While the world focuses on the latest chapter of Greece's debt crisis, I thought I'd take brief look at Greece's most significant domestic banks and what has happened to their share prices over the past five years, an issue that is of particular importance given the recent actions taken to prevent a run on the nation's banking system. Please note that I'm looking at five of Greece's largest banks that have a significant presence both within the Greek economy and overseas. As well, I have added a few facts about each bank's financial situation from their 2014 and 2015 results to help us understand how besieged the nation's banking system has become.

1.) Alpha Bank: In the first quarter of 2015, Alpha Bank had operating income of 606.4 million Euros and after tax losses of 115.8 million Euros. Full year after tax losses for 2014 were 329.7 million Euros. The bank has assets of 73.013 billion Euros. Provisions for loan losses rose from 397.3 million Euros in Q1 2014 to 428.25 million Euros in Q1 2015.

Here is the five year chart for Alpha Bank:

The stock has lost 95 percent of its value from its five year peak of 6.38 Euros in August 2010.

2.) Attica Bank: In the first quarter of 2015, Attica Bank Group had operating income of 30.911 million Euros and after tax losses of 1.258 million Euros. Full year after tax losses for2014 were 49.944 million Euros. The bank has total assets of 3.873 billion Euros. Interestingly, at the end of 2014, Attica Bank recorded impairment losses of 110 million Euros, up 10.4 percent from 2013 and the cumulative allowance for impaired loans reached 546.3 million Euros.

Here is the five year chart for Attica Bank:

The stock has lost 95.5 percent of its value from its five year peak of 1.55 Euros in August 2010.

3.) Eurobank Ergasias: This is the third largest bank in Greece by total assets. In the first quarter of 2015, Eurobank had operating income of 252 million Euros and after tax losses of 165 million Euros. Full year after tax losses for 2014 were 1383 million Euros. The bank has total assets of 68.74 billion Euros.

Here is the five year chart for Eurobank Ergasias:

The stock has lost 99.8 percent of its value from its five year peak of 67.4 Euros in August 2010.

4.) National Bank of Greece: This is the largest and oldest bank in Greece. In the first quarter of 2015, the National Bank of Greece had total income of 880 million Euros and after tax losses of 149 million Euros. Full year after tax earnings for2014 were 106 million Euros after tax benefits of 1528 million Euros (i.e. there was a before tax loss of 1422 million Euros). The bank group has total assets of 119.266 billion Euros.

Here is the five year chart for the National Bank of Greece:

The stock has lost 99.4 percent of its value from its five year peak of $161.50 in August 2010.

5.) Pireaus Bank: In the first quarter of 2015, Pireaus Bank Group had a net loss of 69 million Euros with Piraeus Bank itself having a net profit of 23 million Euros. Full year pre-tax earnings for 2014 were 322 million Euros with loan loss provisions for impaired loans hitting 481 million Euros. Loans in arrears by more than 90 days reached a whopping 37.9 percent. The bank group has total assets of 89.457 billion Euros.

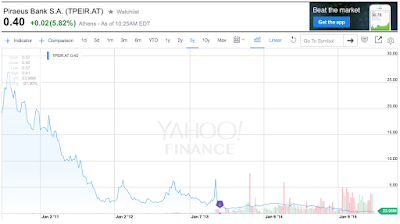

Here is the five year chart for Piraeus Bank:

As you can see, the domestic banking sector in Greece has become another casualty of the nation's ongoing debt crisis. Despite recent increases in capitalization through the issuance of shares and bonds, it is highly likely that the most recent chapter of the crisis will claim at least one of these banks. On the other hand, if you are a risk-taker, this is a sector that really has nowhere to go but up (or bust).

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment