Over the past months, it seems that there has been a never-ending downward spiral of Europe and its debt, starting with Ireland and Portugal earlier in 2011, followed by Greece, Italy, Spain and now France and Belgium. With the recent Standard & Poor’s announcement that ratings for Europe were up for review, things have not looked worse. What has brought us to this point so quickly and what events sparked this debt debacle? A paper by John Makin of the American Enterprise Institute entitled "How did Europe’s debt crisis get so bad?" does an excellent job of summarizing the issue.

Over the past months, it seems that there has been a never-ending downward spiral of Europe and its debt, starting with Ireland and Portugal earlier in 2011, followed by Greece, Italy, Spain and now France and Belgium. With the recent Standard & Poor’s announcement that ratings for Europe were up for review, things have not looked worse. What has brought us to this point so quickly and what events sparked this debt debacle? A paper by John Makin of the American Enterprise Institute entitled "How did Europe’s debt crisis get so bad?" does an excellent job of summarizing the issue.Looking back to October 2011, the leaders of Europe held an all-night meeting in a last ditch effort to stabilize Greece’s economy. Once it became apparent that the "Greek problem" was going to require massive intervention, it became quite clear that the treasuries of the Eurozone nations simply do not have the resources required to accomplish the two tasks required; first, to guarantee the outstanding debt of not only Greece, but Italy, Spain and others and second, to maintain their own credit ratings. This has resulted in a cascade of downgrades the likes of which have not been seen in history. Even the strongest European economies are seeing their debt under threat with France being the latest casualty. This has led to calls for intervention by the IMF (historically, a very bad idea) and the European Central Bank (ECB), the European bond buyer of last resort.

Just one year and five months before the Greek Crisis, the European community set up the European Financial Stability Fund (the EFSF) on May 9th, 2010, a fund designed to allow weaker economies in the EU to service their crippling debt loads. The EFSF was initially set at 440 billion euros, however, a sizeable portion of this amount was already pledged to assist Portugal, Greece and Ireland and funds were also required to recapitalize European banks who were heavily invested in Eurozone bonds of questionable value. On June 24th, the EFSF Head of Government and State agreed to increase the fund’s scope of activity and increase its guarantee commitments to 780 billion euros. The main contributors to the EFSF were Italy, Germany, France and Spain; unfortunately, at least two of these nations have debt levels that are well outside the comfort zone of the world’s bond markets making it more and more likely that they would be guaranteeing repayment of an increase in their own debt, that is, they would be lending to themselves! Here is a screen capture showing how much each European nation has pledged to the EFSF:

Notice that Greece, Ireland and Portugal have already stepped out from making further contributions.

Here, from the EFSF website, is a screen capture showing which nations have benefitted from the largesse of the fund:

I found it particularly interesting that the bonds issued by the EFSF have the following ratings as quoted from their website:

"All three major credit rating agencies assigned the best possible credit rating – Standard & Poor‟s “AAA”; Moody‟s “Aaa”; Fitch Ratings “AAA” – to the EFSF5. The rating outlook was qualified as stable. EFSF has also been assigned the highest possible short term rating from the credit rating agencies – Standard and Poor‟s “A-1+”; Moody‟s (P) P-1 and Fitch Ratings “F1+”.

All of EFSF‟s issues have been assigned the highest credit rating by all credit rating agencies."

If a nation suffers a credit downgrade, the credit rating of the securities issued by the EFSF do not necessarily have to change to reflect the downgrade. So, basically, the EFSF buys garbage, rebundles it and then magically, it becomes triple-A again! Does this remind anyone of the mortgage-backed securities crisis of 2008 – 2009?

Now that we’ve learned about the background behind the EFSF, let’s see where things went so wrong in Europe. The solution cooked up to solve the Greek problem involved bondholders taking a 50 percent haircut on their holdings. The fact that the EFSF could not cover the losses caused the markets to pause and reflect. Spain and Italy alone will require over 1 trillion euros over the next three years to pay interest on and roll over existing debt. How is it possible that two of the contributors to the EFSF are nations that will barely be able to service their own debt? Therein, lies the conundrum.

In recent meetings, France and Germany have insisted that beneficiaries of EFSF largesse must be required to meet stringent fiscal guidelines in the form of lower spending and higher taxes and that they must cut their debt and deficits to certain targets. The Eurozone has had debt and deficit targets since its inception as quoted here from the Eurostat website:

"Monitoring and keeping government debt in check is a crucial part of maintaining budgetary discipline which is essential as Europe undergoes dramatic demographic changes. Its ageing population, in particular, is expected to pose major economic, budgetary and social challenges….

According to the "Protocol on the Excessive deficit procedure", annexed to the Maastricht Treaty on economic and monetary union, Member States in the euro area and euro area candidate countries must demonstrate sound public finances. There are two criteria:

▪ the budget deficit must not exceed 3% of gross domestic product;

▪ public debt must not exceed 60% of GDP." (my bold)

Oops! I guess that didn’t work! Perhaps they’ll be luckier the second time around.

Greece has been at the table before its latest foray into debt servitude. In the second quarter of 2010, Greece received an aid package in exchange for a pledge to cut government programs and raise tax revenues. Unfortunately, these actions had an unforeseen impact of both cutting fiscal growth and raising the deficit, resulting in higher debt-to-GDP ratios. See, economics is not a science after all! It is the impact of the first bailout that created the need for a second. Again, oops!

To assist Greece, the brilliant European minds sitting around the table in November decided that a 50 percent haircut in the value of Greek bonds held by bondholders was required. This is like having a headache and stabbing yourself in the eye to solve the problem. The brunt of this de facto "default" is being borne by Europe’s commercial banks and the European Central Bank, exacerbating the problem further. The weight of this "default" has also been unexpectedly borne by holders of those magical credit default swaps (CDS) that I posted about here. Since the haircut was voluntary, the holder of the "insurance" does not have to be compensated, meaning that the CDS is essentially a worthless investment, Once again, oops!

The Greek "haircut" reminded those who hold European bonds that their bonds may well be worth less than what is printed on their face. This has had a large impact on the valuation of bonds within the Eurozone and has led to a dichotomy; some Eurozone bonds are better than others as measured by their yield as shown in this graph:

To put this into historical perspective, all Eurozone government bonds are denominated in euros and, as such, should all be treated relatively equally as has been the case since the inception of the European Community. This should mean that interest rates across the Eurozone should be more-or-less equivalent.

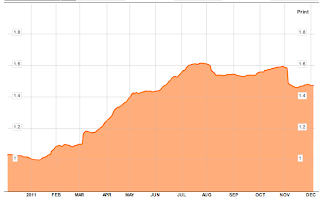

Next on the crisis list is the European banking system. As bond yields have risen, the market value of the bonds has dropped. Who’s the lucky holder of European paper? The poorly capitalized private sector banks in Europe and Europe’s households. The rising uncertainty about the solvency of Europe’s banks has resulted in a rise in the Euribor, the rate charged by one bank to another for lending as shown on this graph:

This whole situation has resulted in a generalized economic slowdown which is being felt even in European nations that have not adopted the euro (i.e. the United Kingdom). As the economy slows, it will make it even more difficult for Eurozone nations to reduce their deficits, further compounding the problem and making the EFSF even less likely to provide the necessary solution since additional funding is less and less likely. As well, as the bond rates have risen, they make servicing the existing debt even more improbable.

The world’s markets (except on those much touted "up" days) are slowly coming to the realization that there simply is not enough borrowing power among Europe’s strongest members to bail out one of their fellow debtor nations. With Italy’s external debt hitting 1.857 trillion euros in June 2011, the funds available in the EFSF certainly appear to be laughably insufficient.

According to the author, Europe has three rather unattractive alternatives:

1.) Borrow more money from outside Europe (i.e. China). China is already expressing concern about its exposure to heavily indebted Western nations so this solution appears less than likely.

2.) Have the ECB buy more bonds as a lender of last resort. It is estimated that the ECB has already purchased about $200 billion worth of bonds that have already lost value. By purchasing these bonds, the ECB could be seen to be reducing the incentive for governments to reduce spending and raise taxes, the concept of moral hazard in action. As well, by monetizing the debt, the ECB risks inflation.

3.) Allow the European Monetary Union to collapse. While the collapse of the European Monetary Union would be painful, it is quite apparent that the union of unequal members has not worked.

In conclusion, Mr. Makin notes that the modern day assertion that sovereign governments do not fault on their debt obligations lies behind the current European crisis. This has boxed the ECB into a corner; to reduce the burden of the debt, reflation is required. As in the United States, Mr. Makin projects that the ECB will undertake a program of quantitative easing. Unfortunately, it may be too late for the painful dose of inflation that the ECB will inflict on the world’s economy to correct Europe’s debt problems. Let’s hope that Washington is watching and learning from Europe’s foray into over-indebtedness.

Click HERE to read more of Glen Asher’s columns.

Article viewed on Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment