Most Americans know of at least one family that has undergone the process of foreclosure. With millions of American’s losing their homes over the past 4 years, one has to wonder what happened to those families. Did they relocate to other areas, move in with nearby family members, rent homes in the same neighbourhood or adopt some other option? Fortunately, the good folks at the Federal Reserve (who helped create the housing bubble with their easy credit, no money down, let’s flood the market with zero percent interest rate money) have actually studied the phenomenon of people losing their homes through foreclosure. Raven Molloy and Hui Shan released their "The Post-Foreclosure Experience of U.S. Households" paper in May 2011 after studying exactly what happened to households after their mortgage has been foreclosed. Let’s take a brief look at their findings and what kind of impact foreclosure has on the housing market as a whole and on families as individuals.

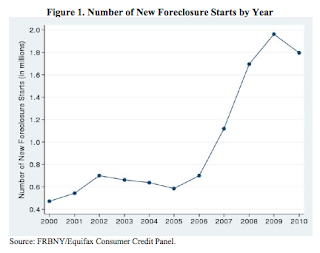

Most Americans know of at least one family that has undergone the process of foreclosure. With millions of American’s losing their homes over the past 4 years, one has to wonder what happened to those families. Did they relocate to other areas, move in with nearby family members, rent homes in the same neighbourhood or adopt some other option? Fortunately, the good folks at the Federal Reserve (who helped create the housing bubble with their easy credit, no money down, let’s flood the market with zero percent interest rate money) have actually studied the phenomenon of people losing their homes through foreclosure. Raven Molloy and Hui Shan released their "The Post-Foreclosure Experience of U.S. Households" paper in May 2011 after studying exactly what happened to households after their mortgage has been foreclosed. Let’s take a brief look at their findings and what kind of impact foreclosure has on the housing market as a whole and on families as individuals.Let’s start by looking at a graph showing the number of new foreclosure starts by year over the past decade to put the situation into perspective:

Molloy and Shan note that where households move after foreclosure has a marked impact on the housing side of the economy; it can impact vacancy rates, homeownership rates and house prices. For example, if post-foreclosure households tend to rent housing, there will be an impact on available rental housing supply and this increased demand could push rents upwards. Foreclosures can also impact where families end up geographically as they may choose to move for better employment opportunities.

As a database, Molloy and Shan used credit report data from the Federal Reserve Bank of New York/Equifax Consumer Credit Panel. This panel selects a representative sample of all American individuals with credit files; approximately 37 million individuals (or 15 percent of the adult population) for each quarter of every year between 1999 and 2010. Each quarter, new individuals that have entered adulthood and new immigrants are added as deceased individuals and emigrants leave the database. Don’t worry about your privacy, the authors claim that all individuals in the database are anonymous, however, the database does allow researchers to track individuals and households over time by the primary individual’s mailing address. Not only does the database contain information on mortgages, it contains data on any other loans that may be in a given household including consumer loans, credit cards, student loans etcetera and, of course, the FICA scores of individuals along with data on foreclosures and bankruptcies.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment