With the recent announcement that China and the United States had come to a "climate agreement", I thought that the time was right to take a look at whether the current American administration has followed up on its 2009 promise to reduce subsidies to the fossil fuel industry in an attempt to mitigate global climate change.

Way back in 2009, the leaders of the G20 nations agreed to phase out subsidies over the medium-term for the oil industry and its fossil fuel peer group as part of a global effort to reduce the risk of global warming. According to Reuters, back in 2009, about $300 billion was spent annually on a global basis by subsidizing fuel prices and offering enhancements to the oil industry such as preferential access to government-owned lands and reduced royalties. By 2012, these subsidies were estimated at $775 billion with two-thirds of the total subsidies actually originating from the World Bank.

Here is a quote from the 2009 Pittsburgh Summit:

"We reaffirm our commitment to rationalise and phase-out over the medium term inefficient fossil fuel subsidies that encourage wasteful consumption, while providing targeted support for the poorest”

In the 2010 G20 Toronto Summit, 13 of the 20 participants provided their implementation strategies for the phasing out of fossil-fuel subsidies. The remaining 9, including Australia, Brazil, France, Japan, Saudi Arabia, South Africa and the United Kingdom claimed that they did not have inefficient fossil-fuel subsidies.

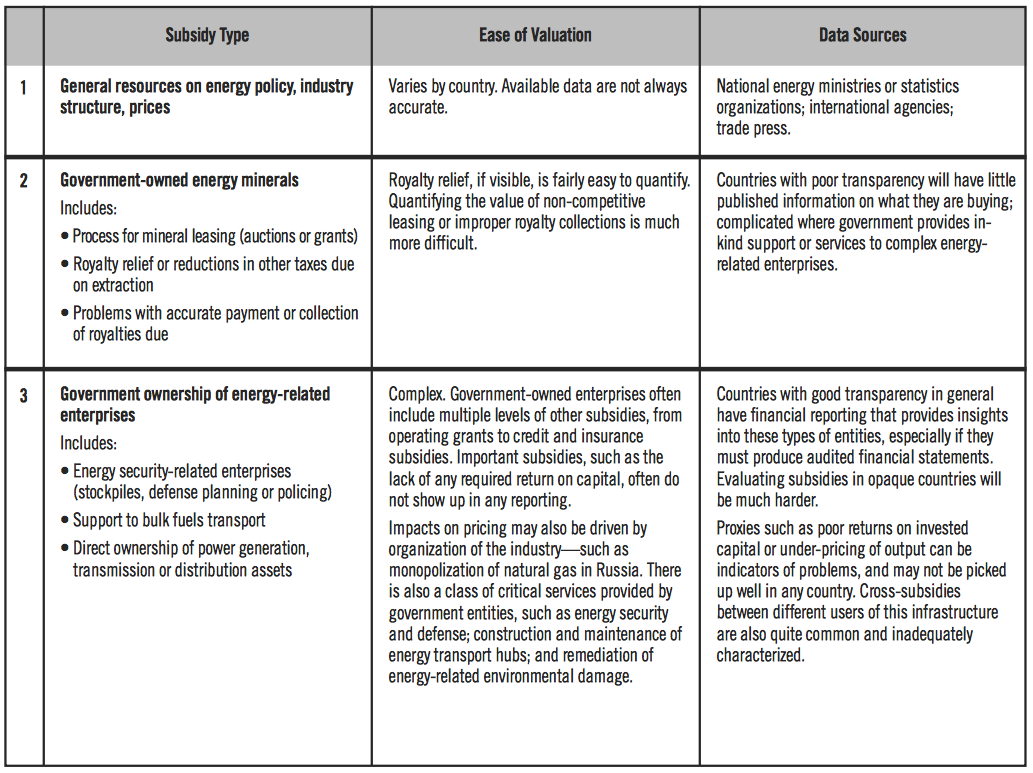

In their Untold Billions study, the International Institute for Sustainable Development's Global Subsidies Initiative looked at the types of subsidies available to the fossil-fuel industry and found that these subsidies fell into eleven categories:

A recent report by Oil Change International entitled "The Fossil Fuel Bailout" states that $88 billion is spent every year by G20 nations to subsidize the exploration for fossil fuels. These subsidies fall into three main types:

1.) investments in the fossil-fuel sector by state-owned enterprises (SOEs) totalling $49 billion annually. Countries with significant investments in fossil fuels through SOEs include China, Brazil, Saudi Arabia, Mexico, India and Russia. Some nations have multiple fossil fuel-based SOE's, including Russia, China and India . Without these subsidies through SOEs, many projects would become sub-commercial.

2.) national subsidies delivered through direct spending and tax breaks totalling up to $23 billion annually. These include depletion allowances, amortization of geological and geophysical expenditures and deductions for intangible oil and natural gas drilling costs. The United States, Australia, Russia, China and the United Kingdom all have significant subsidies for fossil fuel exploration with the United States leading the pack in the overall size of the subsidies available to the energy industry.

3.) public finance from banks and other government-owned financial institutions totalling $16 billion annually. Countries with significant support of this type include Canada, China, Japan, Russia and the Republic of Korea.

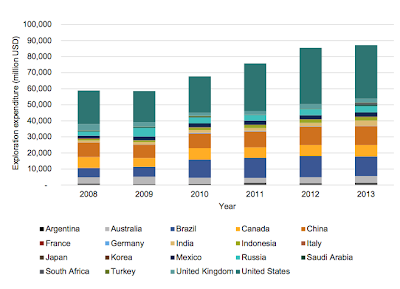

The economics of exploration for oil and natural gas is heavily reliant on government support, particularly since new reserves are found in more and more remote areas of the globe as the world's hydrocarbon age matures. As shown on this bar graph, the amount spent on exploration for oil and natural gas has increased substantially since 2008 from under $60 million to over $85 million in 2013:

Despite the increase in spending, oil and gas reserves in G20 nations have barely budged over the six year period, rising from around 440 million barrels of oil equivalent in 2008 to around 460 million barrels of oil equivalent in 2013.

Without government subsidies, many of these new energy projects would be sub-economic. It is estimated that around half of the oil industry needs crude oil prices in excess of $120 per barrel to generate free cash flow and that nations like Russia need prices near $110 a barrel to balance their budgets.

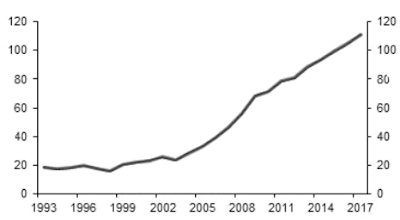

Here is a graph showing how the break-even price for crude oil (the price required to cover the cost of production) has risen since the 1990s:

Here is a table showing the top ten undeveloped oil projects in the world that require oil prices of $95 or more to be economic:

Please note how many of these projects are located in the Canadian oil sands sector.

Let's focus on the United States for a moment. The U.S. plays a central role in the world's fossil-fuel markets as the world's largest consumer of both oil and natural gas and the second largest consumer of coal. It is at the forefront of emerging policies in the development of carbon capture and storage, clean coal technologies and unconventional fossil-derived fuels. All of these involve substantial government subsidization. Keeping in mind the pledge made at the 2009 G20 meeting, we find that, in the case of the United States, approximately $5.123 billion in national subsidies was provided for fossil fuel exploration and extraction in 2013, double the level in 2009. Here is a table showing how the United States federal government fossil fuel subsidies changed between 2009 and 2013:

In addition, many states provide additional exploration subsidies. In total, the authors estimate that G20 nations subsidize exploration and extraction of fossil fuels to the tune of between $16.362 to $22.647 billion annually.

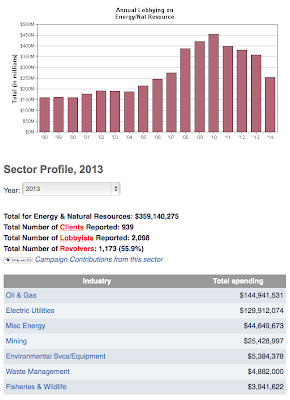

According to Open Secrets, in 2013, the energy and natural resources sector spent $359.1 million lobbying in Washington as shown on this graphic:

…and just under $30 million on campaign donations in the 2013 -2014 cycle, most of which went to Republican candidates as shown here:

With this in mind, it would be a Herculean task for anyone in Washington to maintain a measured approach to the fossil fuel industry. Perhaps this explains why the current President's 2009 promise to his G20 peers that he would cut subsidies to the fossil fuel sector have been such an abject failure.

Click HERE to read more of Glen Asher's columns

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment