In light of Mr. Bernanke’s June 7th assurances that all will be well with the U.S. economy, I thought I’d post an alternate view of the American and world economy as seen through the eyes of another economist, one who has consulted for the U.S. Treasury, the IMF and the Congressional Budget Office. I stumbled across an interesting and brief summary of what could lie ahead for the United States economy written by John H. Makin of the American Enterprise Institute for Public Policy Research. The article entitled "Another Slowdown", the June 2010 edition of the AEI’s Economic Outlook bulletin, discusses a rather dissenting view of what lies ahead for the world economy, particularly when compared to the consensus viewpoint which suggests that the world economy will grow at an expanded rate in the second half of 2011.

In light of Mr. Bernanke’s June 7th assurances that all will be well with the U.S. economy, I thought I’d post an alternate view of the American and world economy as seen through the eyes of another economist, one who has consulted for the U.S. Treasury, the IMF and the Congressional Budget Office. I stumbled across an interesting and brief summary of what could lie ahead for the United States economy written by John H. Makin of the American Enterprise Institute for Public Policy Research. The article entitled "Another Slowdown", the June 2010 edition of the AEI’s Economic Outlook bulletin, discusses a rather dissenting view of what lies ahead for the world economy, particularly when compared to the consensus viewpoint which suggests that the world economy will grow at an expanded rate in the second half of 2011.In the article, Mr. Makin notes that there are several signs pointing to a slowdown in global economic growth.

1.) Dropping oil prices suggest that demand growth could be weakening as a result of a global industrial production slowdown that is, in turn, a result of an earlier overly aggressive buildup of inventory. The excessive inventory buildup in the first part of 2011 may have been a result of an overestimation of future demand.

2.) The drop in the securities markets and marked drop in interest rates on Treasuries as well as other sovereign debt markets including Canada, reflects falling inflation expectations. Once again, the anticipated drop in inflation could well be related to the recent drop in oil prices.

Interestingly enough, the drop in expected inflation is exactly what many critics of the Federal Reserve’s QE2 program did not expect. Many analysts were critical of the Fed’s move to flood the market with $600 billion in its attempt to purchase Treasuries and prop up the moribund U.S. economy. All along, even when presented with data showing that total inflation, as measured using the CPI, had risen above 3 percent, the Fed insisted that the relatively sharp rise was related to increases in the volatile food and energy sectors and that these increases were only temporary. The Fed, as always, maintains that core inflation is a better measure of inflation, largely because central bankers do not live on "Main Street" where those of us that are mere mortals dwell. This view flies in what most of us experience in the real world no matter how much Mr. Bernanke and his fellow central bankers may insist that there is "no inflation".

With signs that the global economy may be beginning to weaken, the Federal Reserve is walking a very, very thin tightrope. If the Fed decides to tighten to control inflation as both the global stock markets and consumer demand are showing weakness, the world could experience an accelerated economic slowdown. With oil prices hovering near $100 per barrel, the world economy is at or very near an economic tipping point. Should energy prices continue their upward climb (because of supply and demand imbalances related to peak oil?), U.S. inflation would rise forcing the Fed to tighten whether they want to or not, no matter how weak the economy. This has become somewhat more of an issue in the past month, largely because some Federal Reserve Presidents (including James Bullard) hold a dissenting viewpoint about the importance of headline inflation versus core inflation. However, if the recent 10 to 15 percent drop in the price of oil is indeed reflecting a global slowdown and not just the exiting of speculators from the market, any move toward tightening by the Fed could exacerbate the decline in growth.

Mr. Makin examines the four major economies of the world as follows:

1.) Japan: Japan’s economy has turned sharply downward as a result of disruptions related to the earthquake in March. Japan has experienced an annualized 3.7 percent drop in their first quarter growth rate and an annualized 2.2 percent drop in private consumption. This was accompanied by a 15.5 percent drop in Japan’s industrial production during the month of March alone. Recovery in Japan’s economy depends largely on how quickly consumers return to spending and how quickly companies in Japan remedy the supply chain disruptions caused by the earthquake; it is these supply chain disruptions that have impacted industrial production in nations around the world. Should Japan’s economy not rebound in the second half of the year as expected, there will be downward pressure on global economic growth.

2.) China: China’s industrial output remained unchanged in the first month of Q2 2011 with auto sales falling 4.7 percent month over month as government stimulus measures that encouraged automobile purchases have ended. Inflation remains over 5 percent and growth has slowed to 8 percent, down 10 percent from the first quarter. China’s massive excess manufacturing capacity could lie idle should the global economy slow further, resulting in further economic slowing.

3.) Europe: Europe is facing massive headwinds related to the ongoing debt crisis in Greece. With Greece experiencing seemingly unsolvable debt and deficit issues, the problem is not going to go away soon and it becomes more and more likely that Greece may have to default on its loans. As an aside, recent research shows that the European Central Bank is increasingly unlikely to be able to continue to bail out Eurozone debtor nations as the ECB is already "tapped out". This will make debt rescheduling difficult for the other PIIGS nations. It is this uncertainty that is likely to constrain economic growth in the Eurozone.

4.) United States: The U.S. economy is slowing during the first part of the second quarter; annual growth estimates of 4 percent have been markedly overly optimistic with growth forecasts for Q2 dropping from 3.5 percent to below 2.5 percent. The employment picture remains dismal at best with data suggesting slowing employment growth as unemployment claims rise. The rather sad employment picture is likely to further depress the already very modest 2.2 percent increase in consumption during Q1. Many economists expected that the Fed’s QE2 program and other stimulus packages would result in growth of 4 percent in the first half of 2011. It now appears that growth for the first half is around 2.2 percent. This very low rate of growth is making it increasingly difficult for the economy to meaningfully reduce unemployment. If economic growth is so modest while stimulus was still in place during the first half of the year, it is likely to stagnate even further in the second half of 2011. As well, governments at the federal, state and local levels are expected to cut spending and raise taxes which will put a further drag on the economy. The residential real estate wealth effect that supported many households during the initial part of the Great Recession has also vanished. The residential real estate markets are still falling in many parts of the United States with massive numbers of vacant homes in many cities.

From all of this information, one can readily see that central bankers around the world have their work cut out for them during the second half of 2011. On an individual basis, each of the issues facing the aforementioned four countries are not insurmountable. However, odds are good that somewhere along the line, the central bank of one of these nations is going to mishandle their economy. On top of that, another massive natural disaster in one of these nations could derail everything just as Japan experienced in March. The United States has already seen the worst weather-related devastation in decades this past spring. Should this year’s hurricane season produce another Katrina-like event, all economic bets are off. As well, once the stimulus of QE2 is removed from the equation, it will be interesting to see whether the recovery is self-sustaining or whether the Fed is forced to invoke QE3.

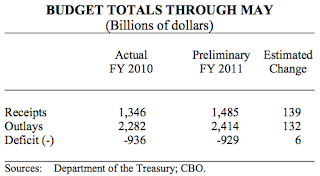

In closing, I’d like to take a brief look at one issue that was not covered by Mr. Makin. According to the latest monthly data release from the Congressional Budget Office on June 7th, the budget totals through to the end of May 2011 look like this:

When you dig a little deeper through the data, you find that net interest payments on the debt grew faster than the other major categories of spending, rising by $24 billion or 16 percent for the month of May from $152 billion in 2010 to $176 billion in 2011. If anything is going to derail the American (and by extension world) economy, these numbers show us what will ultimately be, at the very least, a significant contributing factor.

Click HERE to read more of Glen Asher’s columns.

Article viewed at: Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

All the augeries of multiple economists’ muttering is a distraction from the central pivot point that needs to be addressed.

The U.S. economy’s “Great Recession” is the culmination of over 25 years of structural decay in the composition of our National Income. We’ve seen productive “Earned Income” decay dramatically as a percent of GDP — with corresponding rise in assorted unproductive Financial Industry Shenanigans.

The result is an economy increaingly premised on exponentially increasing Debt-Fueled-Consumption. As may be expected, the cycle ends when the debt can’t be rolled over.

It’s ended and we are here.