Those of us that are baby boomers often heard the adage "cash is king" from our parents. The world is a rapidly changing place, however, and it looks like the world's central banks are heading toward a cashless society, step by step. While I don't want to sound like the "tin foil hat" crowd, there is one thing that we cannot dispute, with the current negative interest rate policy (NIRP) environment in Europe , the weak economic growth in North America, the massively bloated balance sheet of the Federal Reserve and the Fed's long-standing zero interest rate policy (ZIRP) environment, the world inhabited by central bankers is far different than it was at the beginning of the Great Recession. While those of us who grew up during the 1960s, 1970s and 1980s can hardly imagine a negative interest rate world, when the next recession occurs, the world's central banks will already have the example of Europe when it comes to experimentation with negative interest rates. From there, as you will see, it's a very, very short step to a cashless economy.

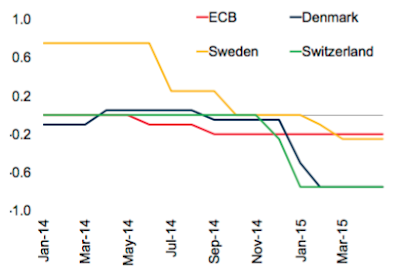

As it stands now, economists consider that current interest rates are at the "zero lower bound", that is, they cannot be lowered further since they are already at zero. As such, the Federal Reserve will be forced to implement newly minted monetary strategies when the already weak global economy falls further into recession. This is where the very concept of interest rates, as we have experienced them for generations, change. One of these strategies could involve the use of negative interest rates, a strategy that is already in place in Europe thanks to the European Central Bank as you can see on this graphic:

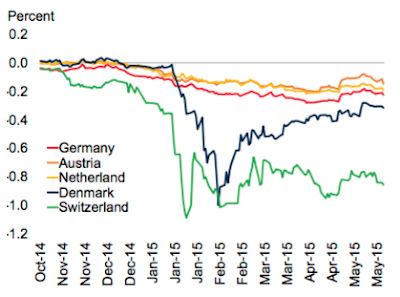

Here is a graphic showing the current yield on two year government bonds:

In all five cases, investors are willing to lose money over a two year period when they buy a bond from these European governments.

Let's listen to a brief discussion about negative interest rates and a cashless system by Dr. Willem Buiter, currently the Global Chief Economist at Citigroup:

In Dr. Buiter's 2009 paper, "The wonderful world of negative nominal interest rates, again", he notes that there are two key ways to remove the zero lower bound on nominal interest rates:

1.) abolish currency – Abolishing currency can be accomplished by eliminating government-issued currency. Private means of payment including cheques drawn on bank accounts, credit cards, debit cards and other forms of e-money would replace currency. It's important to note that all of these means of payment could easily be subjected to transaction fees (if they aren't already), further enriching the banking sector at our expense.

In case you happen to think that you could "beat the system" by taking out piles of cash and hoarding bank notes in your mattress, Dr. Buiter and his fellow economists have that idea covered as well using the following method:

2.) tax currency holdings – As you can imagine, the problem with taxing individual currency holdings is getting those that hold the notes to come forward to pay the tax owing. This could be accomplished quite simply by having rolling expiry dates for currency as legal tender. While this may sound like an impossibility, would be quite easy to put into place. As we know, each bank note has a unique serial number than ends in a numeral between 0 and 9. At the beginning of every year, a government or central bank could declare that all notes ending in a particular numeral will be worthless at the end of that year. To keep the bank note current, the holder of the note would have to come forward to pay the interest due to the central bank before the expiry date at which time the currency would be marked, showing that it is current on the interest owing. While this may seem like an impossibly large task, the inconvenience of having to keep ones' bank notes current would deter the vast majority of people from hoarding any bank notes whatsoever. There is a huge upside to both governments and banks if this mechanism were implemented since taxes/transaction fees would be implemented.

Now, if you should happen to think that an economy can't thrive without at least some cash, a recent newsletter by Mikael Krogerus for Credit Suisse looks at the example of Switzerland. Here's a brief excerpt:

"No matter where you are or what you want to purchase, you will find a small ubiquitous sign saying "Vi hanterar ej kontanter" ("We don't accept cash"). Whether it's for mulled wine at the Christmas market, a beer at the bar, even the smallest charge is settled digitally. Even the homeless vendors of the street newspapers Faktum and Situation Stockholm carry mobile card readers….Four out of five purchases here are made electronically. Plastic dominates, particularly in the retail sector, where 95 percent of all sales are handled with cards. The last area in which a Scandinavian still needs cash is the purchase of illegal items such as drugs. In general, the rule of thumb in Scandinavia is: "If you have to pay in cash, something is wrong. What is clear is that the six largest Nordic banks (with the exception of the merchant banks) have been gradually weaning themselves off cash since 2010. The citizens have embraced this move as if it were the most natural thing in the world. Between 2010 and 2012 alone, more than 500 branches went cash-free. During that same time 900 cash machines were removed, which resulted in the second-to-worst cash machine coverage in Europe. One of the last places where cash can be obtained is at the supermarket checkouts. There one can receive up to 500 Swedish Krona (CHF 55) in cash per purchase." (my bold)

Adjunct Professor Niklas Arvidsson of the Royal Institute of Technology expects that Sweden will be cash free by 2030. While banks love to tout the increased security associated with having cash as well as the savings associated with having to handle cash, it also provides them with a steady source of transaction fees since its customer base is held captive for every single transaction that they make. As well, the banking system will have a record of every expenditure that its customers make, a golden treasure trove of the spending habits of its clientele. While I realize that the banking system in North America already keeps track of our spending when we use credit cards, at least we have the option to use cash when we feel like it without being made to feel like we are criminals…for the time being.

And, in case you simply cannot imagine a negative interest rate policy being implemented by the Federal Reserve, here is a quote from Janet Yellen about negative interest rates in an exchange with Rep. Tom Emmer (R-MN) during a meeting of the House Financial Services Committee:

“Emmer (R-MN): "Will the Federal Open Market Committee ever rule out going to negative interest rates?"

Yellen: "'Rule out' is something we tend not to do. […] If circumstances were to change, suppose economic outlook–which I don't expect–but if it were to deteriorate in a significant way, so that we thought we needed to provide more support to the economy, then, potentially anything including negative interest rates would be on the table."”

As I noted at the beginning of this posting, we are living in uncharted monetary policy territory. When the economy slows, as it surely will, the Federal Reserve (in particular) has left itself with no traditional policy ammunition since, even with a one quarter percent increase in interest rates, the Federal Funds Rate is still essentially zero, leaving the Fed with no "wiggle room".

With the Swedish experiment in mind, it is increasingly apparent that the link between negative interest rates and a cashless society may be more than coincidental.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment