With the Trump Administration leaving American military personel in place to “guard” Syria’s oil (from whom, we really don't know), I thought it was pertinent to look at some data regarding Syria’s oil potential. As you will see in this posting, while its production of oil and natural gas is not large when compared to many of its Middle East neighbours, Syria is, in fact, currently the only producer of oil and natural gas among the nations on the eastern shore of the Mediterranean Sea. It is also pertinent to note that the Energy Information Administration has not updated its Country Analysis Brief since August 2011 which is not terribly surprising given the nearly 9 year-long conflict in the region which makes oil production and reserve statistics impossible to acquire. Fortunately, the EIA has updated its overview which can be accessed here.

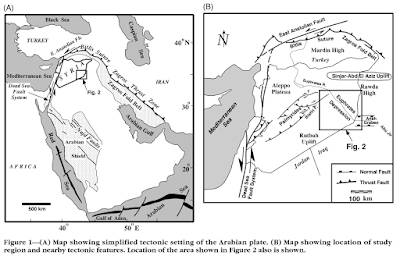

Syria's first oil production began in 1968 with most of the current oil production being located along the Euphrates Graben in the northeastern part of the country. Here is a map showing the geology of the region surrounding and including Syria:

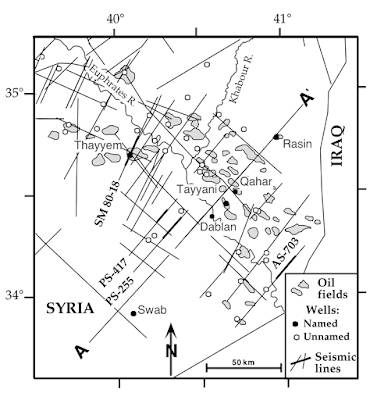

Here is a map showing the detailed geological setting of Syria's oil and gas fields:

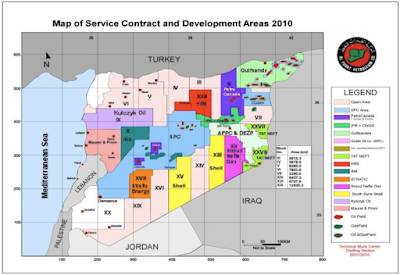

Here is a map showing the contract areas and oil and gas fields in Syria:

For my Canadian readers, please note the participation of PetroCanada in the northeastern most part of the country.

According to the Energy Information Administration (EIA), Syria produced around 400,000 BOPD of combined oil and natural gas liquids in 2009 and 213 BCF of natural gas in 2008. Syria's oil production had been in a state of decline for a decade and a half since peaking at 583,000 BOPD back in 1996. Recent successful development drilling, new discoveries and field rehabilitation are expected to increase production capability and put a halt to production declines. Over the last two years for which data was available, an additional 50,000 BOPD of productive capability has been added and in 2010, an additional 15,000 to 20,000 BOPD was expected to come on stream from new discoveries by Indian and Russian oil companies. According to the Organization of Arab Petroleum Exporting Countries (OAPEC), Syria has 3 billion barrels of oil reserves (0.26 percent of the world's total and 0.46 percent of OAPEC's total). According to the EIA, Syria had 2.5 billion barrels of proved oil reserves and 8500 Bcf of proved natural gas reserves.

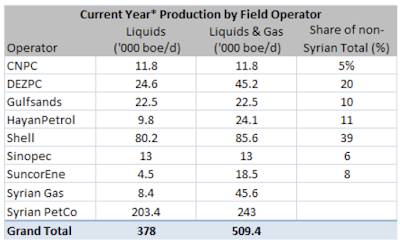

Oil production and development are managed by the Syrian Petroleum Company (SPC), an offshoot of the Ministry of Petroleum and Mineral Resources. Foreign oil companies have been offered a share of Syria's oil industry in an attempt to stem the country's production decline with formation of the Al-Furat Petroleum Company. This joint venture is 50 percent owned by SPC, 32 percent by Shell Oil and China's CNPC. China is also active in other parts of Syria through its Sinochem and Sinopec government oil companies. Here is a table showing the companies that held producing contracts in Syria:

In the first quarter of 2011, SPC produced 1,7385,626 barrels and 1,133,354 thousand cubic metres of natural gas. The company also drilled 49185 metres of hole. As well, SPC has announced that it is offering another Bid Round for three offshore blocks in the Mediterranean Sea with a closing date of October 5th, 2011. As well, the Ministry of Petroleum and Mineral Resources was inviting qualified companies to explore for and develop Syria's oil shale deposits which are estimated to be roughly 285 billion barrels over the 14 blocks that were being offered, a rather significant reserve. The submission for bids was to be due on November 30, 2011, 8 months after the Syrian Civil War began.

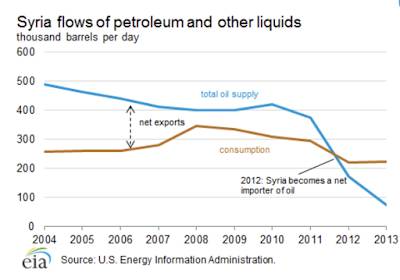

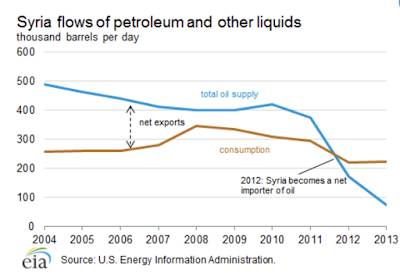

For the past 2 decades or more, Syria had consumed less oil than it has produced. Domestic consumption had risen slowly over the past 2 decades from 200,000 BOPD to 263,000 BOPD in 2006 and 308,000 BOPD in 2010 according to OPEC statistics. As shown in this chart, Syria had exported up to 400,000 BOPD back in 1996; this declined to 149,000 BOPD in 2010, again according to OPEC. According the EIA, Syria's oil production dropped to less than 25,000 BOPD in May 2015 as shown on this graphic, resulting in the nation becoming a net oil importer:

According to the EIA, Syria made up its oil requirement shortfall by importing roughly 60,000 BOPD of crud oil from Iran, its only friend in the region.

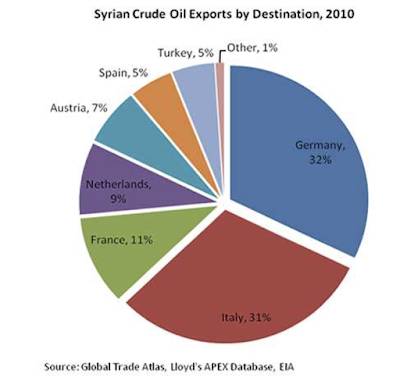

Prior to the civil war, most of Syria's oil exports was shipped to European OECD nations including Germany, Italy and France as shown on this graphic:

In all cases, Syrian oil imports provided a very small portion of each countries daily oil needs.

Syria was estimated to have proven natural gas reserves of 8.5 trillion cubic feet (Tcf), half of which is associated with oil reservoirs. Gas that is non-associated is found in the central and eastern part of the country. In 2008, Syria produced 208 billion cubic feet (Bcf) of natural gas and consumed 213 Bcf. Recent large discoveries had increased gas production to 361 Bcf per year by mid-2010 and it was expected to reach 412 Bcf per year by the end of 2010. As you can see on this graph, the production of Syria's natural gas reserves did suffer significantly from the conflict although not as badly as its oil production:

Approximately 35 percent of Syria's natural gas production was injected into oil reservoirs in an attempt to boost oil production with the bulk of the remainder used domestically for power production and industrial usage. According to the EIA, Syria had plans to substitute natural gas for oil by 2014 for both power production and industrial usage since Syria does not have the refining facilities necessary to produce refined oil for these purposes. With Syria having producing more natural gas than it consumes, it was exporting small volumes to both Lebanon and Turkey.

As we can see, Syria's overall oil and natural gas production is rather insignificant when compared to other Middle East nations, particularly nations such as Libya, another nation that was subjected to an American-driven nation re-engineering experiment. While Syria's conventional reserves of both oil and natural gas are relatively small, the nation's potential for non-conventional oil reserves is quite significant and may prove to be one of the reasons why Washington is intervening in yet another "party" to which it has not been invited.

Click HERE to read more from this author.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment