South Sudan has enough financial reserves to keep the infant country’s economy running, the Governor of the Central Bank of South Sudan (CBSS) Elijah Malok has said.

South Sudan has enough financial reserves to keep the infant country’s economy running, the Governor of the Central Bank of South Sudan (CBSS) Elijah Malok has said.Malok told the press in Juba yesterday that the bank has two categories of reserves to maintain fiscal commitments.

“One category of the reserve will be utilised in running government businesses and projects while the other category will be used for the importation of commodities for the state residents”, he said.

He revealed that the CBSS gives commercial banks between USD 28 and 40 million every month through open auctions and advised the public to seek hard currency from the commercial banks and forex bureaus.

Malok at the same time advised traders to use banking systems to transact cross-border money transfers instead of physical transactions.

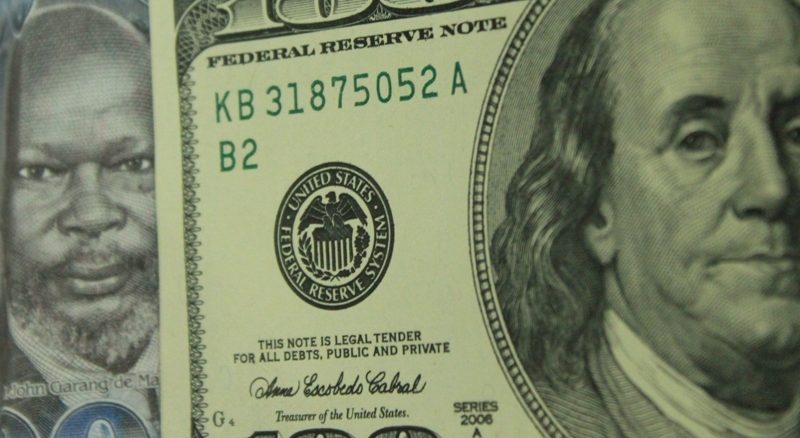

South Sudan’s new currency, the South Sudan Pound (SSP) has been on a steady rise since its entry into circulation with the exchange rate now reported to be at 3.3 due to increased demand. The United States Dollar’s exchange rate to the SSP in the black market stands at 3.7 SSP.

The CBSS Governor explained that the bank has put stringent measures in place to manage public funds.

“The bank exercises caution and has put in place emergency measures to ensure smooth running of the government so that the country’s economy does not grind to a halt”, he said.

He added that the bank has however not received any moneys from the oil sector since May last year, saying the government is running on contingency funds.

“If we didn’t do this, we would have collapsed before the declaration of our independence”, Malok said.

Article viewed at: Oye! Times at www.oyetimes.com

Be the first to comment