In its most recent pronouncement on March 21, 2018, the Federal Reserve stated that it was increasing the federal funds rate to its new target of 1.5 to 1.75 percent as it seeks to normalize interest rates that have been extremely low for nearly ten years. It also stated the following:

“The Committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.” (my bold)

Economists and Fed insiders state that there could be another two to four interest rate increases in 2018 alone based largely on the “strength” of the economy.

That said, if we look at one key measure, it appears that interest rates are telling us something quite different from what the Federal Reserve is suggesting about the strength of the economy.

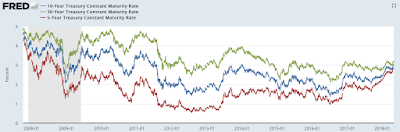

Here is a graphic showing the yield curves for five-, ten- and thirty-year Treasuries since the beginning of the Great Recession:

As you can see, the yields on five-, ten- and thirty-year Treasuries have compressed significantly over the past year. Here is a look at the changes:

January 3, 2017:

Five-year yield – 1.94 percent

Ten-year yield – 2.45 percent

Thirty-year yield – 3.04 percent

On January, 3, 2017, the difference between the yields on five- and thirty-year Treasuries was 1.10 percent.

April 30, 2018:

Five-year yield – 2.79 percent

Ten-year yield – 2.95 percent

Thirty-year yield – 3.11 percent

On April 13, 2018, the difference between the yields on five- and thirty-year Treasuries had fallen to a very small 0.32 percent, the smallest difference in yield since the depths of the Great Recession in November and December 2008.

A similar trend took place in 2006 and 2007 as you can see here:

While the yield curve didn’t invert (i.e. long-term interest rates were not lower than short-term rates) as we saw at the beginning of the 2001 recession:

…the Treasury market did experience a similar compression in yields beginning in early 2005 as we are now seeing.we saw a very similar yield compression starting in early 2005.

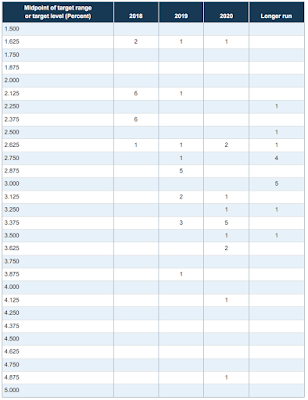

Let’s look at the most recent iteration of the FOMC’s economic projections table which shows that 12 out of 15 FOMC participants believe that interest rates by 2020 will be above 3 percent as shown here:

From this posting, we can clearly see that the current level of yield compression is suggesting that the Federal Reserve is having a great deal of difficulty “unsticking” thirty-year interest rates from the 3 percent range and that the Fed is facing yet another conundrum. If the Fed plans to continue to raise their benchmark federal funds rate over the next 12 to 18 months, they only have 1.25 percentage points or five quarter percent increases of maneuvering room before we experience a yield curve inversion, a historically accurate harbinger of an economic recession.

Click HERE to view more.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment