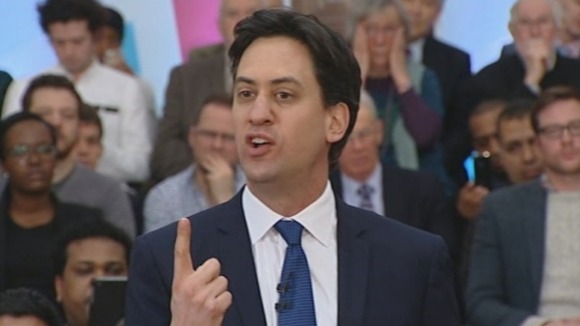

Labour leader Ed Miliband unveils the plan to force high street banks to give up branches in order to make way for new competitors in case Labour stand victorious in coming general election.

Labour leader Ed Miliband unveils the plan to force high street banks to give up branches in order to make way for new competitors in case Labour stand victorious in coming general election.

During a speech at University of London, Mr. Miliband has focused to tackle the “cost of living crisis” to surface out his plan to end the dominance of the four banks which control the lion’s share of mortgages, current accounts and small-business lending.

Miliband has accused U.K. financial services industry of having been an “incredibly poor servant of the real economy”, and has blamed tight business credit and recent mis-selling scandals on a lack of competition. He has promised to make the big five High Street lenders sell-off their branches to increase market competitiveness.

He has told: “Of course, financial services are an important industry in itself. But for an industry that calls itself a ‘service’, it has been an incredibly poor servant of the real economy.”

“We need a reckoning with our banking system, not for retribution, but for reform.

“If we carry on as we are, we will end up stuck with the same old banks dominating our high street: the old economy.

“In America, by law, they have a test so that no bank can get too big and dominate the market. We will follow the same principle for Britain and establish for the first time a threshold for the market share any one bank can have of personal accounts and small business lending.”

Mr. Miliband has also excluded Conservative claims that a fall in inflation is the solution to the cost of living crisis, as he has said: “Let’s hope that happens. But I really warn this government — if they think a few months of better statistics will solve this crisis, they are just demonstrating again that they have absolutely no idea about the scale of the problem or the solutions required.”

The Chancellor of Exchequer, George Osborne has earlier revealed his hopes for an above-inflation increase in the minimum wage, stating that “economy can now afford” to raise the rate, currently set at £6.31 an hour.

The opponents of Mr. Miliband may agree with Governor of Bank of England Mark Carney, who told the Commons treasury committee that “breaking up an institution doesn’t necessarily create or enable a more intensive competitive structure.”

Article viewed on Oye! Times at www.oyetimes.com.

Be the first to comment