On March 31, 2012, the U.S. Federal Government is officially half way through fiscal 2012. The Congressional Budget Office released the data for the first half of this economically confusing year in their Monthly Budget Review and here are a few of the highlights.

Overall, Washington racked up a budget deficit of just under $780 billion for the first half of the fiscal year, a drop of $53 billion or 6.8 percent from the previous year as shown here:

For the month of March 2012 alone, the deficit was $196 billion, up $8 billion from the previous year. In this posting, I won’t be focusing on the changes to the rather volatile monthly receipts and expenditures since I’d prefer to concentrate on the six month cumulative data.

Here is a screen capture from the report showing revenues through the six month period to the end of March:

Receipts for the first half of the year were $46 billion or 4.5 percent higher than last year with nearly 70 percent of the gain or $29 billion resulting from a net increase in net corporate tax receipts resulting from higher payments and lower refunds. Corporate income tax revenues reached $84 billion, up 53.2 percent on a year-over-year basis. While this seems like a big improvement, keep in mind that this is what corporations have paid in previous full fiscal years:

From the graph, it is still quite apparent that corporate taxes are set to be among the lowest in the last eight years if the remittances in the second half are the same as in the first half of fiscal 2012.

In the first six months of fiscal 2012, individual income taxes rose by $10 billion or 2.1 percent to $486 billion; corporate taxes still make up only 14.7 percent of the total income tax haul of $570 billion, well below the levels reached in the mid-2000s when Corporate America’s contribution to Washington made up between 20.97 and 25.32 percent of the total. The CBO attributes the rise in personal taxes to improving wage and non-wage incomes, however, the overall impact of the growth in incomes on individual tax receipts will not be known until taxes are collected in the month of April.

Here is a screen capture from the report showing expenditures through the six month period to the end of March:

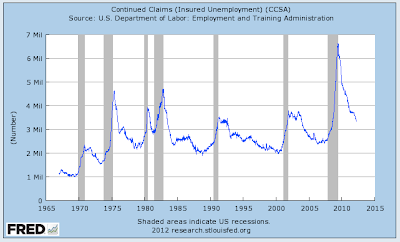

Total expenditures were down a very marginal 0.4 percent on a year-over-year basis from $1.849 trillion in the first half of fiscal 2011 to $1.842 trillion in the first half of fiscal 2012. Most notably, expenditures on unemployment benefits dropped by 21.8 percent on a year-over-year basis from $67 billion to $52 billion, largely because fewer new claims were filed as we well know from mainstream media reports in recent months. Unfortunately, the number of insured unemployed Americans is dropping but still remains at levels that are nearly as high as the peaks after the 1990 – 1991 and 2001 recessions as shown here:

Nearly 1 million more Americans are unemployed as measured by continued claims than were unemployed during the economic "good times" prior to the Great Recession. As well, the number of long-term unemployed is well above levels that would normally be experienced nearly three years after the end of a recession as shown here:

The long-term unemployed are of particular concern, necessitating costly federal "extended" unemployment benefits. Currently, there are about 3.25 million people receiving these extended benefits along with the 3.69 million that are receiving continued benefits as shown in the chart above for a total of 6.94 million beneficiaries. The situation could become critical if the "Eurozone Debt Influenza" floats across the Atlantic Ocean and results in an American recession since the baseline for employment is far worse now that in normal post-Recession periods.

The CBO also notes that net spending on big ticket items including Social Security and Medicare rose by 5.1 percent and 2.9 percent respectively for a total of $606 billion or just under 33 percent of all outlays. Spending on Medicare dropped by 16.3 percent to $121 billion because legislated increases in the federal government’s share of the program’s costs expired in July 2011.

In closing, let’s look at two of my favourite numbers:

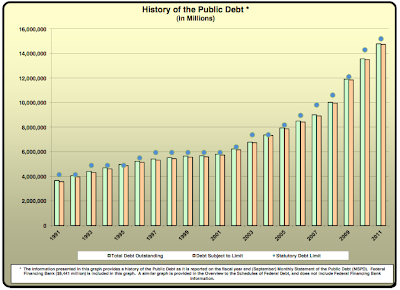

1.) The debt to the penny on March 31, 2012: $15,582,078,681,188.69 up $1.312 trillion or 9.19 percent on a year-over-year basis. Here’s a graph showing the growth of the debt since 1991, noting that, in general, the growth rate is rising:

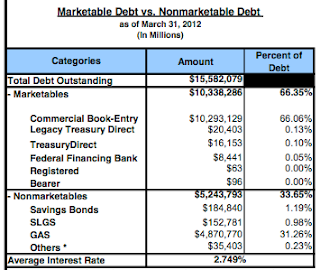

2.) Interest owing on the debt for the first six months of fiscal 2012: $211,352,941,695.70 or $674.50 for every man woman and child in the United States.

The only thing saving Washington’s bacon is the ultra-low average interest rates on the debt as shown here:

Thank you Mr. Bernanke for your wonderful easing and twisting.

If the first half deficit figures are repeated in the second half of fiscal 2012, it looks like the U.S. federal government may well be headed for a new record level of over-expenditure. A more likely scenario suggests that fiscal 2012 will find Washington overspending by roughly $1.3 trillion, the same level as fiscal 2010 and 2011. Fortunately (or not), the government still has just over $855 billion worth of deficits that they can incur before they reach the new debt ceiling of $16.394 trillion. At least we won’t have to watch Washington bicker like school children over a new debt ceiling until the early part of fiscal 2013…hopefully.

Click HERE to read more of Glen Asher’s columns.

Article viewed on Oye! Times at www.oyetimes.com

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment