Mark Carney – The Inflationary Central Banker

Mark Carney is selling himself as the consummate economist who will be able to steer Canada through whatever issues the nation will fact as it deals with the Trump 2.0 Administration. In this posting, we’ll take a very brief look at just how accurate his predictions were about central bank intervention during the COVID-19 pandemic.

On March 18, 2021, this article appeared in Canada’s Globe and Mail:

When he was asked the following question:

“In the book (Value(s): Building a Better World for All), you talk about being worried about the amount of public debt and purchases by central banks. What concerns you the most?

Here is his response:

“I definitely agree with the stance that the major central banks have taken in terms of support. The pandemic is a huge disinflationary, if not deflationary shock, and so the right monetary policy response was in the direction they’ve taken. As well, I’d agree, given that they have fewer and fewer options to provide stimulus when needed, that the shift in the Fed’s reaction function toward this flexible average inflation targeting—so they’d have a bit of an overshoot coming out of this—is also something that’s supported for a durable recovery. We’re gonna get a quick bounce back as things reopen. The question is, does it extend? And I think the Fed’s policy will help it extend.“

Not surprisingly, Carney agreed with the stance that his fellow central bankers, particularly at the Federal Reserve, took to prevent disinflation/deflation during the pandemic, admitting that they would have to overshoot their inflation target of 2 percent to support a durable post-pandemic recovery.

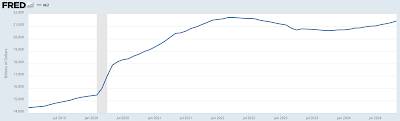

Here’s what the Federal Reserve did to stimulate the COVID economy:

During most of 2019, the Fed’s balance sheet hovered around the $4 trillion mark. On February 26, 2020, the balance sheet stood at $4.159 trillion, rising to $7.17 trillion in June 2020, an increase of $3.011 trillion or 72.4 percent. BY the time that Mark Carney made his comments as noted above, the Fed’s balance sheet had risen to $7.904 trillion, an increase of $3.745 trillion or 90 percent above its pre-pandemic level. The balance sheet continued to rise, hitting a peak of $8.965 trillion in April 2022, a total increase of $4.806 trillion or 115.6 percent from its pre-pandemic level. Since then, the Fed’s balance sheet has begun a very slow decline to just below $7 trillion.

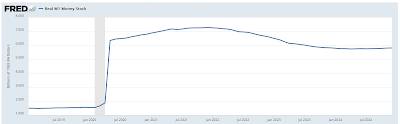

So, what was the result of all of this money printing? The M2 measure of the supply of money did this:

…M1 money supply did this:

…and real M1 money supply did this:

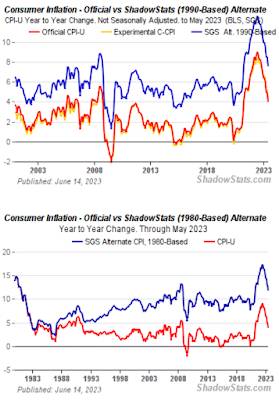

As a result of the unprecedented increase in the supply of money (after all, all of that “helicoptered money” has to go somewhere), this happened:

The average consumer price index for all goods for all consumers rose by a maximum of 9 percent in June 2022, the highest level of inflation going back to December 1981. According to Shadowstats, the situation was far worse with consumer inflation hitting nearly 13 percent using the pre-1990 definition of inflation and nearly 17.5 percent (which is actually worse than the rate of inflation back in the early 1980s) using the pre-1980 definition of inflation as shown here:

Please keep in mind that while politicians would have us believe that inflation is under control because the rate of inflation has dropped to something approximating the Fed’s 2 percent target, the prices of goods and services have NOT dropped, they are just inflating at a lower rate.

Let’s repeat what Carney said for emphasis:

“I definitely agree with the stance that the major central banks have taken in terms of support. The pandemic is a huge disinflationary, if not deflationary shock, and so the right monetary policy response was in the direction they’ve taken. As well, I’d agree, given that they have fewer and fewer options to provide stimulus when needed, that the shift in the Fed’s reaction function toward this flexible average inflation targeting—so they’d have a bit of an overshoot coming out of this—is also something that’s supported for a durable recovery.“

Is this the kind of economist that Canada needs in a leadership position? For someone who thinks that his level of intelligence far exceeds that of the sweaty peasants and with his experience as a leading central banker, he didn’t even have the ability to see that the Fed’s actions (as well as the actions of other central banks) during the early stages of the pandemic were going to lead to very painful levels of inflation for consumers, many of whom will not recover financially from this economic shock treatment. He couldn’t even seem to grasp the concept that printing unprecedented amounts of “money” would result in a punitive inflationary nightmare.

But then again, does Carney really care what is best for Canadians or is he in it to remold Canada into a World Economic Forum approved dystopia?

Be the first to comment