We are hearing a lot about the looming fiscal cliff but there is one aspect of the pending changes to the tax code that has received little or no coverage, the impact of the expiring tax cuts on the federal estate taxes and state estate tax revenues. A paper by Norton Francis of the Urban-Brookings Tax Policy Center looks at the negative impact of the sunset of the 2010 Tax Relief, Unemployment Insurance Reauthorization and Job Creation Act (the 2010 Act) on state tax revenue and suggest that the resurrection of revenue from federal credits for state estate and inheritance taxes may help states replace this lost income.

Let's open by taking a look at the history of estate taxes in America. The modern federal estate tax was launched in 1916 and, in 1924, was expanded to include gifts (i.e. transfers of money between individuals). The 1924 law stated that gifts that were given while the giver was alive would be taxed as part of the estate but that taxes paid on these gifts would eventually reduce the total tax owing on the estate. A state tax credit equal to 25 percent of the federal tax was implemented to share the estate tax with states and, in 1954, was changed from a percentage of the federal tax to the "credit for state death taxes" or CSDT of up to 16 percent.

Before the implementation of the Economic Growth and Tax Relief Reconciliation Act (EGTRRA) in 2001, every state imposed an estate tax equal to the credit for state death taxes of up to 16 percent which had the effect of transferring the estate tax revenues from the federal level to the state level. This also meant that all states had roughly the same taxation level for estates, handy if you happened to inherit property located in more than one state.

How much revenue did the estate tax raise prior to implementation of the EGTRRA changes? In 2000, the federal government collected $24.4 billion from estate taxes from an aggregate gross estate value of $130.4 billion. It seems like a pittance when compared to a trillion dollar deficit but every penny counts.

All of this changed in 2001. Much to the surprise of most analysts, President Bush's 2001 Economic Growth and Tax Relief Reconciliation Act (EGTRRA) actually ended up with a complete phase-out of estate taxes in 2010. It also phased out the state level CSDT by 25 percent a year in each of 2003, 2003 and 2004 and replaced it with a tax deduction in 2005. How did these changes impact Washington's estate tax revenue? Between 2001 and 2009, the federal estate tax revenue ranged from $21 billion and $25 billion despite a five-fold increase in the exemption, a two-thirds drop in taxable estates and a 10 percentage point drop in the top tax rate. This relatively stable federal government estate tax income stream was maintained for two reasons:

1.) The average value of estates rose.

2.) Replacing the CSDT with a tax credit shifted between $4 billion and $5 billion in tax revenue per year from the state level to the federal level.

By 2010, fewer than 7,000 estates paid $13 billion in taxes and fewer than 1,500 estates paid $3 billion in taxes in 2011.

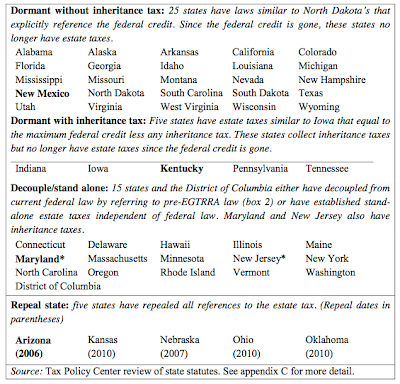

In 2001 when EGTRRA replaced the CSDT with a less valuable deduction, states acted in different ways. Some did nothing since their state estate taxes were coupled to the CSDT and ended up collecting no taxes. Others repealed their own estate taxes, also resulting in no estate tax revenue. Some states adopted their own estate taxes further complicating the issue for estates with holdings in multiple jurisdictions. Here is a chart showing which actions each state took in response to the end of the CSDT money-maker:

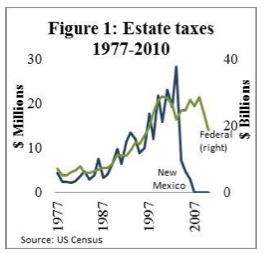

Here is what happened to estate tax revenues in New Mexico which did not amend its tax laws when the federal government ended CSDT (a dormant state) (please note that federal tax revenues are in green and state revenues are in blue):

Revenues dropped from $28 million in 2003 (one percent of total revenues) to zero by 2010.

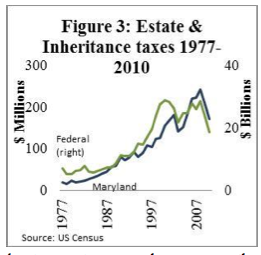

Here is what happened to estate tax revenues in Maryland which has its own inheritance taxes:

Maryland's estate tax revenues barely budged since they decoupled their estate tax system from the federal system.

The tax provisions of EGTRRA were extended by the 2010 Act until the end of 2012 and will expire on January 1, 2013. The 2010 Act actually reinstated the estate taxes for 2011 and 2012 with a higher exclusion amount and lower tax rate and, what's worse for Americans is that, on January 1, 2013, the top federal tax rate on estates will rise from 35 percent to 55 percent and the estate property exclusion will drop from $5.12 million to $1 million. This higher rate will be a bit of a windfall for Washington, bringing in an estimated $31 billion in 2013. Restoration of the CSDT in 2013 would reduce federal government estate tax revenues by $5 billion and would increase the revenues in dormant states (those that had estate taxes that referenced the CSDT prior to its expiry but which now have no estate taxes) by $3 billion (i.e. see New Mexico above), half of which would end up going to California and Florida.

It is interesting to see how changes to federal legislation regarding mundane issues such as estate taxes can have such a big impact on the level of revenues at the state level and how these changes can lead to confusion for both taxpayers and legislators. Until the President and Congress come to a saw-off regarding the expiring 2010 Act, states and taxpayers will find it very difficult to plan for their futures. As an aside, I also find it hard to imagine that governments around the world will not be tempted to take a greater share of the estate pie in this age of rapidly growing debt levels. It's a target that is just too easy to hit, particularly over the next 20 years as baby boomers depart this orb in growing numbers.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment