I thought I’d take a look at the financial condition of yet another of the PIIGS countries (they’ve GOT to hate that moniker but it has an interesting ring to it). Today, we’ll take a look at Portugal; once again, I have tried to gather information from government documents wherever possible. If you notice a blue link and click on it, you will be taken to the webpage where you will find the references to what I have posted.

Portugal has, to date, received very little press although coverage is starting to pick up. Fortunately for the country, it seems to have slipped under the press radar, unlike its EU cousins Ireland, Greece and Spain. Portugal is a small country especially compared to its neighbour Spain and, having travelled there, I can attest to just how small it really is geographically.

Portugal has a total population of 10,637,713 (end of 2009) with 10,144,940 people living in continental Portugal and the balance of 245,374 living on the Azores and 247,399 living on Madeira. In total, 1.9 million residents are 65 and older, roughly 17.9 percent of the entire population and 1.62 million residents are under 15 years of age, roughly 15.2 percent of the entire population. The country’s birthrate was 1.32 children per woman, well below the replacement rate of 2.1 children per woman. The country’s unemployment rate stood at 10.9 percent in Q3 2010 In September 2010, Portugal imported €1.53 billion more goods than it exported. In the third quarter of 2010, exports drove Portugal’s GDP up by 1.5 percent year-over-year. If you are interested in more obscure statistical data from Statistics Portugal (i.e. how many ABM transactions per resident there were in 2009 or how many telephones there are per 100 residents), here is the English website link.

From the State Budget for 2011 document from the Ministry of Finance and Public Administration website, I have gleaned the following information. One of the key proposals is a reduction in the budget deficit from 7.3 percent of GDP in 2010 to 4.6 percent of GDP in 2011. This is down from a rather stratospheric 9.3 percent in 2009 shown in this graph:

Remember, the EU allowable deficit to GDP is 3 percent so Portugal is still well over the limit until at least 2012. As well, debt to GDP is limited to 60 percent. For the European Parliament Economic and Monetary Union Framework for Fiscal Policies document that states these prerequisites from member states, click here and look under Achievements just down slightly from the top.

In 2008, the budget deficit was €5.037 billion and public debt stood at €112.353 billion. By 2009, the deficit had risen to €15.701 billion and the public debt stood at €127.908 billion. Government estimates for 2010 put the deficit at €12.544 billion and the debt at €141.832 billion ($192.892 billion) or 82. 1 percent of GDP, well over the 60 percent EU cutoff. The rapid growth in debt is worrying; the year on year increases have ranged from 13.8 percent in 2009 and 10.9 percent in 2010. On a per capita basis, their debt works out to €12,024 or $16,353, well in the lower range when compared to the G8 nations.

One of the advantages that Portugal has had over Ireland and Spain was that the country did not experience a massive real estate bubble so, unlike Ireland, their local banks did not require recapitalization because of their portfolios of bad mortgage loans.

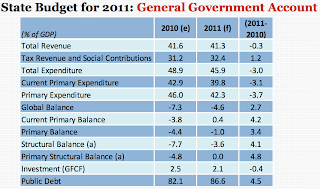

In an attempt to balance its budget (or at least try to balance its budget), Portugal has instituted a program of "resizing" its public administration. It plans to reduce public sector employees from 750,000 in 2005 to an estimated 660,000 by the end of 2010; on top of that, it plans to freeze civil servant promotions, career progressions and reduce civil servant wages by a nominal 5 percent on average. As well, the 2011 State Budget plans to reduce unemployment benefits, social inclusion income, family allowance and Civil Servants’ Health Insurance Scheme expenditures. Cuts to the National Health System, transfers to Education and other measures should lead to an overall reduction in expenditure of 2.7 percent of GDP. Despite these measures, expenditures will exceed revenues by 7.3 percent of GDP as noted above, resulting in the total public debt reaching an estimated 82.1 percent of GDP by the end of 2010, up from 76.1 percent in 2009 and rising to 86.6 percent of GDP by the end of 2011. Portugal also plans to privatize 12 of it State-owned energy, transportation, financial and communications companies in an attempt to raise €1.2 billion in 2010 and €1.87 billion in 2011.

Here’s a chart showing Portugal’s Budget for 2011 in terms of its GDP:

As in the case of the United Kingdom and Ireland, an increase of 2 percentage points in Portugal’s VAT was announced on September 29th, 2010 on top of the 1 percentage point increaseannounced on May 14th, 2010 bringing the country’s VAT to a lofty 23 percent, the same as Ireland’s proposed rate. As well, an additional charge on personal income taxes are planned to further gouge the country’s taxpayers.

When all decreases of expenditure (2.7 percent of GDP) and increases of revenue (1.4 percent of GDP) are tallied, the Portuguese government expects to improve their budgetary balance by 4.1 percent of GDP.

There are a couple of weaknesses (well, okay, more than a couple) in their projections. If they are banking on a 4.2 percent rate of growth for 2011 for the world’s economy and it doesn’t happen (as I suspect it won’t), all of their projections of returning to balance are threatened. Fortunately, they are only predicting a 0.2 percent growth in 2011 for their own economy so an over-estimation of world economic growth will only affect their export markets. An even larger problem could arise from their prediction of world oil prices, especially since they import nearly all of their oil. They are projecting a small increase in the price of oil and since they only produce 4720 BOPD and consume 270,620 BOPD, an unanticipated rise in the of imported oil will have a marked effect on their economy.

That’s it for Portugal and their impending circling of the fiscal porcelain bowl. How many more countries can the ECB/IFM/EU afford to bailout? How soon will it be before the financial markets determine that both the United States and Japan are circling the same bowl?

Click HERE to view more.

You can publish this article on your website as long as you provide a link back to this page.

Hi Glen

This is the first article of yours that I have read , and it is nice to know there are others out there with simular views. I think it is time that people relised what the bottem line reason for all this soverign debt is, and the only possible cure.The worlds economy has split into 2 groups. Those that lend and those who borrow. The cure is simple , the lenders must start spending thier money in a way that the unemployed can earn it instead of investing for an ever larger return.