This article was last updated on June 26, 2025

Canada: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

USA: ![]() Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

Oye! Times readers Get FREE $30 to spend on Amazon, Walmart…

The Strait of Hormuz – The World’s Key Economic Choke Point

One aspect of the recent Iran-United States-Israel hostilities is a key issue that could have significant negative impacts on the global economy. Thanks to the geography of the Persian Gulf, there is a choke point which could be used by the Iranians to reduce the supply of hydrocarbons to the world’s markets.

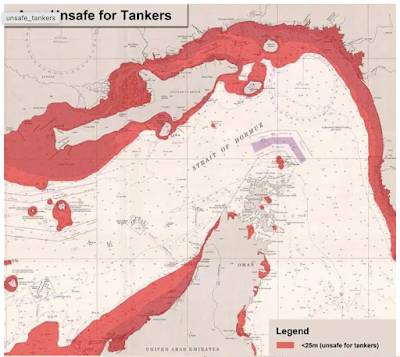

As shown on this map, the Strait of Hormuz lies between Oman and Iran, a very narrow body of water that provides passage from the Persian Gulf and the Gulf of Oman:

The Strait is between 47 and 95 kilometres (29 to 60 miles) wide and has an inbound and outbound shipping lane which are both only 3 kilometres (2 miles) wide with a 3 kilometre buffer zone separating the two lanes. The shipping lanes are located mainly in Omani waters however they are governed by international maritime law with Iran controlling the waters to the north of the shipping lanes and Oman controlling the waters to the south of the shipping lanes. The Strait is deep with a minimal number of marine hazards and reaches depths of up to 650 feet in the shipping lanes however, there are zones which are unsafe for tankers because water depths are less than 25 metres as shown here in red:

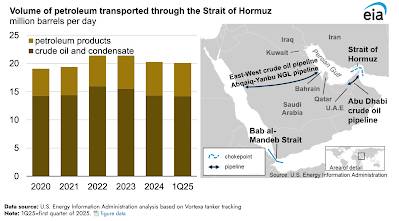

Given its proximity to the hydrocarbon producing regions immediately adjacent to the Persian Gulf, it’s clear that the Strait of Hormuz is a choke point for the flow of oil. Here is a graphic from the EIA showing how much oil and other liquid petroleum products have passed through the Strait since 2020:

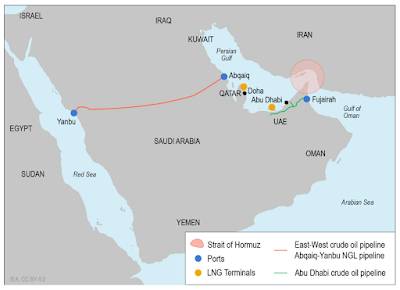

Approximately 20 percent of global liquids production flows through the Strait every day however it is important to keep in mind that an even higher percentage of total globally exported hydrocarbon liquids pass through this choke point. An estimated minimum of 30 percent of total exported seaborne oil and nearly 40 percent of global crude oil trade exits the Persian Gulf through the Strait. While the Abu Dhabi crude oil pipeline running from the UAE to the Gulf of Oman could offset some of the lost oil exports should the Strait be closed, it has a capacity of only 4.2 million barrels per day. The East-West crude oil pipeline that runs across Saudi Arabia from Abqaiq on the Persian Gulf to Yanbu on the Red Sea has a total design capacity of 5 million barrels of oil per day with roughly 3.3 million barrels of daily spare capacity as shown on this graphic:

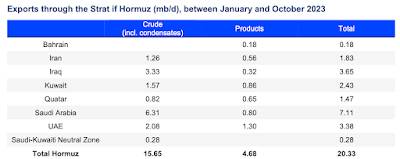

Here is a table showing which nations exported oil and liquids through the Strait of Hormuz for the period between January and October 2023:

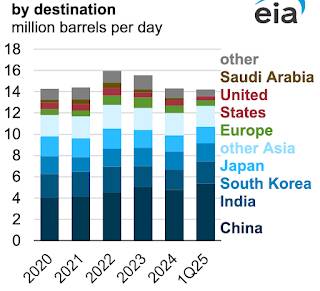

Here is a graphic showing the destination of the exported crude oil that transits the Strait of Hormuz:

It is estimated that 84 percent of the crude oil and condensate that moved through the Strait went to Asian markets in 2024.

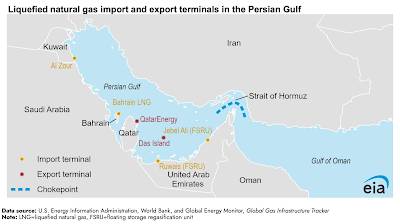

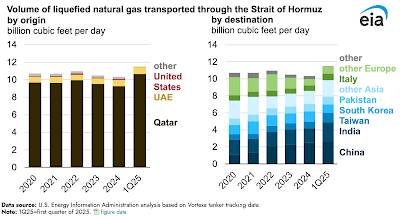

Not only is the Strait of Hormuz a choke point for oil and associated liquids, it is a choke point for Liquified Natural Gas or LNG, primarily produced by Qatar. In 2024, approximately 20 percent of global LNG trade passed through the Strait with Qatar exporting about 9.3 billion cubic feet of LNG per day through the Strait in 2024. The EIA estimates that 83 percent of the LNG that passed through the Strait in 2024 went to Asian markets, primarily China, India and South Korea. Here is a map from the EIA showing the LNG infrastructure in the Persian Gulf:

Here is a graphic showing the origin and destination of LNG that is transported through the Strait of Hormuz:

The Strait of Hormuz is an extremely important and vulnerable geographic feature that has the potential to throw the world’s economy into chaos. Should Iran choose to hinder or harass maritime traffic passing through the Strait, it could have significant ripple effects through the global economy by pushing oil prices to record levels.

Be the first to comment