Now that the Republican tax plan, flaws and all, has passed Congress, the repercussions of the changes, particularly to Corporate America, will continue to ripple through the markets. While conventional wisdom would suggest that the reduction in the headline corporate tax rate in the United States would lead to increased employment and wages and greater investment in capital goods that will make American businesses more competitive on the world stage, such is not necessarily the case.

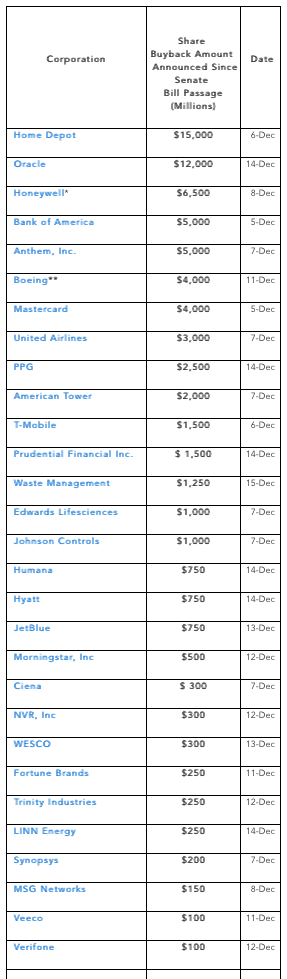

According to data published by the Democrats in the Senate, here’s where Corporate America is likely going to spend even more of the tax breaks that they will be given under the Tax Cuts and Jobs Act:

In total, the companies that have announced that they will spend $100 million or more on stock buybacks has reached $70.2 billion in the slightly less than two week-long period between December 6th and December 15th.

Who does this benefit? While the companies involved always use a boilerplate “It’s to maximize shareholder value”, such is not completely true. Let’s look at the stock holdings/stock awards/stock option awards of the Named Executive Officers (NEO) of the top four companies on this list as well as the Beneficial Ownership declaration which shows how much company stock is held by the company’s NEOs and Directors:

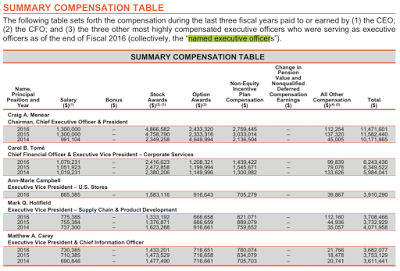

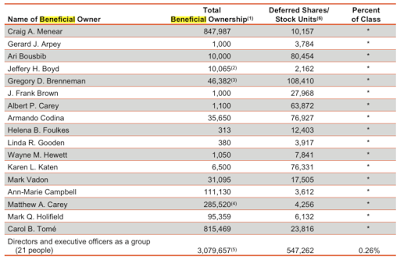

1.) Home Depot:

Here is the insider ownership of stock by Home Depot executive officers and directors:

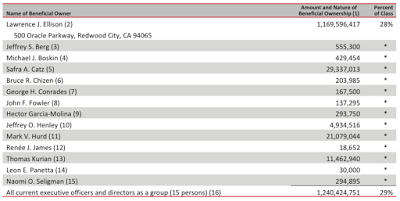

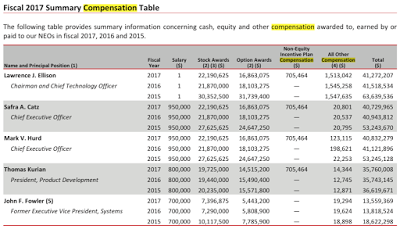

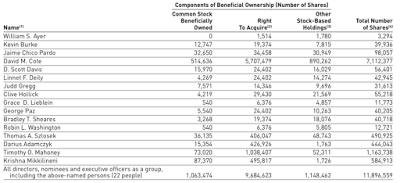

2.) Oracle:

Here is the insider ownership of stock by Oracle executive officers and directors:

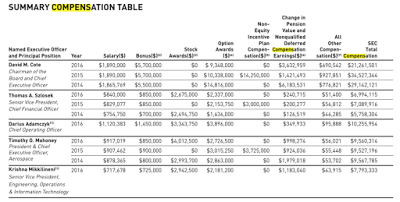

3.) Honeywell:

Here is the insider ownership of stock by Honeywell executive officers and directors:

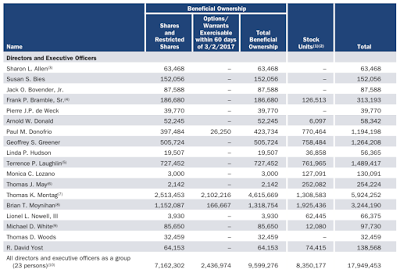

4.) Bank of America:

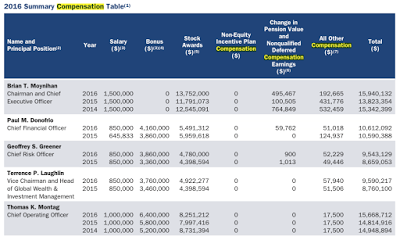

Here is the insider ownership of stock by Bank of America executive officers and directors:

With this data in mind, who do you really think that reducing the volume of outstanding shares for any of these five companies is really benefitting? Obviously not the Mom and Pop investors who may own a few hundred shares at most nor is it benefitting employees.

Corporate America’s insiders owe a great debt of gratitude to the Trump Administration for their munificent gesture.

Click HERE to view more.

You can publish this article on your website as long as you provide a link back to this page.

Be the first to comment