In light of the recent issues facing Japan’s nuclear power generation industry, I thought I’d take a look at TEPCO, the Tokyo Electric Power Company, the owners of the Fukushima Daiichi Number 1 nuclear power plant that is experiencing severe difficulties. I’ll also look at TEPCO’s entire operation and how the loss of one nuclear power plant could impact the world’s oil market over the long term.

In light of the recent issues facing Japan’s nuclear power generation industry, I thought I’d take a look at TEPCO, the Tokyo Electric Power Company, the owners of the Fukushima Daiichi Number 1 nuclear power plant that is experiencing severe difficulties. I’ll also look at TEPCO’s entire operation and how the loss of one nuclear power plant could impact the world’s oil market over the long term.TEPCO is the world’s fourth largest electric power company and has roughly one-third of the electricity market in Japan. To put TEPCO’s size into perspective, in one year, TEPCO sells as much electricity to its customers in Japan as the entire country of Italy uses annually.

TEPCO was founded on May 1, 1951 with 242 small hydroelectric generation facilities and 9 small thermal generating facilities capable of generating 1.79 GW (gigawatts) of power. It commenced operations of its first major thermal power generating facility in 1953. It has grown massively over the past 60 years and is now capable of producing nearly 65,000 MW daily.

TEPCO has had issues with its power plants before. In 2002, the Japanese government revealed that TECPO had admitted to falsifying technical data submitted to the government over 200 times and that they had concealed plant safety incidents. TEPCO also admitted that a nuclear unit had nearly reached a critical point in 1978. In July 2007, a 6.9 magnitude earthquake caused damage at TEPCOs Kashiwazaki-Kariwa plant, the largest nuclear power plant in the world. Widespread minor damage to the plant took place; as well, radioactive material that was being stored in drums at the site was spilled and a transformer fire took place. Out of the seven reactors at the plant, four are still out of service and this has had a massive impact on the finances of TEPCO.

TEPCO opened its first nuclear power facility, the now newsworthy Fukushima Daiichi Nuclear Power Station (Number 1 reactor), on March 26th, 1971. The reactor is capable of producing 460 MW of power (one MW can generally power approximately 1000 homes). By October 12, 1979 when the Fukushima Daiichi Power Station Unit 4 was brought online, the company’s nuclear power generating capability exceeded their capacity for hydroelectric power generation for the first time. When the Fukushima Daiichi Power Station Unit 6 began operations in October of 1979, the station was capable of producing 4696 MW. On May15th, 1995, TEPCO’s cumulative nuclear power generation output reached one billion MW over the company’s history.

Here is a chart showing how TEPCO’s power generation capability has grown since its inception 60 years ago:

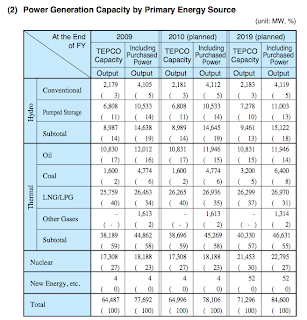

Here is TEPCO’s planned power generation capacity from 2009 for the various each of its energy sources:

Note that TEPCOs current (2009) output capacity is 64,487 MW and that they planned to increase their capacity to 71,296 MW by 2019. Of the total in 2009, 17,308 MW was from nuclear power which comprised 27 percent of all electricity generated. This is (or was) expected to rise to 30 percent or 21.453 MW by 2019.

Here is a bar graph showing TEPCO’s generation capacity by energy source by year over the company’s history:

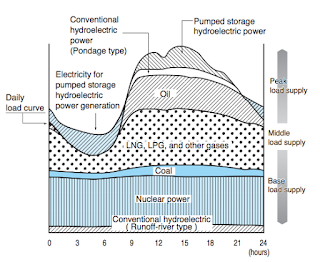

Here is an interesting graph showing how TEPCO uses various energy sources to meet the demands of its customers for electricity over a given 24 hour period:

Nuclear power forms majority of the base load supply during the entire 24 hour period with small contributions from hydroelectric and coal generation. Liquified natural gas (LNG) and liquified petroleum gas (LPG) as well as oil provide the energy source used by TEPCO during daily peak demand periods.

Now, let’s step back and take a look at Japan’s entire nuclear power generation picture. Here is a map showing the nuclear power plants located throughout Japan (mostly near coastlines):

Here is a listing of all plants and reactors:

Japan’s strategy for undertaking a massive program to develop nuclear power stemmed from the country’s nearly complete lack of energy resources (except hydroelectricity). As shown here, in the year 2000, Japan was dependent on imports for 80 percent of its energy needs, second only to Italy among OECD nations:

Japan was using nuclear power to ensure energy security for its people. Here’s what the Japanese government has to say about its dependence on oil in its Long-Term Energy Program from its Japan Nuclear website:

"Moreover, because, among economically and industrially advanced nations, Japan has the highest rate of primary energy dependence on oil, and an alarmingly high rate of reliance on Middle Eastern oil imports, an important strategy involves the use of alternative energy sources to the extent feasible."

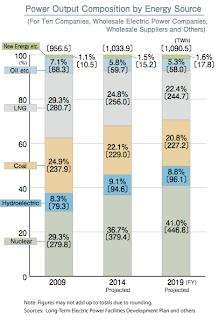

Here is a graphic from the Federation of Electric Power Companies of Japan (FEPC) showing the composition ratio of the fuel used to generate electricity for all electricity generation in Japan for the year 2009 and projections for the following years:

Note that in 2009, 29.3 percent of Japan’s electricity was generated by nuclear power plants and that this was projected to rise to 36.7 percent by 2014 and to 41 percent by 2019.

Nuclear was the only fuel source projected to grow. Oil was the fuel used to generate only 7.1 percent of the nations’ power needs in 2009 and this was projected to shrink to 5.3 percent by 2019… at least until now.

From the BP Statistical Review of World Energy 2010, we find that in 2009, Japan imported 4.396 million BOPD or 5.1 percent of the world’s total oil daily oil production. This is down from a peak of 5.598 million BOPD in 1999 and, in looking at Japan’s consumption over the past 10 years, it has declined nearly every year.

Now that Japan’s nuclear power industry is under the microscope and the country’s plans to expand its nuclear fleet is under worldwide scrutiny, an alternative to uranium as a source of energy will most likely have to be found. As well, in light of the issues facing Japan’s nuclear industry, many countries are reviewing their own nuclear plans, Germany and China among them. If it is true that the world’s oil supply and demand is very delicately balanced and that the balance will become even more delicate as peak oil is reached and demand from both China and India rise, increased oil demand from Japan as a replacement for uranium will put additional pressure on oil supplies and upward pressure on prices. That’s why I’ve found it so surprising that the price of oil has dropped over the past week; nothing has changed except that demand for oil over the long-term has nowhere to go but up.

It’s interesting to see how an earthquake in Japan has the potential to impact the entire world, isn’t it?

Click HERE to read more of Glen Asher’s columns.

Article viewed at: Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Dear Glen,

oil prices dropped because that’s how they usually react to spikes in risk aversion, and increased risk aversion was the effect of the Japan disaster.

Oil will not necessarily be the winner here in the long term – even though in the short term some increased demand from Japan is possible (to fuel its old oil-based generators normaly used during emergencies), in the long term there is very little chance that Japan will develop its oil-fueled generation; it will rather go for gas which is much cheaper, more environmentally friendly and easier to buy (more fuel security). Currently gas is the most important thermal fuel for power generation, and nobody really develops oil facilities any more.