten year Treasuries is just under 2.4 percent, around half of the yield between 2000 and just under one-third of the yield between 1962 and the launch of the Fed's Grand Monetary Policy Experiment.

The Federal Reserve's ability to extricate itself from its policy corner will be interesting to watch. Investors, particularly fixed income investors, have become complacent, giving the Federal Reserve the benefit of the doubt when it comes to ending their long-term monetary experiment. We are putting our trust in the hands of central bankers who had this to say on January 31, 2006 about the issuance of 30 year bonds just as the nation's housing catastrophe was about to begin:

"But this is the first evidence—at least that I’ve been able to see—that this is an overwhelming force because, irrespective of the other forces that drive the long-term rates, the spread between the thirty-year and the fifty-year is really quite pronounced. And it is suggesting that it cannot be an economic forecast. We have enough trouble forecasting nine months." (my bold)

Please note that the Fed's minutes from that meeting show that Mr. Greenspan's comment was followed with laughter.

The ability of the Fed to have such a substantial impact on the market for Treasuries should frighten all of us, particularly given that the Fed is basically a rudderless policy machine trying to find its way through an unpredictable economy.

On the upside, individual American investors may not be the only ones left holding the bag when interest rates begin to head back into normal territory.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment