A fascinating infographic on the Visual Capitalist website looks at the major unintended consequence of the extended period of post-Great Recession ultra-low interest rates; debt creep by the world’s governments. During this lengthy monetary experiment by the world’s leading central banks, national governments (and other levels of government as well) have taken the opportunity to load up on debt since it appears that, at low single digit interest rates, there is no risk in accumulating additional debt.

Let’s start by looking at two examples starting with the United States. Here is what has happened to interest rates on key Treasuries since the end of 2007:

This, along with government’s unwillingness to balance the federal budget, has led to this happening to Washington’s debt load, an increase that can be termed “debt creep”:

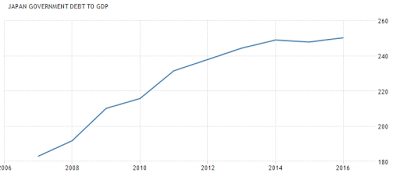

Japan, the world’s second-most indebted nation provides us with another example of “debt gone wild”:

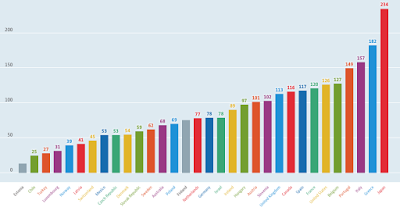

Here is a graphic from the OECD showing the debt-to-GDP level for all OECD nations (i.e. the so-called advanced economies) in 2015:

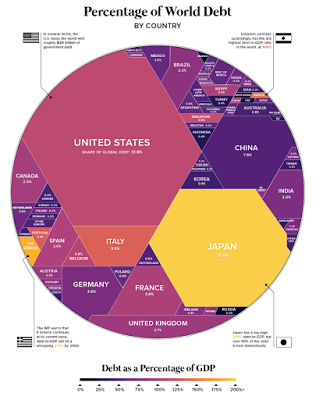

Let’s look at the global scale of the debt creep problem. Here is Visual Capitalist’s take on the global sovereign debt issue where the size of a nation’s nominal debt is proportional to the area inside the circle:

In nominal terms (i.e. in dollars or dollar equivalents), the most indebted nations are:

1.) United States – $20.453 trillion or 31.8 percent of global sovereign debt

2.) Japan – $11.813 trillion or 18.8 percent of global sovereign debt

3.) China – $4.976 trillion or 7.9 percent of global sovereign debt

4.) Italy – $2.454 trillion or 3.9 percent of global sovereign debt

5.) France – $2.375 trillion or 3.8 percent of global sovereign debt

When measured in terms of the size of the local economy (i.e. debt-to-GDP), the most indebted nations are:

1.) Japan – 239.3 percent

2.) Greece – 181.6 percent

3.) Lebanon – 148.7 percent

4.) Italy – 132.6 percent

5.) Portugal – 130.3 percent

Thanks to the actions of the world’s most influential central bankers and their “hangers-on”, the world is awash in sovereign debt, debt that has continued to creep upwards despite the hard lessons taught (and unlearned) during the Great Recession and its aftermath. This is just another in a long line of unintended consequences of experimental monetary policies implemented by the ECB, the Federal Reserve and the Bank of Japan. As well, the ruling class has, to this point in time, seen little reason to reduce government debt and in many cases, has continued to accumulate debt to the point where there is almost no chance that governments will be able to reduce the pain of higher interest rates in the future. Debt creep will prove to be the undoing of the global economy during the next severe recession when governments are simply unable to stimulate their local economies let alone help bail out the weakest debtor nations.

Click HERE to view more.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment